Introduction

Trust depends on transparency in the business world. Investors and stakeholders expect reliable financial statements backed by independent audits. Knowing the types of audit reports your company may receive helps you anticipate outcomes. Enabling them to act strategically.

Auditing integrates AI tools and new regulations in 2026. This makes reports more insightful and nuanced. Understanding the different audit report types and their components empowers business leaders. They can better maintain credibility and address risks. This fosters confidence in their financial reporting.

The detailed guide is written to shed light on what an audit report is, its types, key components, and key guidelines to prepare one. We’ll discuss every topic one by one. The purpose is to equip you with the latest information to implement best practices in your business.

What Is an Audit Report? Why It Matters?

An audit report represents the auditor’s objective assessment of financial statements and internal controls. It goes beyond compliance and offers valuable feedback. The feedback is based on governance, risk, and control effectiveness.

A well-crafted audit report signals financial accuracy to investors. It highlights internal control weaknesses while offering improvement suggestions. A clear audit report supports regulatory compliance and strategic decision-making

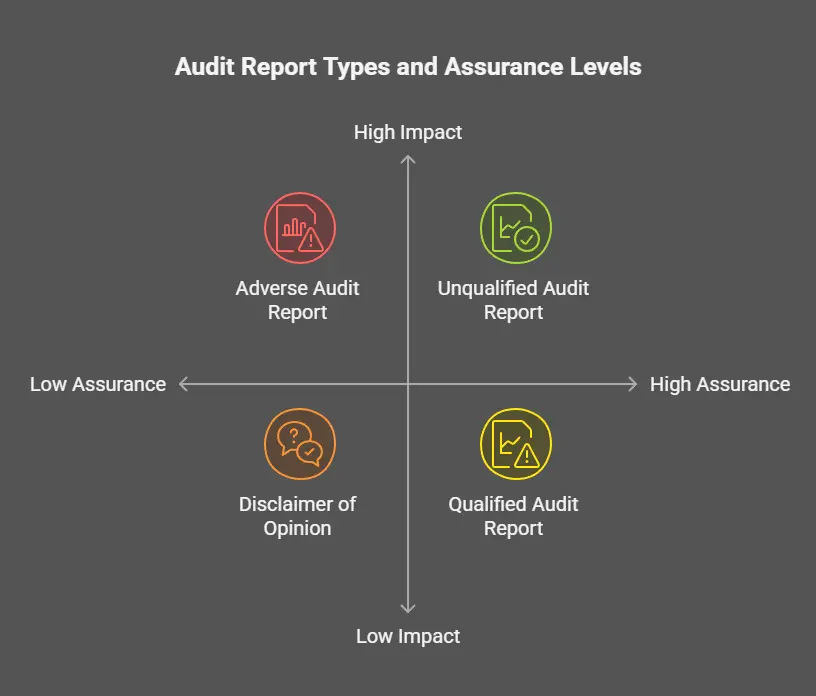

Type of Audit Report

Audit reports fall into four main categories. They are based on the auditor’s findings:

- Unqualified

- Qualified

- Adverse, and

- Disclaimer.

Each reflects a different assurance level and impact.

1. Unqualified (Clean) Audit Report

Also called a clean opinion, this is the best outcome. The auditor confirms that the financial statements are accurate. Validate whether they comply with applicable standards and contain no material misstatements. This builds trust with investors and lenders.

2. Qualified Audit Report

Issued when minor issues or limited scope errors arise. The auditor states that, except for specified matters, the statements are reliable. They may highlight a particular misclassification or missing disclosure.

3. Adverse Audit Report

This is the worst opinion. It signals pervasive material misstatements and unreliable financial statements. Stakeholders treat this with caution. When issued, it severely undermines investor confidence.

4. Disclaimer of Opinion

Here, the auditor cannot issue any opinion, usually due to restrictions in audit scope or insufficient data. It indicates an inability to verify the financial statements.

Vital Components of an Audit Report

Most audit reports share a structured format as formatted below:

At the Top

- Title: Usually “Independent Auditor’s Report.”

- Addressee: The board of directors or shareholders.

- Auditor’s Information: Firm name, location, and date.

Opinion Section

This declares the audit opinion type and confirms that the financial statements fairly present financial position, results, and cash flow.

Basis for Opinion

Auditor describes their audit responsibilities. The adherence to standards and the method of gathering audit evidence.

Detailed Findings & Recommendations

Reports may include the “5 C’s” structure per finding:

- Condition: What’s wrong?

- Criteria: Which standard was missed?

- Cause: Why did it happen?

- Consequence: Risk or impact?

- Corrective Action: Suggested remediation steps.

Additional Sections

- Critical Audit Matters for unqualified opinions per PCAOB AS 3101

- Explanatory Paragraphs when needed

- Signature and Reporting Date

Audit Reports Preparation Guidelines

Ensuring quality and clarity is essential. To achieve this, follow these best practices:

1. Understand Audience and Purpose

Determine whether the report is for investors, the board, or internal stakeholders. Tailor tone and depth accordingly.

2. Use Jargon-Free Language

Write clearly and concisely, focusing on readability. Avoid vague statements; be specific and direct.

3. Include Structured Recommendations

Base recommendations on 5‑C analysis. Provide timelines and accountability for corrective actions.

4. Address Critical Audit Matters Transparently

If required, explain complex judgments, high-risk areas, and management override risk.

5. Leverage AI Tools Carefully

Many firms use AI for risk scoring, data extraction, and board reporting. However, regulators now expect proof that auditors monitor AI effectiveness and avoid bias.

6. Ensure Compliance with New Standards

Effective later in 2026, PCAOB AS 1215 mandates thorough documentation. Adhere strictly to retention and evidence norms.

7. Review and Finalize with Stakeholders

Ensure reviewed drafts go through partners, legal counsel, and management for accuracy and completeness.

Typical Audit Report Format Table

The format table below is used for a typical audit report:

| Section | Key Content |

| Title & Addressee | Independent report heading, addressed to stakeholders |

| Opinion Paragraph | States unqualified, qualified, adverse, or disclaimer |

| Basis for Opinion | Explains audit scope, standards followed, auditor’s role |

| Critical Audit Matters (if any) | Discloses significant risks and judgment areas |

| Findings & Recommendations | Details each audit issue using the 5 C’s framework |

| Signature & Date | Auditing firm’s sign-off, location, and report date |

Latest Trends in Audit Reporting (2026 Focus)

Discover the latest trends that are being widely adopted by auditing firms in audit reporting. From AI integration to sustainability reporting, there are several new trends going on.

AI Integration and Audit Quality Concerns

Auditing firms now automate risk identification, transaction analysis, and contract review using AI. Regulators demand metrics to monitor these tools’ effect on audit quality, not just usage. Firms must track performance indicators, detect bias, and ensure reliability.

ESG & Sustainability Reporting

New audit reports now include commentary on ESG disclosures and climate‑related financial risks, per emerging regulatory norms.

Unified Internal Audit Reporting

Internal audit functions now issue reports aligned with board expectations, including governance and control assessment summaries using the standardized Pulse of Internal Audit framework across different types of internal audit.

Why Knowing the Types of Audit Report Matters

Understanding the audit report type matters due to so many reasons. We’ve compiled some of those in the section below:

- Unqualified Reports boost credibility and investor confidence.

- Qualified Reports signal minor concerns that need attention.

- Adverse Opinions can derail funding and prompt investor withdrawal.

- Disclaimer Reports raise red flags about transparency or cooperation issues.

Next steps after receiving a report:

- For qualified reporting: address the issues flagged.

- For adverse or disclaimer: engage advisors and consider re-audit or remediation.

- For internal audit findings: implement corrective actions and track improvements.

Conclusion

Understanding the types of audit reports and their components empowers businesses. Permitting them to interpret audit outcomes clearly and act decisively. A clean report validates good financial health. Meanwhile, qualified, adverse, or disclaimer opinions can guide meaningful improvements.

In 2026, audit reports evolve beyond statement opinions. They inform risk management, governance, and strategic trust.

Organizations should prepare thoughtfully, embrace transparent reporting, and align with evolving standards and AI oversight. By doing so, you transform audit report types into levers for stronger governance and sustainable growth.

If you still have queries, you can leverage the expertise of professional consultants from MBS Consultancy to closely understand the audit reports. Our consultants lets you know how it works and how it’ll make your business operations clear and transparent.

FAQs

Q: What are the four types of audit reports?

They are Unqualified (Clean), Qualified, Adverse, and Disclaimer of Opinion. Each represents a different level of assurance.

Q: Why would an auditor issue a qualified opinion?

They issue it when only specific parts of the financials have minor misstatements or scope limitations. Not pervasive enough to affect the whole report.

Q: What does an adverse audit report indicate?

It indicates substantial inaccuracies in financial statements that undermine their reliability. Stakeholders often view it as a serious red flag.

Q: What is included in the basis for opinion section?

It outlines audit scope, standards followed, responsibility statements, and audit methodology. This builds the foundation for the opinion given.