Certain issues come with operating a small business in the UAE. One of the most important things for small businesses is to make sure that their financial records. Bookkeeping systems are up to date and comply with local laws.

A professional accounting firm can help these kinds of organizations by taking care of their accounting and financial records. This article talks about the accounting services for a small business, reasons to acquire these services, and tips to stay updated with financial records and remain compliant.

What are the Accounting Services Suitable for Small Businesses

Basically, it’s the process of keeping track of funds and cash flow, evaluating, and reporting on the transactions of a business. It involves maintaining a complete and organized record of all financial activity. Including analyzing and reporting these transactions to executives, partners, and regulatory organizations.

In general, accounting services for small businesses in Dubai are very important to make smart financial choices and be responsible for their financial status. There are numerous kinds of accounting, each with specific tasks to perform in a business, such as:

Financial Accounting Services for SMEs

Financial accounting services in Dubai help companies to prepare and report financial data for outside groups, including financiers, creditors, government agencies, and other interested parties. To give a full and correct image of how a business is doing financially and what its status is. It is important for deciding whether to invest and determining if a company is creditworthy and has the resources to do so.

Auditing Services for SMEs

Checking and assessing the firm’s transactions, accounting records, and internal mechanisms to make sure that financial reporting is accurate, complies with the regulations, and is trustworthy. To find any mistakes, false statements, or illegal activities, and suggest ways to make financial controls and reporting systems better.

Internal auditors typically perform audits to let stakeholders, including financiers, creditors, and government authorities, know that the company’s financial statements are genuine and authentic.

Tax Accounting Services for SMEs

Getting tax returns and other tax-related financial papers ready, looking at them, and figuring out what they mean. It involves understanding and handling your tax obligations, making sure you comply with the current tax regulations, and looking for ways to minimize the cost of your taxes.

Tax accountants further assist individuals and companies in planning their taxes, finding reductions and credits, and filling out their tax forms. To correctly figure out and submit to the government how much tax a business owes.

Management Accounting Services for SMEs

Looking at and getting ready financial information so that management can make favorable business judgments. It includes creating reports, making budgets, analyzing costs, and helping with tactical planning and decision-making.

Accounting programs for small businesses can assist executives in comprehending and assessing financial data so that they may reach the organization’s goals. They also give managers information about how business operations affect the company’s finances.

Accounting Information Systems for SMEs

An Accounting Information System is a set of tools that gathers, keeps, processes, and shares financial and accounting data. It mixes learning about and doing accounting with designing, building, and keeping an eye on electronic information systems.

It is used to assist with operating an organization on a daily basis and to offer decision-makers financial information for future planning and administrative analysis. Business strategy, accounting forensics, feasibility analyses, and other accounting-related services are also available within these systems.

Cost Accounts Services for SMEs

Accounting services for a small business help keep track of, evaluate, and report on the financial implications associated with producing goods or services in a business. To give thorough information about the expenses of different parts of a business, like production, operations, and other activities, so that the company may control its costs, evaluate its performance, and make the right decisions.

Why Do Small Businesses Require Accounting Services in the UAE?

If you own a small business in the UAE, it’s important to maintain and keep track of your financial resources to perform well. Beneficial accounting outsourcing services may help you monitor your finances, make smart choices about spending and investing, and keep your business running smoothly.

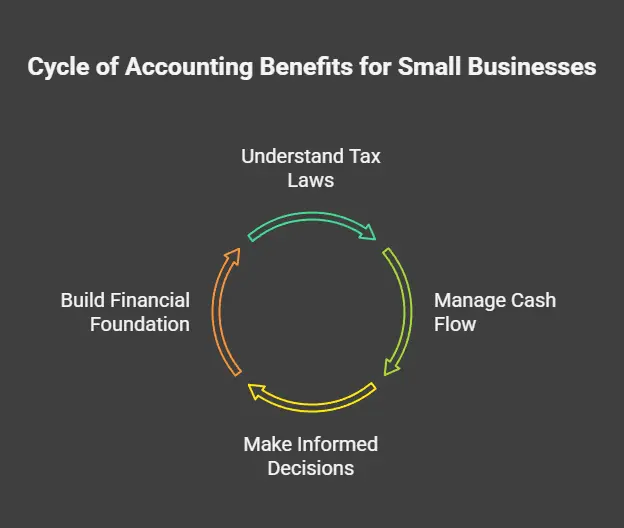

Learning About Tax Legislation:

If you own a business in the UAE, you need to know about the different tax rules. Accounting services help you to understand how the tax system works. You can better plan your financial affairs and stay out of difficulties with the law. It is the most significant role of accounting in business to identify and fulfill tax criteria in the region.

How to Handle Cash Flow:

Accounting assists you in maintaining records of how much funding you generate and spend, which may help you regulate your cash flow better. You may prevent spending too much capital and make smart choices about investments and growth by keeping an eye on your cash flow.

Making Smart Choices:

When you need to make smart choices regarding your business, it’s important to have accurate financial information. Accounting helps you figure out how well your organization is doing financially, find ways to make it better, and make smart choices regarding investments, costs, and growth.

Creating a Powerful Financial Base:

Beneficial accounting services for a small business can help you with bookkeeping and set up a solid financial base for your business. You may find areas where you can improve and make smart decisions that can assist your business to thrive by maintaining accurate records and keeping an eye on your finances.

Remarkable Tips for Small Businesses: Stay Updated with Accounts and Bookkeeping

Small businesses need to know some important things. These recommendations can help them understand the UAE’s laws for managing accounting and bookkeeping.

Maintain Proper Records:

All financial transactions must be recorded accurately by small enterprises in the UAE. It means keeping track of all payments, like receipts, invoices, and bills. Small firms can identify any fiscal issues, make smart choices, and comply with the rules imposed by the UAE government. It is important to keep documents safe and structured and update them regularly.

Utilize Accounting Software Technology:

Small businesses in the UAE can keep track of their finances easily with accounting software. Businesses can use accounting software to automate a number of operations, such as making invoices, keeping track of spending, and reconciling bank accounts. In the UAE, there are several accounting software programs to choose from. Businesses should pick the one that works best for them.

Keep Your Business and Private Finances Separate:

People who own small businesses in the UAE should keep their business and personal funds separate. In other words, opening a bank account in Dubai for your business and your individual funds separately is essential.

Mixing your personal and business funds might cause complications with your bookkeeping and make it hard to keep track of corporate costs. Corporate owners may also keep better track of their finances and file their taxes more simply if they keep their personal and corporate accounts separate.

Keep An Eye on Cash Flow:

Small businesses in the UAE need to maintain their cash flow to ensure their financial solvency and stability. It involves keeping track of all of the revenue transactions and comparing them to the budget. Small businesses can have major issues with cash flow. But keeping an eye on it can help owners detect complications early and fix them.

Strategies for Taxation:

Companies in the UAE should pay the least amount of taxes as possible and avoid issues by making tactical strategies for taxation with the help of expert accounting services for a small business.

Employ An Accountant:

Small businesses in the UAE should think about hiring an accountant to assist them in maintaining records of their financial resources. An accountant can give you useful guidance and knowledge on a number of accounting topics, such as taxes, financial reporting, and budgeting. Small businesses can save time, avoid mistakes in accounting, and make smart financial choices by hiring an expert accountant.

FAQs

What are the common methods of accounting for small businesses?

Accrual accounting and cash accounting are the most common methods for small businesses.

How can accounting services help small businesses?

They can help with bookkeeping, business and taxation advisory, cash flow and cost control, utilizing new technologies, and legal adherence to local laws.

What are forensic accounting services?

These accounting services deal with financial fraud, litigation, conflicts, and legal proceedings.

Final Words

It might be difficult for small firms to figure out Dubai’s complicated financial system. But businesses can get through tough times, get their finances in order. Do well in the competitive UAE market with the help of legitimate accounting services.

Get started by scheduling a free consultation with MBS Consultancy today for expert accounting services.