The United Arab Emirates (UAE) is the ultimate growth center when it comes to welcoming foreign aspirants. Those who seek a progressive future or an exceptional successful fate of their businesses, find this country beneficial. This increases the construction of offshore companies within Dubai and across the borders of UAE. This significant escalation in the recent years is driven by globalization, technological advancements, and the advantages offered by the UAE’s business-friendly environment. This empowers the landscape of international commerce.

Proceeding with the article, you will discover every nook and cranny of offshore company formation UAE. The detailed guide will be directing and dissecting this significant area. This covers the topic of legal frameworks and benefits of establishing an offshore body. This will equip you with the information and resources to ensure the seamless process.

What is an offshore company in UAE

A unique business entity known as an offshore company formation in UAE lies in the heart of the Arabian Peninsula. Unlike its onshore equivalents, an offshore company is not limited by the physical boundaries of the Emirates. It is a legal form of business in the fertile ground of free zones. It is dedicated to international trade and financial operations, unburdened by the usual domestic regulations.

Imagine a ship, not tethered to any particular port, and is able to navigate the global trade winds with agility and freedom. That is the essence of an offshore company formation in Dubai. Certainly, these specialized entities operate beyond the traditional onshore framework. Offering a haven for entrepreneurs and businesses seeking enhanced flexibility, confidentiality, and access to new markets.

An offshore company formation in Dubai, Abu Dhabi, Sharjah, and the UAE definitely is not identical with illegal practices. On the other hand, it is a genuine and progressively widespread business strategy practiced by reputable companies globally. An offshore company formation in Dubai does not allow you to conduct business directly within the UAE itself. Imagine it as a base camp that is ready for trips into distant regions, perched on the edge of a desert. It serves as a launching pad for your foreign endeavors and a means of propelling your business into a worldwide scale.

Benefits of setting up an offshore company in UAE

The allure of offshore company formation in Dubai, extends far beyond its unique operational framework. Nestled within its structure lies a treasure chest brimming with benefits, each one a shimmering pearl beckoning entrepreneurial minds. Let us unlock these advantages and discover why countless businesses choose this path to success.

- Tax Oasis: The UAE’s free zones, where offshore company formation Dubai flourishes, are renowned for their exceptionally low tax rates. In fact, many offer complete exemption from corporate income tax, making them a haven for profit-focused ventures. Imagine retaining a larger share of your hard-earned wealth, reinvesting it into your business and fueling its growth.

- Confidentiality Coffer: For those who value discretion, offshore company formation in Dubai provides a cloak of anonymity. Unlike onshore entities, where shareholder information is often publicly available, offshore companies offer enhanced privacy.

- Global Gateway: The UAE occupies a strategic position at the crossroads of East and West, bridging continents and cultures. As a result, an offshore company formation here, positions you at the heart of this vibrant trade hub. Therefore, granting access to a vast network of international markets.

- Operational Agility: Unburdened by onshore regulations, offshore companies in Dubai can enjoy streamlined operations. Such as simplified licensing procedures, minimal reporting requirements, and flexible corporate structures allow you to navigate the business landscape with ease.

- 100% Foreign Ownership: The UAE welcomes foreign investors with open arms. Offshore company formation Dubai grants you complete ownership and control over your business, thus eliminating the need for local sponsors or partnerships.

- Multilingual Melting Pot: The UAE is a melting pot of cultures, languages, and diverse skill sets. This environment fosters a dynamic business ecosystem, subsequently offering access to a pool of talented professionals from around the world.

Documents required to start an offshore company in UAE

With the alluring benefits of offshore company formation in Dubai laid bare, it is time to equip yourself with the essential tools for accomplishing this. Embarking on this entrepreneurial journey requires gathering the necessary documents, indeed. Following this, we will delve into the required paperwork:

The Foundational Files:

- The Memorandum of Association (MOA) contains information about your company’s name, goals, authorised capital, and share distribution to shareholders.

- The association’s articles (AOA): lays out your company’s internal governance structure and the rights and obligations of shareholders, directors, and other stakeholders.

Evidence of Residence and Identity:

- For directors as well as shareholders, passports or Emirates ID cards are required. Reputable identity documents are necessary to confirm your identities and guarantee that you are following the law.

- Evidence of address: Authorities in free zones want documentation proving your residence address, whether it be utility bills or bank records.

Financial scheme:

- Business plan: It should outline your company’s vision, market strategy, and financial projections demonstrates your preparedness to potential investors and free zone authorities.

- Bank reference letter: It depends on the specific requirements of your chosen free zone. A letter from your bank confirming your financial standing and creditworthiness might be requested.

Additional Provisions:

- Power of attorney: if Shareholders and directors are not available physically, theyc can hire a specific representative who can deal with the company formation process.

- No objection certificate (NOC): a NOC should be provided by the people who are currently employed in the UAE before the foundation of the company.

These are the necessary documents that may be required for your offshore company formation in Dubai, and the UAE. However, depending on the specific free zone and the nature of your business, additional paperwork might be required.

Steps to start an offshore company in UAE

he UAE is enriched land for the offshore company formation. It offers a wide spectrum of advantages such as low or zero taxation, high confidentiality, strong legal protection, and access to a large market. Before going all in for the establishment of offshore company in the uae, you must get the knowledge of all the requirements that needs to be fulfilled and challenges to overcome. Not to forget, the precise planning, steadfast determination and proper guidance, your international business plan will be executed successfully.

For a journey to be succeeded, a well-charted course, clear landmarks, and unwavering determination are required. Moreover, building the offshore company in Dubai would be a profitable decision for entrepreneurs and investors who want to take advantage from the city’s regulations. This may include what this jurisdiction offers like tax advantages, asset protection, and confidentiality Even yet, establishing an offshore business appears to be a straightforward procedure, but it fact calls for careful preparation, investigation, and adherence to the most current updates to rules and regulations. This section will provide you a thorough rundown of the steps involved in establishing an offshore business in the United Arab Emirates.

Opt For The the Appropriate Jurisdiction

The very first decision is selecting the most suitable jurisdiction for your company’s launch. Each free zone has its set of regulations, strengths, and target industries. Without a doubt, exploring this choice requires careful consideration and expert guidance. Picking the right zone is crucial for a smooth and prosperous journey. Next, we will describe the key factors to ponder as you chart your course:

- Business Activity Alignment:Align your chosen free zone with the specific activities your offshore company intends to undertake. Each zone has its own permitted ventures. Research the available options, ensuring your chosen free zone allows you to navigate freely within your intended business parameters.

- Regulatory Landscape: Different free zones have varying regulations regarding company structure, licensing requirements, and reporting obligations. Consider your comfort level with the legalities. Choose a zone with a regulatory framework that aligns with your operational needs and risk tolerance.

- Cost Considerations: Free zone fees, licensing charges, and ongoing maintenance expenses can vary significantly. We recommend that you seek the best offshore company formation service that can assist you with the financial landscape across different zones.

- Ease of Setup and Ongoing Management: Some free zones boast streamlined setup processes and efficient administrative support. While others might require more paperwork and bureaucratic hurdles. Choose a zone that prioritizes ease of doing business, allowing you to focus on your entrepreneurial endeavors.

- Access to Talent and Resources: Consider the availability of skilled professionals and relevant resources within your chosen free zone. Moreover, some zones are renowned for specific industries or attract a diverse talent pool.

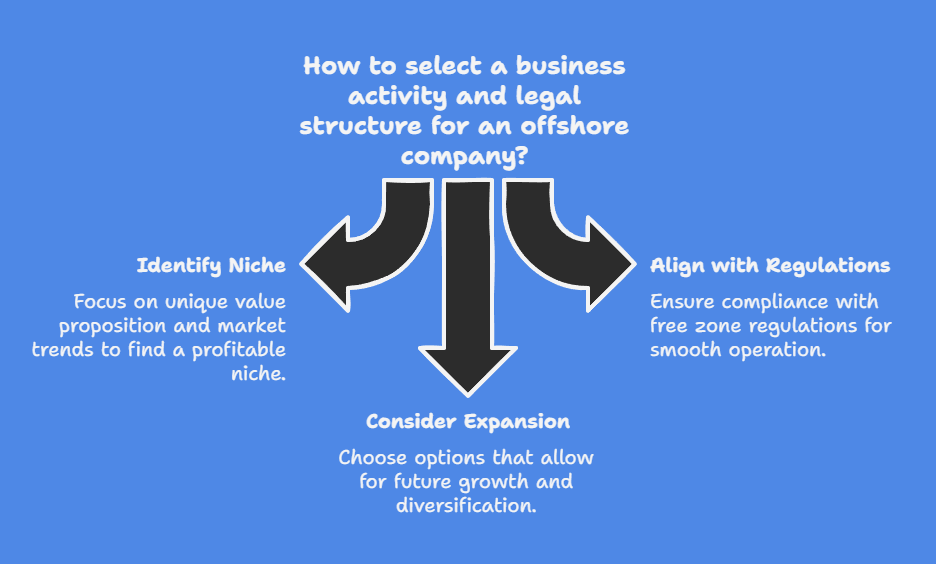

Select a Business Activity and Legal Structure

Having chosen your ideal harbor in the UAE free zones, it is time to set your course. This involves deciding on the specific business activity your offshore company will undertake. Also, selecting the most fitting legal structure to navigate the waters of international commerce. We recommend you to consider the next factors:

- Identify your niche: What unique value will your offshore company bring to the global marketplace? Research market trends and identify a profitable niche within your chosen free zone’s permitted activities.

- Align with regulations: Ensure your chosen business activity adheres to the specific regulations of your selected free zone.

- Consider future expansion: Think beyond your immediate goals. Choose a business activity and legal structure that allows for future growth and diversification.

Some of the popular legal structures are:

- Limited Liability Company (LLC): A well-liked option due to its establishment simplicity and flexibility. By providing directors and stockholders with limited responsibility, an LLC shields your personal assets from company obligations.

- Free Zone Establishment (FZE): This type of structure provides simplified operations with low reporting requirements, and it permits 100% foreign ownership. It frequently has limitations on the kinds of company operations that are allowed, nevertheless.

- Branch Office: if you have already established onshore business, then establishing a branch office in a free zone will help your business to grow more and reach new markets.

Keep in mind that the best course of action and legal framework for your offshore company will mostly rely on your individual objectives, industry, level of risk tolerance, and long-term ambitions.

Company Registration

Registration of an offshore company establishment in the United Arab Emirates is completed, following the complete local laws and regulations. Companies that operate outside of the country in which they were incorporated are known as offshore corporations. select a suitable offshore jurisdiction and then follow the described steps to register an offshore business in the United Arab Emirates:

Select a distinctive moniker for the offshore business. The name shouldn’t be confusing to any already-existing business in the United Arab Emirates or the selected offshore country. Additionally, no prohibited terms or phrases, such bank, insurance, trust, or royal, shall be included in the name.

These are the documents that list the objectives, organizational chart, and rules of the offshore firm. In any case, the memorandum and articles of organization should be drafted in accordance with UAE legislation as well as the laws of the chosen offshore jurisdiction.

Complete the application and remit payment

The following paperwork should be included with the application: copies of the directors’ and shareholders’ passports, evidence of each director’s and shareholder’s address, a bank reference letter for each director, the memorandum and articles of association, the name reservation certificate, and, if necessary, a power of attorney. The chosen offshore jurisdiction and registered agent have an impact on the fees. Receive the certificate of incorporation. Once the application is approved, the offshore company will receive its certificate of incorporation, which is the official document that confirms its existence and validity.

Open a Bank Account

You must choose a bank that provides corporate banking services for offshore corporations in the United Arab Emirates after registering your offshore business. There are several local and foreign banks to select from. The factors like minimum balance requirement, transaction fees, interest rates, online banking options, customer support, and reputation should be considered while choosing bank.

Once a bank has been chosen, a corporate bank account application must be made. The business plan, the bank reference letter, the passport copies of the directors and shareholders, the memorandum and articles of organization, the certificate of incorporation, and the proof of address must all be completed and presented with the application form. You may also be required to submit any additional documents or information that the bank requires.

The approval procedure can range from few days to several weeks. This depends on the bank have chosen and how complex your case is. You might need to attend a meeting or interview with the specific bank representative to confirm your identity and business information. After getting the approval, you will have to activate your bank account. Sign a contract with the bank and submit minimum monetary figure into the account. You will be received your account number, IBAN number, SWIFT code, debit card, cheque book, and online banking credentials.

Connect with us for the comprehensive consultation with qualified professionals at MBS Consultancy, leading provider of offshore company formation services. We make sure you have all the compulsory documents, assuring a smooth and effective journey towards founding your offshore entity.