The corporate tax UAE with its free zones is the main aspect for businesses intending to base their operations in this thriving economy. The complexities of corporate tax UAE rules are critical in the formulation of sound strategic plans and long-term development.

In this article, we go in-depth with seven important considerations that clearly show the nature of the corporate tax UAE free zones. In terms of eligibility criteria, legal structures, compliance requirements, international considerations, challenges, risk mitigation strategies and the future prospects.

Understanding the Basics of Corporate Tax in UAE Free Zones

The corporate tax UAE free zones is the fundamental element in the governance of businesses within these stipulated zones.

Overview of Corporate Tax:

UAE’s tax system is characterized by its business-friendly atmosphere. As long as there are no federal corporate or personal income taxes. While individual emirates and free zones have the power to set taxes and fees. Such as UAE corporate tax, in their jurisdictions, businesses are allowed to operate in these districts.

Latest UAE Corporate Tax Law Updates (2023–2024):

The introduction of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (effective June 1, 2023) has reshaped the UAE’s tax landscape. Under the new law, while free zones continue to enjoy incentives, a 9% corporate tax applies to taxable profits exceeding AED 375,000. However, businesses that qualify as a “Qualifying Free Zone Person (QFZP)” can still benefit from a 0% corporate tax rate, provided they meet specific conditions related to eligible activities, compliance, and reporting requirements.

Tax Exemption Period:

A key appeal of UAE free zones is corporate tax UAE exemption for a certain time. This is usually between 15 and 50 years. During this period companies are given exemption from corporate tax UAE 2024 on profits; they generate from their operations within the free zone.

Tax Rates After Exemption:

At the end of the tax holiday period, companies become liable to profit tax. Tax rates applying vary depending on the particular type of free zone and the type of business activities performed.

Value Added Tax (VAT):

Although corporate tax UAE 2024 is not applied at the federal level in the UAE, the country’s businesses are subject to VAT that came into force in 2018. VAT is charged on most goods and services with a standard rate of 5%.

Tax Planning Considerations:

Proper corporate tax UAE planning is crucial to maximizing UAE corporate tax benefits and achieving optimal tax position of companies operating in UAE free zones.

Importance of Compliance:

While free zones provide favorable UAE corporate 2024 benefits, obligation with regulatory regulations is indispensable. Companies should keep accurate financial records, observe reporting obligations, and obey relevant law and regulation so as to avoid penalties and maintain their tax exemptions.

Identifying Eligible Business Activities

The tax deduction entitlements in UAE Free Zones is dependent on the type of business operations. In some cases, some sectors or industries may get preferential treatment. But others may be subject to restrictions or have some additional requirements.

Having the criteria for qualifying business activities in mind is important. Especially, for companies that want to create better corporate tax UAE scenarios.

Permissible Activities:

UAE free zones commonly categorize businesses’ activities into specific sectors or industries. Each sector has its legal procedures and requirements. Activities which are allowable may encompass trading, manufacturing, logistics, services, technology, among others.

Specialized Zones:

Some free zones in the UAE are reserved for certain sectors and offer customized incentives and infrastructures. This, to additionally draw the businesses that are active in those sectors. For instance, Dubai Internet City concentrates on technology and innovation.

Restrictions and Limitations:

The exceptions considered in free zones in UAE are the ones which are restricted or limited due to regulatory considerations or strategic priorities.

Impact on Tax Liability:

The types of business the companies are carrying out is one of the key factors that, furthermore, can shape the UAE corporate tax 2024 obligations of companies in free zones. The enterprises that will support economic diversification, innovation, and job creation may get additional corporate tax benefits or incentives.

Expansion Opportunities:

Companies working in UAE free zones can experience a certain level of flexibility to diversify their business activities through time. Provided that they comply with applicable regulations and that certain approval processes are completed.

Consultation and Advisory Services:

Professional firms offer companies specialized and expert legal, tax, and business advisory services. In order to make the task of identifying corporate tax eligible business activities in UAE free zones easier.

Legal Structures and Business Forms

Choosing the appropriate legal form is moreover an important decision that companies making incursions into the UAE free zones must make.

Free Zone Company (FZC):

Free Zone Company has furthermore become a preferred mode of business incorporation. Moreover, for businesses wanting to set up an autonomous one-off entity within an Emirates Freezone. LLCs are a type of FZCs and they have therefore limited liability.

Branch Office:

A foreign business can open branches of its companies in the UAE Free Zones to carry out particular business activities. This, without having to structure a standalone legal entity.

Representative Office:

Rep Offices is a non-trading sub-entity of foreign firms where they can advertise and market their products, services, conduct market research, liaise with clients/customers in UAE free zones.

Special Purpose Vehicle (SPV):

Special Purpose Vehicle (SPV) are legal entities created for a certain purpose or besides a particular project. Moreover, like asset holding, financing activities and investment facilitation.

Joint Ventures and Partnerships:

Collaborative arrangements such as joint ventures and partnerships enable companies to come together, share some of their resources, risks and pursue the same objectives in UAE free zones.

Licensing and Registration:

Setting up a new company within a free zone in the UAE will moreover require obtaining the required corporate tax registration and license from the relevant authorities. The corporate tax registration tool, as such, may therefore vary.

Compliance with Regulatory Requirements

Abiding by regulatory requirements is one of the necessary conditions that shut up in UAE free zones must meet to continue having a beneficial corporate tax status and, consequently, escape legal and financial penalties.

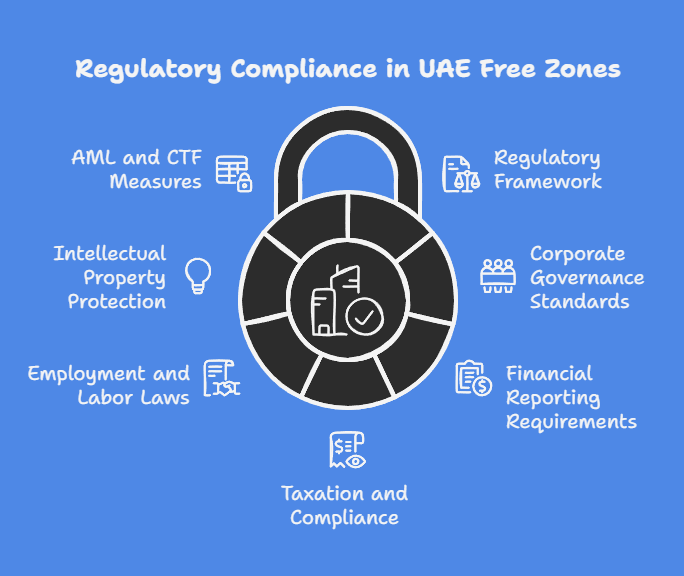

Regulatory Framework:

UAE free zones have moreover their legislation defined under the rules of the respective free zone authorities and relevant governmental bodies. Additionally, the regulatory field includes laws, regulations, policies, and guidelines dealing with different facets of operations at the firm level.

Financial Reporting Requirements:

An organization operating in UAE free zones moreover shall be maintaining proper financial records and preparing annual accounts. Consequently, based on the International Financial Reporting Standards (IFRS) or any other applicable accounting standards.

Update on Compliance & Reporting (2024 Requirements):

From 2024 onwards, all free zone companies are required to file a corporate tax return annually, even if they qualify for a 0% tax rate under the free zone regime. Businesses must also ensure compliance with Transfer Pricing (TP) rules, applying the arm’s length principle and maintaining proper TP documentation for intra-group transactions. Corporate tax returns must typically be filed within 9 months from the end of the relevant financial year, making timely compliance essential to avoid penalties.

Taxation and Compliance:

Free trade zones provide corporate tax UAE benefits and in addition exemptions to lure businesses. However, companies must comply with the existing tax laws and regulations. This, to continue enjoying the corporate tax privileges and evade penalties.

Employment and Labor Laws:

UAE Free zones-registered companies should follow local employment and labor legislations that cover various issues relating to employment relationships, such as recruitment, employment agreements, wages, working hours, health and safety, and termination of employment.

Intellectual Property Protection:

Together with intellectual property (IP) rights, companies operating in UAE free zones in knowledge-based sectors such as technology, media, and healthcare view IP rights as capital assets.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Measures:

UAE free zones have moreover set high compliance standards on combating money laundering, terrorist financing, and other financial crimes through the adoption of stringent AML and CTF regulations and measures.

Double Taxation Agreements (DTAs) and International Considerations

The globalizing business world makes international tax treaties and agreements an important tool for the companies working in free zones to therefore maximize corporate tax UAE efficiency, reduce risks, and simplify cross border transactions.

Overview of Double Taxation Agreements:

DTAs are usually either bilateral or multilateral agreements between countries which apportion taxing rights and give relief from double taxation on a company’s income and capital gains derived by the residents of the contracting states.

Benefits of DTAs:

DTA agreements provide a number of advantages to businesses operating in UAE free zones such as reduced withholding tax rates on cross-border payments, tax credit or exemption for foreign tax paid.

Application of DTAs:

The use of DTAs is subject to the residency status of the taxpayer, moreover the type and the source of income, and the provisions of the associated DTA.

Limitations and Anti-Avoidance Measures:

Despite the fact that DTA’s purpose is to prevent double taxation and enhance economic cooperation, they may also comprise limitations on benefits provisions, anti-abuse clauses, and anti-avoidance measures to prevent tax evasion, treaty shopping, and other forms of tax abuses.

International Tax Planning Strategies:

International tax planning plays a critical role in the operations of companies in the UAE free zones where it is utilized to optimize the companies’ tax position, additionally reduce risks, and improve competitive advantage in the global arena.

Compliance and Reporting Obligations:

UAE free zone companies should comply with laws and regulations related to taxation, moreover including the reporting requirements for related-party transactions and cross-border investments.

Potential Challenges and Mitigation Strategies

Businesses enjoy multiple advantages when they operate in free trade zones in UAE. Including, but not limited to compliance, planning and operations in corporate tax UAE.

Impact on Multinationals and SMEs:

The new corporate tax regime affects businesses differently based on their size and scope. SMEs and startups earning below AED 375,000 remain exempt from the 9% tax rate, but they are still required to register and file annual corporate tax returns. On the other hand, multinational corporations and larger foreign investors must carefully evaluate transfer pricing rules, cross-border taxation, and compliance requirements, as their tax exposure and reporting obligations are far more complex.

Regulatory Complexity:

The dynamic regulatory backdrop in UAE free zones, comprising, among others, changes to:

-

- Tax Laws

- Regulations

- Policies

Presents risks to businesses to continue their compliance and adjust their tax planning operations accordingly.

Compliance Burden:

Corporate tax compliance with the laws and regulations, including reporting and keeping records as well as filing deadlines can impose a wonderful burden on the companies operating in UAE free zones.

Tax Disputes and Litigation:

Disagreement with tax authorities in matters of taxation may result from interpretational, administrative, or enforcement differences. Moreover, companies are required to keep accurate books, document their corporate tax positions and enter into a constructive dialogue with tax authorities.

Transfer Pricing Risks:

Problems of transfer pricing, the setting of prices for intra-group transactions, the allocation of profits, evidence requirements, moreover can become the subject of full-scale investigation by tax authorities, may entail adjustments, penalties and international double taxation.

Geopolitical and Economic Factors:

Political issues, economic issues, and world situations can furthermore influence the conduct of business, the conditions in the market, and the tax systems in UAE free zones.

Technology and Cybersecurity Risks:

The widespread digitalization of business operations and increased adoption of Information Technology therefore create the risk of cybersecurity incidents, data breaches and cyber-attacks.

Talent Acquisition and Retention:

Having access to a skilled talent pool is crucial for the companies that function in free zones in UAE for them to become innovative, grow and be competitive. Firms are required to have policies that create an environment of effective recruitment, training and retention of qualified personnel.

Future Outlook and Growth Opportunities

Yet in spite of the complexities and challenges in corporate tax of UAE free zones, companies can still set their eyes on the horizon with optimism.

Economic Diversification:

The UAE government’s economic diversification and innovation focus, manifested in policies such as Vision 2030 and the National Innovation Strategy, creates a host of prospects for companies to engage with fast-growing markets.

Infrastructure Development:

Investments in the UAE’s ongoing infrastructure development mean companies can:

-

- Grow Their Operations

- Access New Markets

- Fortify Their Supply Chains

Innovation and Entrepreneurship:

UAE government’s backing for innovation and entrepreneurship, via schemes such as:

-

- Free Zones

- Business Incubators

- Investment Incentives

Makes a good environment for businesses, startups, and multinational companies.

International Trade and Investment:

Some of the factors that contribute to the UAE’S strategic location as a global hub for trade and investment are, therefore, its strategic location at the crossroads of major trade routes and its open and liberal business environment.

Sustainable Development Goals:

The UAE’s commitment to sustainable development that involves environmental stewardship, and moreover social responsibility opens up the possibility for companies to bring their business activities in line with the United Nations Sustainable Development Goals (SDGs).

Digital Transformation and Industry 4.0:

The implementation of digital transformation, automation, and Industry 4.0 technologies is critical for the companies to therefore increase the efficiency, flexibility, and competitiveness in the constantly changing business environment.

2026 Outlook (Emerging Trends):

Looking ahead to 2026, the UAE’s free zone corporate tax framework is expected to keep evolving. Possible developments include:

- Global Minimum Tax Alignment: Adoption of OECD Pillar Two rules with a 15% minimum tax for large multinational groups.

- Refined QFZP Criteria: Further clarification and tightening of “qualifying income” definitions.

- AI-Powered Compliance: Mandatory use of digital platforms and AI tools for real-time tax reporting.

- Sustainability-Linked Incentives: Tax benefits tied to ESG-friendly business models and clean energy investments.

- Expanded Tax Treaties: More DTAs with international partners to protect cross-border income.

Conclusion

Navigating the corporate tax UAE free zone framework requires careful planning, compliance, and awareness of evolving regulations. While free zones continue to provide significant benefits such as tax exemptions, flexibility in operations, and access to global markets, the introduction of new laws like Federal Decree-Law No. 47 of 2022 means businesses must adapt to stricter compliance and reporting standards.

Whether you are an SME, startup, or multinational corporation, understanding eligibility, maintaining compliance, and leveraging international tax agreements will help you maximize opportunities while minimizing risks. With a forward-looking approach, companies can thrive in the UAE’s dynamic business environment and remain competitive well into 2026.

Frequently Asked Questions (FAQs)

Is UAE Free Zone Still Tax-Free After 2023?

Not entirely. While free zones still offer incentives, companies must meet specific criteria to qualify as a “Qualifying Free Zone Person (QFZP)” to enjoy a 0% corporate tax rate. Otherwise, profits exceeding AED 375,000 are subject to 9% tax.

Do All Free Zone Companies Need to File a Corporate Tax Return?

Yes. From 2024 onwards, all free zone companies must file an annual corporate tax return, even if they qualify for a 0% tax rate.

What Is the Corporate Tax Rate in UAE Free Zones?

Qualifying businesses in free zones can still enjoy a 0% corporate tax rate on eligible income. However, non-qualifying income and profits above AED 375,000 are taxed at 9%.

What Happens After the Tax Exemption Period in A Free Zone?

Once the tax holiday (usually 15–50 years) ends, companies may be liable for corporate tax depending on their business activities, income type, and compliance status.

How Does Corporate Tax Affect SMEs vs Multinationals in UAE Free Zones?

SMEs earning below AED 375,000 remain exempt but must still file tax returns. Multinationals face stricter rules, including transfer pricing compliance, cross-border tax considerations, and potential alignment with the OECD’s global minimum tax framework.