Want to boost your business and earn trust? Start with the right audit.

Understanding the difference between internal audit vs external audit is about making smart decisions. Internal and external audits both help your business grow stronger. But they work in different ways, involve different people, and serve different goals.

This easy guide breaks it all down, fast. You’ll learn what each audit does, why it matters, and how to choose what fits your business.

Firms like MBS Consultancy offer expert help in the UAE that you need. They conduct both internal and external audits, tailored to meet local compliance and business needs.

What Is an Internal Audit?

An internal audit is a detailed review of your business’s internal activities. It’s usually done by your staff or a hired internal audit team. These auditors work under your management’s direction.

The goal of an internal audit is to find weak spots, identify risks, fix errors, and improve systems. It helps you spot problems early, so you can avoid bigger issues later.

Internal audits don’t just focus on money. Different internal audit types look at areas like HR, supply chain, inventory, and IT. This makes them a powerful tool for keeping operations smooth.

They can be done regularly or whenever a specific issue comes up. UAE businesses often work with firms like MBS Consultancy for ongoing audit support that aligns with local compliance requirements.

What Is an External Audit?

An external audit checks your company’s financial records. A third-party audit firm does this. They must have no connection to your business.

Their goal is to confirm your financial statements are accurate and follow accounting standards. These audits are common for public companies or firms in regulated industries.

The external audit benefits your business by giving it credibility. It shows outsiders, like banks, investors, or government agencies, that your finances are accurate.

External audits are especially important in regions like the UAE, where financial accuracy and transparency are expected. Audit service providers such as MBS Consultancy help companies meet these expectations.

Internal Audit vs External Audit: What’s the Purpose?

Both audits help improve your business, but in different ways.

Internal audits help business owners and managers. They find problems early and improve how things run. These audits are preventive.

External audits are more about proof. They confirm your financial records are correct. Investors and regulators use them to measure your trustworthiness.

In short:

- Internal audit = Checks how your business runs

- External audit = Confirms your financial records are right

Comparison Table: Internal Audit vs External Audit

| Feature | Internal Audit | External Audit |

| Purpose | Improve operations, detect risks | Verify financial accuracy and compliance |

| Conducted By | Internal team or consultants | Independent audit firms |

| Focus Area | All business processes | Financial statements only |

| Reporting Audience | Management and board | Investors, lenders, regulators |

| Legal Requirement | Usually optional | Often mandatory |

| Frequency | As needed or periodic | Annually or as required by law |

| Report Confidentiality | Internal use only | Often shared with external stakeholders |

This table helps you quickly understand how the two types of audits compare.

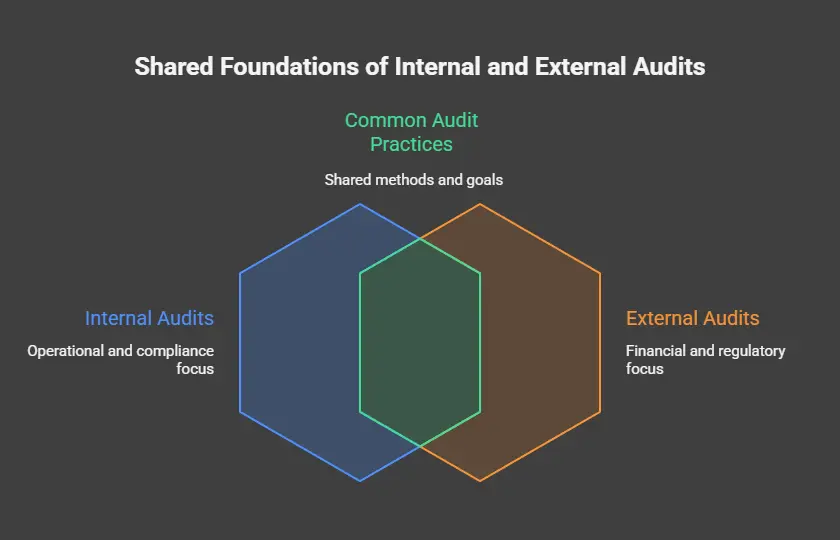

Internal Audit vs External Audit: Key Similarities

Even though internal and external audits are different in purpose, they do share some important common ground. Here are the major similarities:

Both Aim to Improve Business Performance

Internal and external audits both help businesses operate more efficiently. Internal audits identify inefficiencies, while external audits ensure accuracy in reporting. Together, they support better performance overall.

Both Follow a Structured Process

Each type of audit uses a step-by-step process to evaluate systems and data. From planning and data gathering to reporting, both audits rely on structure for effectiveness.

Both Rely on Accurate Records

Whether it’s an internal operations review or an external financial review, reliable records are critical. Auditors in both roles examine documentation to reach valid conclusions.

Both Help Manage Risk

Risk identification is a shared benefit. Internal audits focus on risks like process gaps and compliance issues. External audits flag financial inaccuracies and regulatory risks.

Both Support Accountability and Compliance

Both audits encourage responsibility within the organization. They also ensure that the company complies with applicable standards, laws, and internal policies.

For UAE businesses, these shared traits make combining both audits, ideally with a firm like MBS Consultancy, a smart move for total transparency.

What Does Each Audit Cover?

Internal audits cover all internal operations. This includes risk controls, staff training, IT systems, and more. They help you make smarter decisions and find gaps before they grow.

External audits focus only on finances. They review your income, expenses, assets, and debts. These audits make sure your financial records are correct and follow accounting standards.

Together, both types give you full control and credibility.

Who Sees the Audit Reports?

Internal audit reports are private. They are shared with your management team and board. These reports help plan internal changes.

External audit reports are shared with outsiders. These include lenders, investors, and regulators. Some businesses may even make them public.

Who Performs Each Type of Audit?

Internal teams or outside consultants you hire conduct Internal audits. These auditors must stay independent of the teams they’re reviewing.

Independent auditors or certified audit firms conduct external audits. They have no connection to your company and follow strict rules.

Firms like MBS Consultancy provide both services with expert teams who understand regional needs.

Why Are Both Audits Important?

Internal audits help your business run smoothly. They prevent fraud and reduce waste. They also improve decision-making.

External audits build your reputation. They help you attract investors, stay legal, and build trust with others.

Doing both makes your business stronger and more transparent. If you’re unsure where to begin, MBS Consultancy can guide you through internal and external audit planning in the UAE.

Which Audit Should You Prioritize?

If your main goal is to improve how your business works, start with internal audits. They give you insight and control.

If you want to raise money, comply with laws, or show you’re trustworthy, go for external audits.

In most cases, doing both works best, especially as your business grows.

Final Thoughts: Make Audits Work for You

Understanding internal audit vs external audit gives you the power to plan better. Internal audits help your business stay efficient. External audits build outside trust.

When you use both, you get better results, lower risks, and more chances to grow.

Whether you’re a startup or a large company, audits aren’t just about numbers. They’re about making your business stronger from every angle.

MBS Consultancy acts as your trusted audit partner in the UAE, offering both internal and external audit services tailored to your industry. With their help, you don’t just meet the standard, you raise it.

FAQs

What Is the Main Difference Between Internal Audit and External Audit in UAE Companies?

Across the UAE, internal audits improve processes and manage risks within the company. The external audits verify financial records for accuracy and compliance. The first one serves management, and the latter one serves regulators, investors, and other stakeholders.

Why Do Businesses in Dubai and The Wider UAE Need Both Internal and External Audits?

In Dubai, UAE, Internal audits strengthen operations and prevent risks. However, the external audits build credibility with regulators and investors. They achieve compliance, transparency, and business growth when implemented together. It helps UAE firms gain internal efficiency and external trust.

Who Appoints Internal Auditors vs External Auditors in A UAE Company?

In a UAE company, the management or the board appoints internal auditors, from within or through consultants. In comparison, external auditors are appointed independently by shareholders/regulators. Their duty is to ensure an impartial financial review.

Are Internal Audits Mandatory in The UAE, or Only External Audits?

For most UAE companies, external audits are mandatory, especially those in regulated sectors. Usually, internal audits are optional but strongly recommended for risk control, compliance, and operational improvement.

How Does the Scope of Work Differ Between Internal and External Auditors?

Internal auditors review all business processes, including operations, risks, IT, HR, and compliance. But external auditors focus only on financial statements. The purpose is to meet accounting standards and regulatory requirements.

Do Internal Audits in The UAE Focus More on Operations, While External Audits Focus on Financial Compliance?

Absolutely! Internal audits dig into daily operations, controls, and efficiency, while external audits mainly assess financial compliance and accuracy of reports. However, both complement each other for full business oversight.

How Often Should a Company in Dubai Conduct Internal vs External Audits?

A company operating in Dubai does Internal audits on a quarterly, semi-annually basis, or as needed. Typically, external audits are conducted annually, required by UAE law/regulators.

How Do Internal and External Audits Help with Fraud Detection in UAE Businesses?

In the UAE, internal audits detect fraud risks early by checking controls and processes. On the other hand, external audits confirm financial accuracy and flag irregularities. Together, they provide a stronger safeguard against fraud.