UAE introduced VAT back in 2018 at 5%. And by 2026, the system is polished but still tweaking here and there. If you are a business owner, your relationship with VAT is probably complicated: ignore it, and things get awkward fast. Miss a deadline? That incurs a fine. Misclassify a transaction? Another fine.

But staying compliant isn’t impossible. (Not when you have us for assistance.) With a few smart moves, you can turn VAT from a chore into a checkbox. This blog post breaks down what’s new, what’s unchanged, and how to avoid common pitfalls.

What Are UAE VAT Rules in 2026, Really?

VAT (Value Added Tax) in the UAE still sits at a standard rate of 5%. The rate hasn’t changed, but the game certainly has. Reporting, documentation, and audit readiness have all leveled up. Businesses are now expected to demonstrate their compliance in black and white, not just nod along.

Key changes businesses need to act on:

- Tighter scrutiny on returns: Your VAT filing must mirror your actual ledgers. Mismatches raise red flags.

- E-invoicing mandates: The FTA is phasing out paper trails. Expect more pressure to digitize.

- Stiffer penalties: Deadlines matter. Wrong claims cost you. Excuses won’t save you.

If you were coasting with minimal effort, now’s the time to level up your tax game.

The rules aren’t getting softer. That’s why your strategy should get smarter.

UAE VAT rules are updating, not disappearing. The Federal Tax Authority isn’t turning a blind eye in 2026; it’s sharpening its focus. Businesses dragging their feet on compliance? They’re stacking up penalties faster than they can spell “Value Added Tax.”

Staying compliant doesn’t need to feel like walking on a legislative tightrope. With the right guidance, UAE VAT rules stop being a nightmare and start becoming second nature. This blog post is going to be your cheat sheet for 2026. We’ll show you how to play it smart, not scared. You will learn what matters, what’s changed, and how to avoid the audit spotlight.

What’s Changing (And What’s Not) in 2026

The 5% Rule Stays

The standard VAT rate remains 5% for most goods and services. No surprises here. But keep an eye on exempt and zero-rated categories (like education and healthcare), which still require meticulous documentation.

Digital Reporting Just Got Sharper

As of 2026, the Federal Tax Authority continues to tighten digital reporting expectations. While VAT reporting is not yet fully real-time, businesses are increasingly expected to ensure system accuracy, clean audit trails, and rapid response to FTA queries.

Tax Registration: Who Needs It?

It’s probably you! The registration is mandatory if your taxable turnover exceeds AED 375,000 annually. Voluntary registration kicks in at AED 187,500. Still unsure? Ask yourself:

- Do you import/export goods?

- Do you sell taxable supplies?

- Are you tired of not claiming input tax?

If you answered yes, register. Merge your corporate tax in UAE obligations with VAT compliance to avoid double work.

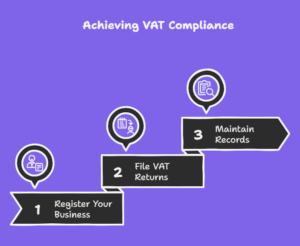

Here’s What You Need to Do:

VAT doesn’t reward guesswork. Whether you’re a startup, SME, or seasoned trader, there’s no room for “I thought I was doing it right.”

1. Register (or Check Your Status Like Your Business Depends On It)

If your taxable turnover hits AED 375,000 annually, tax registration is mandatory. The threshold hasn’t changed, but enforcement is way more proactive.

- Secure your TRN (Tax Registration Number) with valid financials

- Match your trade license activity to what you actually do

- Don’t sleep on renewals because penalties are going to stack up, and they stack quite fast

Got more than one license? Make sure each is covered appropriately. The FTA relies heavily on automated systems and post-filing reviews. Non-compliance is more likely to result in penalties than reminders.

2. File Like a Pro

VAT returns are quarterly or monthly depending on your business model. Don’t be the person rushing to file on the last day with spreadsheets full of guesswork.

- Verify sales and purchases under the correct VAT categories

- Cross-reference entries with physical or digital receipts

- File before the deadline. Else, the fines are going to climb higher and higher, each day.

Use tax filing software. Or better yet, a pro who actually knows what they’re doing.

3. Keep Records the FTA Would Actually Want to See

FTA audits are real, and they don’t show up with cupcakes. You need:

- Tax invoices with proper formatting, dates, and TRNs

- Five years’ worth of accounting records. Think of ledgers, receipts, and bank statements.

- An organized digital trail

Corporate Tax in UAE: What’s It Got to Do With VAT?

Corporate tax in UAE, introduced in 2023, targets business profits, while VAT tackles transactions. One is profit-based, the other is consumption-based.

They’re managed by different branches of the tax system but should both be reflected in your books. Mistake one for the other and you’ll land in double trouble.

- Keep profit/loss reports separate from transaction logs

- Avoid mixing deductible expenses across tax categories

- Use dual-ledger software if you’re running multinational accounts

You wouldn’t use a butter knife to cut steel. Don’t use one method to manage both taxes. In another blog post, we have gone into detail covering strategies your business can use for corporate tax optimization.

VAT Refund Rules in UAE: Reclaim What’s Yours

Tax isn’t always a one-way street. The VAT refund rules in UAE give you a chance to get some cash back, if you follow the system properly.

You might qualify for a refund if:

- You’ve overpaid VAT by error or during transitional tax periods

- You run an export-heavy business

- You qualify under the foreign business refund scheme

But here’s the catch: The process is detail-heavy.

- Collect valid proof of payment and TRNs

- Use the FTA refund portal

- Track correspondence. If they ask for more info, respond fast

Mess it up? You’ll not only lose your refund. You might even get flagged for review.

VAT Rules in UAE: What They Mean for Freelancers & Startups

Freelancers, small business owners, and side hustlers often overlook VAT. And that’s one big costly mistake.

Here’s where you stand:

- Income over AED 375,000? You must register

- Income between AED 187,500 and AED 375,000? You can register and it’s often wise to do so

Why bother?

- Boost your credibility. VAT-registered freelancers are taken more seriously

- Claim input VAT on coworking spaces, software tools, internet, and more

- Position yourself for scaling without tax chaos later

Employment Visa Rules in UAE vs. Your Tax Status

Here’s where it gets interesting (and confusing for some). Your team’s visas impact VAT compliance. For example:

- Employees on payroll affect input tax claims for staff-related expenses.

- Contractors without proper visas? Red flag for audits.

Holding an employment visa doesn’t give you a free pass from VAT rules. If you have side gigs, consulting work, or passive income above the threshold, you’re still liable.

Some things to check:

- Are you operating a trade license on the side?

- Are your freelancing invoices hitting VAT-eligible levels?

- Are you mixing personal bank accounts with business income?

Your visa might say “employee,” but your tax behavior might say “liable.” That’s where most people get caught. Best to untangle it now.

How Can MBS Consultancy Assist You with VAT?

The worst VAT strategy? Hoping they don’t notice you.

Here’s what we help with:

- Proper registration from scratch or renewal

- Accurate, on-time filing without drama or panic

- Pristine records in case of an audit

- Distinguishing between corporate tax in UAE and VAT because they are absolutely not the same thing

We’re not just your compliance copilot. Nah, we are your “never-worry-about-VAT-again” team.

UAE VAT Rules Don’t Have to Wreck Your Week

Yes, they’re more intense in 2026. But no, they don’t have to ruin your day. With the right systems and a pro services team that gets it, VAT stops being a looming threat and starts becoming just another part of your ops.

So stay smart. Stay accurate. And most of all: stay ahead.

Stuck? We’ll handle VAT, corporate tax, and even license renewals. Because paperwork shouldn’t ruin your day.

Book a free consultation, get compliant, and let’s turn tax time into tea time.