Experiencing a company wind-up due to financial decisions or a strategic move? Shutting down a business isn’t as simple as turning off the lights and locking the doors.

Whatever the reason is, the process must be clean and compliant. It should be officially documented to avoid any confusion. That’s where the liquidation audit report comes in. It’s a vital piece in wrapping up operations the right way.

This easy-to-follow guide walks you through everything you need to know. Learn about liquidation audits in the UAE, why they matter. Plus, know the steps involved and how professionals can make your exit smooth and stress-free.

Why Liquidation Audits Matter in the UAE

A liquidation audit isn’t just a box to tick. It’s the key to closing your business legally. This protects shareholders and creditors in avoiding future legal trouble or penalties.

Liquidation audit is crucial for regulatory compliance. A document that proves the company followed UAE laws and cleared all obligations. The audit improves financial transparency. It does so by confirming that all debts, assets, and financial records are fairly presented.

It also assists in risk management. The document helps to avoid shareholder disputes, creditor claims, or post-closure issues.

Types of Liquidation in the UAE

The UAE offers different liquidation routes based on the company’s financial standing and legal situation. We’ve shared the common types included.

Common Types:

- Voluntary Liquidation: Started by shareholders when the business is no longer viable.

- Mandatory Liquidation: Ordered by a court for insolvent or non-compliant companies.

- Summary Winding Up: For companies with no debts and simple exit plans.

- Creditors’ Winding Up: When creditors are actively involved in the dissolution process.

Each type involves audits. This guarantees fair settlement of dues and legal obligations.

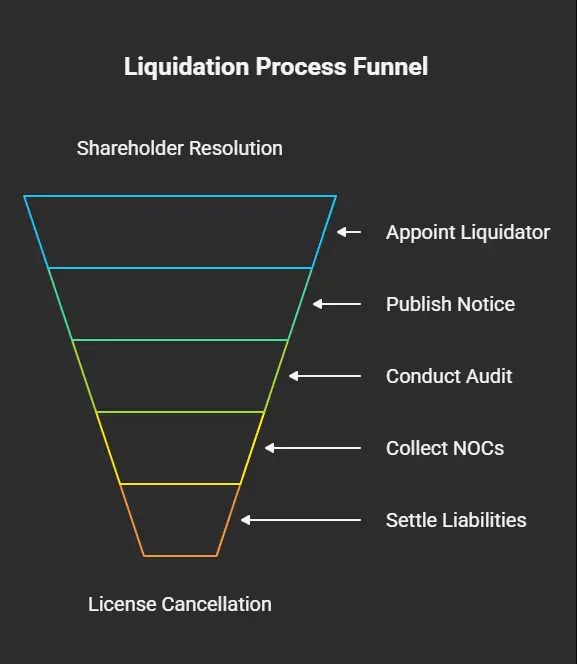

Liquidation Audit Checklist: Step-by-Step

Want to make the liquidation process smooth? You can use this roadmap:

- Pass the Shareholder Resolution

Conduct a formal board meeting to pass a resolution to liquidate the company. You can also appoint a registered liquidator (audit firm).

- Appoint a Licensed Liquidator

The second step is to choose an approved audit firm. The liquidator takes charge of the company’s assets and liabilities.

- Publish Public Notice

Publish a 45-day notice in two newspapers. The newspapers must be in Arabic and English. It notifies creditors to file claims during the notice period.

- Conduct Asset and Debt Audit

The audit firm reviews financial records, inventory, and fixed assets. They will also look into the outstanding payables and receivables.

- Collect No Objection Certificates (NOCs)

At this step, clear all dues and collect NOCs from utilities. Including DEWA, SEWA, and others. Clear the dues of telecommunications providers. Gather NOCs from the Free Zone or the mainland authority.

- Settle Liabilities and Distribute Assets

Now, sell company assets if needed. Pay off debts in the following order:

- First: Secured creditors (e.g., banks)

- Second: Unsecured creditors (e.g., vendors)

- Third: Shareholders (if funds remain)

- Final Audit Report and License Cancellation

Lastly, submit the final audit report, statement of Affairs, and all clearance certificates. It’s time to proceed with license cancellation and company deregistration

Key Documents You’ll Need

Being prepared with the right paperwork speeds up the process.

Must-Have Documents:

- Notarized Board Resolution

- Auditor’s Final Liquidation Report

- NOCs from utilities, telecom, and bank

- Newspaper publication proof

- Statement of Assets and Liabilities

- Tenancy contract cancellation

Common Hurdles in the Liquidation Process

Understanding the challenges in advance helps you avoid delays.

Challenge

Missing NOCs

Impact

Halts final clearance

Solution

Follow up early with all authorities

Challenge

Incomplete Financial Records

Impact

Delays in audit and report issuance

Solution

Organize statements before the audit begins

Challenge

Shareholder/Creditor Disputes

Impact

Legal delays or complaints

Solution

Ensure audit transparency and mediation

Challenge

Free Zone Requirements

Impact

Extra paperwork in places like DMCC, JAFZA

Solution

Hire experts familiar with specific zones

How Audit Firms Can Help

Closing down a company is a sensitive and technical process. Partnering with a certified audit firm in the UAE makes things easier. Working with audit firms gets you accurate, compliant liquidation audit reports. You’ll obtain guidance through DED or free-zone procedures

The audit firms have good coordination with government authorities. They play the role as a bridge between you and the government. They also act as a mediator between partners, creditors, and stakeholders. Audit firms like MBS Consultancy bring deep experience. Their presence saves you time and protects your reputation.

Costs Involved in Liquidation Audits

Here’s a rough breakdown of potential costs:

| Item | Estimated Cost (AED) |

| Liquidator/Audit Firm Fees | 5,000 – 15,000 |

| Newspaper Public Notice | 1,000 – 2,000 |

| Government Clearance & NOC Charges | 2,000 – 5,000+ |

| License Cancellation Fee | 1,500 – 3,000 |

Note: Prices vary by company size, location, and complexity.

Timeline for Liquidation

Here’s what a typical liquidation timeline looks like:

| Stage | Time Estimate |

| Shareholder Resolution & Setup | 1 Week |

| 45-Day Public Notice Period | 1.5 Months |

| Audit and Document Collection | 2–4 Weeks |

| Final Submission & Deregistration | 2–3 Weeks |

| Total Estimated Time | 2.5 to 4 Months |

Final Thoughts

Winding up a UAE business takes more than just good intentions. You’ll be required to have good planning, paperwork, and precision. A properly conducted liquidation audit is mandatory. It assures that your business exits the market legally, ethically, and without loose ends.

No matter where your company is based in a free zone like DMCC or on the Dubai mainland, attach yourself to someone experienced. Working with a qualified liquidation auditor can turn a complicated procedure into a manageable process.

MBS Consultancy is the name of reliability and professionalism. We have been operating in the UAE for decades. You can get our assistance in liquidation audit matters and receive the necessary support within just a few hours after contacting us. Exit from the UAE market stress-free with our team of consultants, who are more than ready to deliver exceptional results.

FAQs:

Q1: What is a liquidation audit?

It is a financial audit performed during company closure to verify debts, assets, and compliance.

Q2: Who can perform a liquidation audit in the UAE?

Only licensed audit firms registered with the UAE authorities.

Q3: Can I liquidate my company without clearing debts?

No. All liabilities must be settled before final closure.

Q4: How long does liquidation take?

Typically 2.5 to 4 months, depending on paperwork and NOCs.

Q5: Do free zone companies follow the same rules?

Most of the steps are similar, but specific zones may require extra documentation or procedures.

Need help with liquidation? Contact a trusted audit firm today, like MBS Consultancy, and ensure a smooth, hassle-free exit from the UAE business market!