What is a limited liability company? An LLC is a company structure in UAE that protects its owner’s assets from illegal and creditors concerned about the company’s business debts.

Limited liability companies are combinations of entities with the features of an organization and a type of partnership or a private company.

While the limited liability aspect is the same as that of a corporation, the availability of pass-through taxes to LLC members is more characteristic of a partnership than an LLC.

Understanding the Structure of LLC

What is a limited liability company? In the UAE, LLCs are a common corporate structure that offers various benefits. It requires at least two and up to fifty shareholders, with responsibility restricted to their shares. While a UAE native sponsor was formerly required, recent reforms now allow for 100% foreign ownership in numerous areas.

Consulting with legal and business setup specialists is vital to ensure legality and increase the potential advantages of an LLC structure in the UAE.

LLC Formation in UAE

An LLC company in Dubai is a limited liability company that does not impose any liabilities on its owners or shareholders. The company itself is directly responsible for liabilities and debts. LLCs offer location flexibility, with mainland, free zone, and offshore setup possibilities.

They provide tax breaks, including no corporate or personal income tax. However, certain restrictions and compliance criteria must be followed, such as getting a trade license and following local labor laws.

Requirements to Form an LLC in UAE

To form an LLC in the UAE, you typically need the following:

Initial Requirements:

- At least two stockholders are needed.

- Some industries now require local sponsors, while others allow 100% foreign ownership.

- Businesses must have clearly defined activities to receive the necessary license.

- A real office space is required, either on the mainland or in a free zone.

- Obtain initial approval from the UAE’s relevant authorities or applicable free zone authority.

- Create the Memorandum of Association, LLC agreement, and other legal documents.

- Process visas for employees and partners.

- Open a corporate bank account in UAE.

Other Considerations:

- Select a unique and compliant trade name for business registration.

- Although there is no minimum capital requirement for share capital, it varies by business activity.

- Comply with local laws, including labor and tax rules.

- Consult a local business setup specialist to assist in shortening the process and assure compliance.

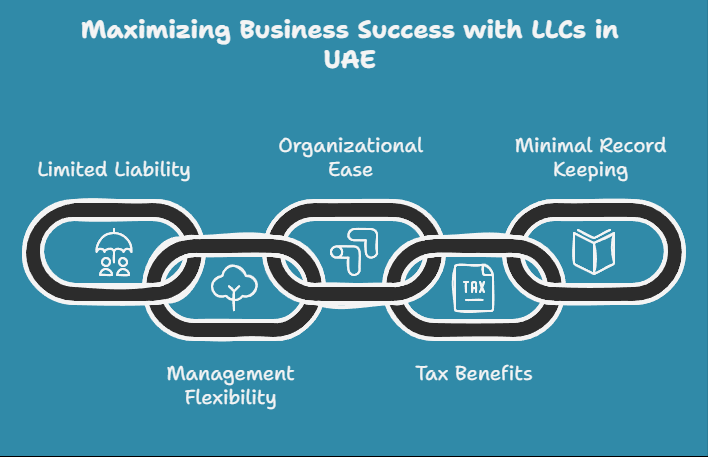

LLC Formation Advantages in the UAE Business Landscape

LLC Members:

An LLC company in Dubai offers its members with limited personal liability for the company’s commercial debts.

Limited Liabilities and Involvement:

An LLC company in Dubai can be administered by its members, or the members might employ a management to handle day-to-day operations. Some members may prefer to be more or less involved than others. The liabilities cannot be imposed on the owners or shareholders individually. The LLC is responsible for handling its own liabilities.

Easy Organization and Flexibility:

It is relatively simple to plan and get up and running. It provides you the freedom to choose between pass-through or corporate taxation (as a S Corporation or C Corporation).

Expenses as Deductions:

Many business expenses can be written off as deductions, lowering taxable income. These exemptions are claimed on the LLC or personal return depending on the taxation criteria as they selected, corporate or pass-through.

Pass-Through Taxation:

Its pass-through taxation prevents double taxation, which means paying taxes twice: first on LLC profits and again on profits received by individual members.

Less Record Keeping:

LLC business structure is feasible and smooth for administrative tasks. It requires less record-keeping and complex documentation than corporations. It allows business members to pay more attention and focus on business perspectives and major goals to acquire smooth operational freedom and ultimate success.

Partnership Business Structure Vs. LLC

An LLC differs from a partnership in dividing the company’s financial assets from the shareholders’ assets. This protects the owners from the LLC’s obligations and investigations.

LLCs and partnerships are permitted to pass on their profits and the responsibility of taxation on them to their business owners. The loss from the revenue of every member can be offset and it’s only concerned by the certain investment in business.

A business continuity agreement can be used in an LLC to ensure that interests are transferred smoothly when one of the owners departs or dies. Without such a contract, the remaining partners must dissolve the LLC and form a new company.

Taxation for LLC and Corporate Businesses in the UAE

Although corporations and limited liability companies can be incorporated in the UAE, their taxes differ. LLC companies in the UAE are often excluded from corporation and income taxes. This is an easy choice for companies looking to reduce their tax burden.

However, it is vital to remember that the LLC’s tax-free status may differ depending on its unique activities and location (mainland, free zone, or offshore).

In 2023, the UAE implemented a federal corporation tax that applies to all businesses and persons operating under company licenses in the UAE. On the other hand, businesses in the UAE are liable to corporate tax.

The 9% tax rate applies to net profits. You must speak with a tax specialist to fully understand the exact tax consequences for your UAE company’s structure.

Conclusion

A Limited Liability Company in Dubai is the most reliable business structure that provides various benefits. It requires at least two and up to fifty shareholders, with responsibility restricted to their shares. While a UAE native sponsor was formerly required, recent reforms now allow for 100% foreign ownership in numerous areas.

LLCs offer location flexibility, with mainland, free zone, and offshore setup possibilities. They provide tax breaks, including no corporate or personal income tax. However, restrictions and compliance criteria must be followed, such as getting a trade license and following local rules and regulations.

Consulting with legal and business setup professionals is important for ensuring compliance and maximizing the benefits of an LLC structure in the UAE.