Dreaming of launching your business in Dubai? Congratulations on being among those who want to tap into the world of opportunities. However, there’s a popular rumor that starting a business in Dubai requires millions. This is not the case!

With thoughtful planning and smart decision-making, you can set up your business with minimal upfront capital and make this difficult step much easier.

Dive into the UAE’s market with as little as AED 12,000 to AED 50,000. It, however, depends on your setup choice. In this guide, we’ll break down how to launch your Dubai business with minimum investment in a simple and transparent manner. Be ready for action!

Keep reading and know the minimum investment to start a business in Dubai.

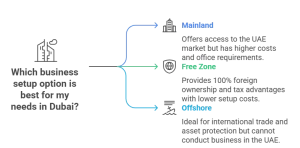

Which is Best: Mainland vs Free Zone vs Offshore Options?

Starting your business journey in Dubai? Before that, you should know that the city offers three main business setup paths for you. Every option comes with unique benefits and cost implications:

Business Setup in Mainland:

Mainland grants you access to the UAE market, allowing you to do business throughout the country. The business set up, however, has higher costs with office requirements.

Business Setup in Free Zone:

Under this setup, you are offered 100% foreign ownership, tax advantages, and full profit repatriation. It’s a highly popular model due to its flexibility and relatively lower setup costs.

Business Setup in Offshore:

The offshore setup is ideal for international trade, holding companies, and asset protection. Under this model, you can’t conduct business within the UAE.

Cost Breakdown:

We are breaking down the cost of setting up businesses in the mainland, free zone, and offshore. This will give you clarity for a minimum investment to start a business in Dubai for foreigners.

Mainland Setup

A typical mainland business might cost 30,000–50,000+ AED in total with trade license that require 12,000–25,000, name reservation & approval may cost you 600–1,200, office space (flexi to dedicated) has a fee of 15,000–50,000+ annually, visas (investor/staff) cost 3,000–7,000 per person, while Immigration/Establishment Card 2,000–3,500, and PRO & Government Coordination cost you 2,000–4,000 respectively. Now, mainland businesses often allow full 100% foreign ownership. This makes it more accessible.

Free Zone Setup

Setting up in a Free Zone often starts much lower with a license package (incl. desk) costing you 8,000–25,000, while virtual/co-working space is available at 5,000–15,000 annually, visa & immigration packages incur a cost of 3,000–7,000 per person, and registration & establishment cost you 1,000–2,500.

In short, the total cost of setting up in a free zone usually requires you to invest 12,000–35,000 AED. For instance, budget-friendly zones like IFZA or SHAMS can kick off your journey for roughly AED 12,000!

Offshore Setup

Offshore setups work well for those who don’t need a physical presence. The registration may cost you 12,000–18,000. Agent Service & Renewal has a fee of 6,000–10,000 annually.

The total investment you require to start offshore is 15,000–25,000 AED. Offshore setups suit holding companies or international trade models. They are not operational within the UAE.

What Drives These Costs?

Many factors and considerations must be taken into account that affect and impact the cost of setting up your business in the mainland, free zone, and offshore. We have shared a few of them for your better understanding:

- License Fees: License fees are the essential “entry ticket” for your business, varying by jurisdiction and activity.

- Office Space: Fixed office space is mandatory for mainland setups. Free zones offer flexible and virtual options.

- Visas and Immigration: They are essential for you and your employees. It typically ranges between AED 3,000–7,000 each.

- PRO, Legal, and Bank Fees: They are additional support services that often get overlooked.

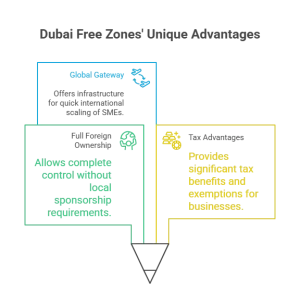

Why Set Up in Dubai Free Zones?

The following are some of the reasons that make free zones unique from the rest of the setups, i.e., mainland or offshore.

- Full Foreign Ownership: Under the free zone, you may have total control without sponsors.

- Tax Advantages: The free zone offers corporate tax and personal tax holidays, VAT exemptions, and ease.

- Global Gateway: Free zones like DMCC, DAFZ, and JAFZA offer infrastructure enabling SMEs to scale internationally fast.

Hidden Costs to Budget For:

In this section, we walk through the hidden cost that you often miss. These costs must be budgeted accordingly as other important costs:

- PRO Service Fees: If you hire PRO service to get easy approvals or other help, then you must incur a fee against it.

- Annual License Renewals: Your business licenses need to be renewed every year. You have to pay the annual license renewal fee each year.

- Document Attestation/Translation: Documents may need to be translated into Arabic and attested by government bodies. This can add a few hundred to a few thousand dirhams to your total cost

- Bank Account Minimums: Opening a bank account for business purposes sometimes, has a requirement to open an account with some amount. It is often required by some banks.

Smart Ways to Lower Your Startup Investment

These are some tricks and techniques that gradually lower your start-up investment. Let’s explore what those are:

- Start with a Free Zone + Virtual Office to keep costs minimal.

- Opt for flexi-desk packages rather than full offices.

- Use bundled packages from setup service providers for savings and convenience.

Wrapping Up!

Dubai is a go-to place for a lot of entrepreneurs to start their business with a minimum investment. The roadmap is easy, whether you want to launch a mainland setup, a free zone setup, or an offshore setup. All you need is smart planning and a choice of jurisdiction. Make up your mind today and launch in Dubai on a lean budget. The is your turn to make it happen.

Hire the MBS Consultancy services if you want to set up your business in Dubai with only a minimum investment needed. Our team is more than ready to assist you in setting up your business!