The United Arab Emirates has become an international trading hub, drawing both new and established businesses. Opening a corporate bank account is a very important step for any firm that wants to enter this fast-paced market. The procedure may appear complicated because of rigorous compliance rules, but knowing what you need to do and how to do it can open up a lot of income prospects.

This article is a complete guide on how to open a bank account in the UAE. It provides information on the different types of accounts you can open, the rules you need to follow, and the mistakes you should avoid.

Seamless Procedure for Opening a Bank Account for UAE Business

There are a number of well-planned actions that must be taken to open a business bank account in the UAE:

Look into and choose the right bank.

It is a very important initial move. Not all banks are the same; they may have different fees, minimum balance requirements, services, and customer service. Think about the following factors:

Basic Balance Criteria:

Some digital banks don’t charge anything, whereas larger financial institutions may charge a fee for services. Make sure that the bank’s needs match your expected cash flow.

Services, Costs, and Fees:

Check out the fees for starting an account, maintaining it each month, transferring money internationally, cash deposits and withdrawals, and issuing checks.

Online Banking Features:

A lot of modern firms depend on online and mobile banking. Check out the bank’s digital platforms to see how easy they are to use, what features they have, and how safe they are.

Assistance for Customers:

When dealing with complicated transactions abroad, responsive and competent customer support is very important.

Expertise in a Field:

Some banks may offer specialized services or have experience in certain fields that could help your business.

Quick Approval:

How to open a business bank account in the UAE? Quick acceptance and compliance verification can take a while, but certain financial institutions are known for processing applications more rapidly. For example, they can finish the whole procedure in seven to ten days for qualified candidates. Online financial institutions are also becoming competitive options, especially for new businesses.

Pre-requisite Paperwork

Because of rigid Anti-Money Laundering regulations, the procedure can get tough. Take great care when completing all the necessary papers. Some common documents are:

Business Documents:

- A legitimate trade authorization from the DED or the applicable free zone authorities.

- Incorporation Certification.

- Articles of Association and Memorandum, and any changes to them.

- Shares Certification.

- A board resolution that lets the account be opened and lists the people who are allowed to sign.

- A Company profile or business plan that includes information about the business idea, financial estimates, and the sources of funds.

Documents for Shareholders and Signatories:

- Copies of the passports of all directors and owners who are allowed to sign.

- Copies of the UAE Residency Visa and Emirates Identification Cards for all shareholders and signatories who live there.

- CVs or resumes of stockholders who have worked in a similar field.

- Personal bank statements from the last six-month period to show where the funds came from.

- Proof of where you live, like a utility bill, a lease, or an Ejari.

Evidence of Business Task:

- Proof of the address of the office or a lease.

- Agreements or invoices from current or potential clients (to show business operations and relationships).

- Contracts with suppliers.

- Bank statements from current enterprises.

- A VAT and a corporate tax registration certificate.

Note About Attestation:

If any shareholder is based outside of the UAE, their legal papers will need to be signed by the UAE Embassy in the nation where the firm is registered and then by UAE authorities. It can take a lot of time and be difficult to understand.

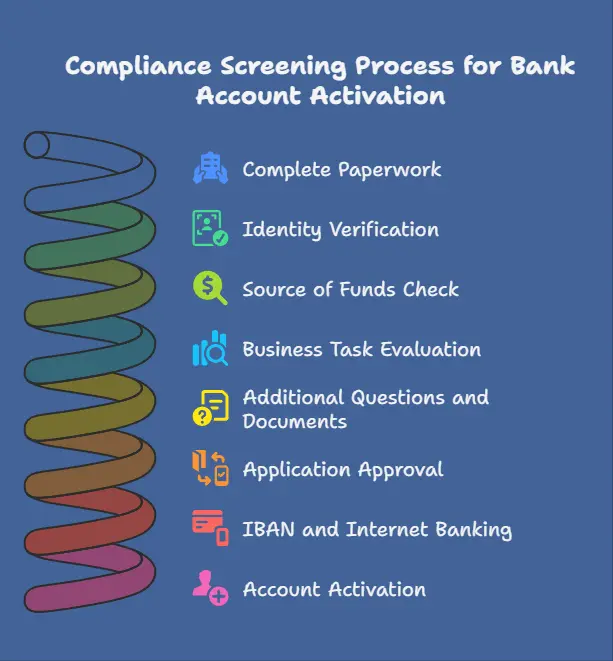

Go Through Compliance Screenings

Compliance screening is essential to deliver your application after you have completed all the paperwork. Banks will do extensive inspections. It includes:

Checking Your Identity:

Making sure that everyone involved is real.

Source of Money and Wealth:

Banks will look closely at where your business’s funds came from.

Business Task Evaluation:

Banks need to know exactly how your business works, how many transactions you anticipate doing, and what kind of clients and suppliers you have.

More thorough examinations and lengthier processing periods may be needed for businesses that are high-risk or have complicated ownership arrangements.

During this step, you should be ready to answer more questions and give more paperwork. Your information needs to be clear and consistent.

Acceptance and Activation:

Depending on the bank, how detailed your application is, and how complicated your business is, it takes a few days to a few weeks for approval. After your application is granted, you will get your International Bank Account Number (IBAN) and be able to use internet banking. To activate the account, you will usually need to deposit the minimum amount.

Stay Compliant and Prevent Common Pitfalls and Errors

To avoid frequent mistakes while dealing with banks in the UAE, you need to be very aware of compliance and take action.

Primary Measures for Remain Complaint

Financial Intelligence Rules:

These are very important parts of the UAE banking rules. Banks must alert the UAE’s Financial Intelligence about any transactions that seem suspicious. Businesses need to make sure that their financial dealings are honest and clear.

Get To Know Your Client:

Banks may keep an eye on transactions beyond the first checks and ask for new information from time to time.

Rules for the Ultimate Beneficial Owner:

Companies must keep records of investors, beneficial owners, and directors, and they must also give copies of important UBO forms.

Economic Substance Standards:

Particular companies in the UAE that do certain “relevant activities” must show that they have enough economic substance in the UAE. It’s a broader business compliance need, even if it’s not immediately related to bank accounts.

VAT Regulations:

If your firm is registered for VAT, you need to make sure that you file your VAT returns and payments on time.

UAE Wage Protection System Regulation:

For firms on the mainland, the WPS clarifies that salaries must be paid through recognized banks or exchange houses.

Avoid Erroneous Moves

Getting the Wrong Financial Institution:

Choosing a bank that doesn’t fit your business size, number of transactions, or minimum balance requirements might cause problems and extra expenses.

Missing Documentation:

It is the most common reason for delays and rejections. Check all of the required documents again to make sure they are accurate, complete, and consistent.

Fail to Comply with Guidelines:

If you don’t follow these regulations seriously, you could face long delays or even rejection. Be open and give all the information that is asked for right away.

Non-UAE Residents:

Some banks may accept applications from people who don’t live in the UAE. However, they must have at least one shareholder or director with a UAE residence visa. It usually makes things easier and gives you more banking options.

Below the Required Balance:

A lot of business accounts need a minimum balance. If you don’t keep this up, you could be in trouble or perhaps have your account frozen.

The Company Profile is Not Clear:

Banks need to know exactly what your business attempts to do, how it makes money, and how it runs. A business plan that is unclear or inconsistent can be a sign of trouble.

Complicated Business Structures:

When companies have layered structures, especially when they include more than one jurisdiction, they will always be looked at more closely and take longer to process.

Dormant Business Account:

Banks are hesitant to open accounts for businesses that don’t have clear, ongoing company operations or a demonstrated requirement for a local account.

FAQs

What papers do you need for this process?

To start the procedure, you’ll need an appropriate business license, an MOA/AOA, shareholder passports, identification numbers, and a full business strategy.

Do you need a UAE resident visa?

Some banks make exceptions, but possessing a UAE resident visa for at least one shareholder or signatory makes it much easier to open an account.

What is the expected time frame for this process?

The expected time varies by bank and the intricacy of the firm, but it normally takes two to four weeks, with compliance inspections being a significant component of it.

Final Words

If you want to start and expand your business in the UAE’s booming economy, you need to know how to open a bank account in the UAE. The process requires a lot of attention to detail and following rigorous rules, but the benefits are huge.

Corporations can get the most out of UAE business banking by doing thorough research on banks, making sure they have all the necessary paperwork, knowing their compliance duties, and avoiding common mistakes. It will make their financial operations run smoothly and help them develop faster.

To make sure that creating an account goes smoothly and successfully, it is generally a good idea to consult company setup experts or banking advisers who know a lot about the UAE’s banking system.