Business owners have used several kinds of result-driven tactics and strategies to ensure the financial sustainability of their businesses. The audit is the first and most important priority that they ensure to complete each year. There are numerous kinds of audits in Dubai, each carried out by licensed auditors. The audit assists in determining where the firm stands, its present financial position, and if it conforms with all relevant laws and regulations.

The goal is for an independent entity to audit and check the accounts to ensure that the financial statements of accounts have been maintained honestly and that no deceit or fraud occurs. Before announcing their quarterly results, all firms must have their accounts scrutinized. Audit companies in Dubai operate nationwide to assist businesses in complying with statutory legislation and avoiding fines and penalties.

Explore the details and relevant information about an internal audit Dubai to avoid fines and legal obligations.

An Internal Audit for Businesses: An Overview

An audit is the evaluation or inspection of a company’s books of account. It is normally carried out by licensed auditors in Dubai, followed by an in-person inventory check to verify that all departments record transactions consistently. The audit checks the accuracy of the organization’s financial statements and examines compliance with the state’s commercial laws and regulations.

The organization’s internal auditors perform an internal audit of the business. The audit is started by the firm’s owner and carried out by another person. Firms with shareholders or other directors use this audit to stay updated on their company’s finances. Internal auditing is helpful for ensuring that financial goals are achieved. It enables firms to ensure the accuracy of financial reporting, clear transactions, and other fundamental system controls.

The internal auditor and external audit are slightly different as internal auditors perform actions for internal business activities while external auditors perform audits for external activities of the business.

Importance of Auditing for Businesses in the UAE Business Landscape

Businesses are created to expand globally, generate additional income, and remain competitive. To ensure success, every organization must deal with financial transparency. One of a company’s primary aims to attain its targets is to keep its management in top form.

Business entities usually exercise caution during audits. Company executives focus more on evaluating all aspects of monetary affairs to streamline and monitor transactions.

As a business owner in Dubai, keeping your accounts audited every year ensures that your company’s records are updated and trustworthy. An audit in Dubai examines an organization’s internal controls, existing systems, and financial statements to assess its financial position and stability.

An audit conducted by audit companies in Dubai may benefit you in various ways including:

- Helps identify fraudulent operations.

- Aids to the firm’s development.

- Supports in making substantial choices for the business’s growth.

- It helps to maintain regulations and to comprehend the company’s values.

Ultimate Advantages of Internal Auditing for Businesses in Dubai

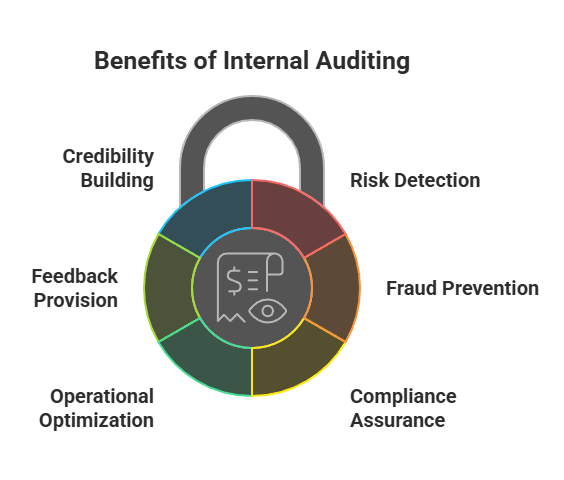

The internal audit Dubai provides numerous major benefits for UAE organizations that opt to undertake them on a regular basis. In addition to offering openness and developing confidence with stakeholders and regulatory agencies, they provide insight into an organization’s internal operations. Such monitoring maintains the accuracy of financial records while identifying possible dangers and inefficiencies in internal operations.

Detecting Risks:

Risk is an intrinsic component of conducting business. It may take several forms, including financial data, internal processes, external variables, or a mix. By identifying and fixing these problems early on through internal audit risk management, an organization may protect itself against possible risks. From accountancy to inventory management, spotting errors early helps prevent future difficulties that might cost you money or hurt your reputation.

Avoiding Fraudulent Activity:

The UAE’s financial rules have become more rigid in recent years, making it more necessary than ever to remain attentive against fraud. Internal audits examine financial data and transactions for discrepancies that could indicate fraudulent activity. Your business may make it more difficult by assessing internal controls, reinforcing them as needed, and fostering a culture of transparency via frequent audits.

Ensure Adherence And Avoid Sanctions:

Failing to comply with Dubai’s regulatory obligations is now more expensive than ever, with stiffer fines imposed on non-compliant firms and people. Businesses must have tight internal controls to discover financial irregularities early. The UAE’s laws make corporations responsible for their workers’ activities. Therefore, ethical finance policies in anti-money laundering and other high-risk sectors are critical.

Optimizing Operating Methods:

The internal audit Dubai may also help determine how effectively a company’s internal procedures and results work. They can find opportunities for improvement that can assist your bottom line by saving time and expense in your operations. This might include identifying inefficiencies in how you manage inventory or finish transactions. An operations audit will review your processes and systems and recommend simplifying your operation.

Provide Balanced Feedback:

Receiving an impartial, expert assessment of your company’s performance may be really beneficial. It’s easy to accept the status quo internally and miss obvious inefficiencies in your operations. For organizations aiming to develop or experience market constraints, a new perspective may shed light on the many accessible options, allowing them to make better decisions.

Establishing Confidence And Credibility:

The internal audit Dubai may help you develop confidence and credibility with your other stakeholders by fostering a culture of responsibility and transparency inside your firm. This may improve your connection with investors, regulators, and consumers. As financial rules have become more restrictive in recent years, it is more crucial than ever to be seen as reliable by people looking to conduct business or collaborate with you, and working with a trusted investment consultant Dubai can further strengthen that credibility.

Preventing Legal Penalties and Maintaining Compliance with Internal Audits for Businesses

Companies should take proactive measures throughout the year to prevent the fines and hassles of non-compliance. Here are some recommendations for staying on top of regulated audit obligations.

Planned The Horizon:

Make sure to compile your financial accounts ahead of time and get an appropriate auditor as soon as possible. Waiting until the last minute may cause delays or inaccuracies in your audit procedure.

Hire A Trustworthy Certified Auditor:

Work with an accredited auditor familiar with the unique needs of the local rules and the larger Dubai regulatory environment. A certified auditor can assist you in ensuring that your financial records are updated and fulfill the standards set by the law.

Monitor Your Financial Statements:

Examine and update your financial statements regularly to verify they are correct and represent your company’s actions. Regular internal audits may help detect inconsistencies early on, reducing the effort during the external audit.

Stay Updated on Statutory Amendments:

UAE legislations are subject to change. Thus, it is critical to remain updated on any revisions or changes to auditing standards. This helps guarantee that your organization stays compliant and prevents surprises during audits.

How Can MBS Consultancy Help Businesses with Internal Auditing?

MBS Consultancy provides bespoke internal audit services to satisfy the particular demands of Dubai-based enterprises. Our skilled personnel provide complete auditing solutions that enhance risk mitigation, operating effectiveness, and adherence to regulations.

As reputable UAE financial consultants, we deliver credible and comprehensive audit results that enable companies to make rational decisions. Whether you want to increase financial transparency or squeeze internal controls, our expertise can help you achieve long-term business achievement.

Conclusion

Maintaining a regular internal audit Dubai is one of the best decisions of a Dubai-based firm. It increases operational effectiveness and legal compliance and helps prevent fraud and make strategic decisions. By collaborating with professionals, you can guarantee that your company stays competitive, complying, and ready for development in the constantly evolving UAE market.