Thinking about setting up your business in the UAE or already running one? You’re probably asking yourself how to register VAT in the UAE. That too, without making costly mistakes or wasting time. The VAT process might seem overwhelming, especially with government portals, new rules in 2026, and long checklists.

But here’s the good news: this complete guide breaks everything down in simple steps. It’s designed for business owners who want to get it right the first time. This article has skipped the jargon, answered the real questions people ask, and built a resource you can trust, whether you’re just starting or scaling up.

What is VAT, and why does it matter for UAE Businesses

VAT or Value Added Tax is a type of indirect tax charged on most goods and services. It was introduced in the UAE back in 2018 to help the country reduce its reliance on oil revenue.

Understanding VAT is important for pricing, cash flow, and long-term planning. Businesses must stay updated to avoid penalties and stay competitive.

VAT Thresholds in 2026

| Type of Registration | Annual Turnover Requirement | VAT Registration Type |

| Mandatory | AED 375,000 or more | Compulsory |

| Voluntary | AED 187,500 to AED 374,999 | Optional |

These are the latest FTA-set thresholds. Meeting them determines whether your business must register or can register voluntarily.

Who Needs to Register for VAT

Not all businesses are required to register for VAT, but many must. Businesses exceeding AED 375,000 in taxable turnover must register. Startups expecting to cross the threshold within 30 days should apply in advance. Freelancers and service providers also need to register if their income meets the criteria. Even if you’re below the threshold, voluntary registration is available.

Step-by-Step: How to Register VAT in UAE

The VAT registration process can be carried out through online means by the Federal Tax Authority’s EmaraTax portal. You can easily register VAT in the UAE by following these simplified steps

Create an Account on the EmaraTax Portal

Visit EmaraTax and register. You’ll need a valid email address, Emirates ID (for individuals), and optionally UAE Pass for quicker access. Once registered, log in to your dashboard.

Prepare Required Documents

Having your documents ready speeds up the process. You’ll need your trade license, passport, and Emirates ID of the owner or authorized signatory, business contact details, bank information, and proof of revenue such as contracts or invoices.

Fill the VAT Registration Form

Go to the VAT tab in your EmaraTax dashboard. Click “Register for VAT.” Complete each section with accurate details about your business activities, customs involvement (if any), and financial figures. Be honest and double-check your inputs.

Submit and Wait for TRN

After completing the form, submit your application. The FTA will review it and issue your TRN (Tax Registration Number) by email upon approval. This number allows you to issue VAT invoices and file returns.

How to Register VAT for a New Company in the UAE

New companies often overlook VAT registration in their early setup. But if you’re crossing the revenue limit soon, registration is mandatory.

Understand Your Sales Forecast

Estimate your revenue for the next 30 days. If it will exceed AED 375,000, you’re legally required to register for VAT. Even if you’re below that, registering voluntarily can help with vendor trust and reclaiming input VAT.

Apply Early

Don’t wait until you’re over the threshold. Apply early to avoid penalties. Upload documents that support your projections, like signed contracts or MOUs.

Common Mistakes to Avoid During VAT Registration

Even small errors can give rise to major delays or potential fines if not addressed on time. Here’s how to avoid the most common VAT registration pitfalls in the UAE.

Missing Financial Proof

VAT registration requires documented proof of your taxable income. Without it, the FTA may reject or delay your application. Always submit recent sales invoices, signed contracts, or business bank statements that support your revenue claims.

Using Expired Trade Licenses

Submitting an expired trade license is a common mistake. Check the expiry date before uploading and renew the license if needed to avoid automatic rejection.

Wrong Business Activity Selection

During registration, you’ll need to select your business activity from a predefined list. Picking the wrong one can trigger questions or audits. Match your trade license activity to the correct FTA category.

Incomplete Form Submissions

Leaving sections blank or submitting half-filled forms is a red flag for the FTA. Double-check each section before you submit to prevent delays.

Late Application

If your business crosses the mandatory threshold, you must apply within 30 days. Missing this window may lead to a fine of AED 10,000. Keep track of your turnover and act quickly.

Avoidable errors can delay your VAT registration. Pay attention to these issues.

Missing Financial Proof

FTA needs proof of revenue. Attach clear sales invoices, signed contracts, or bank statements. Projections should be backed by documentation.

Using Expired Trade Licenses

Make sure your trade license is valid. Renew it before starting the VAT registration process.

Wrong Business Activity Selection

Choose the correct activity from FTA’s list. Mismatched activities can trigger audits or registration delays.

How Long Does VAT Registration Take in the UAE?

Time matters for your operations. Knowing the expected timeline helps you plan better.

Usually, it takes between 5 to 20 business days. Delays may occur due to incomplete applications, manual reviews, or form errors. Check your application status on the EmaraTax portal regularly.

After VAT Registration: What Comes Next?

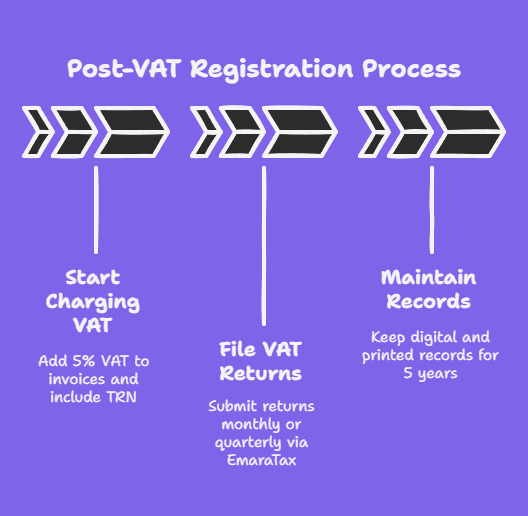

VAT registration is only the beginning. Here’s what to do after getting your TRN.

Start Charging VAT

Add 5% VAT to your taxable invoices. Mention the TRN on every bill using the FTA’s invoice format.

File VAT Returns

Log in to EmaraTax to file returns either monthly or quarterly, based on your assigned cycle. Submit them on time to avoid penalties.

Maintain Records

Keep both digital and printed records for at least 5 years. This includes all VAT invoices, credit notes, and any import/export paperwork.

Benefits of Registering VAT in the UAE

VAT registration isn’t just about following the law. It brings real business advantages that support long-term success.

Access to Larger Business Opportunities

Many government contracts and corporate clients prefer or require suppliers to be VAT-registered. This opens up a broader network of partnerships and collaborations.

Input VAT Recovery

Registered businesses can reclaim the VAT they pay on business-related purchases and expenses. This helps reduce costs and improve cash flow.

Improved Business Credibility

A VAT-registered status adds legitimacy to your company. Clients, vendors, and investors are more confident working with compliant businesses.

Better Financial Tracking

VAT registration encourages better record-keeping and financial discipline. It helps you organize your income, expenses, and tax obligations more clearly.

Legal Protection and Transparency

When you’re VAT-registered, your business stays aligned with UAE tax laws. This protects you from penalties and future complications.

Registering for VAT in the UAE is a smart move for businesses that want to scale, reduce costs, and operate with trust and transparency.

VAT registration offers more than legal standing. It also provides key business advantages.

You can reclaim input VAT, build credibility with vendors, qualify for large contracts, and operate more transparently. Clients are more likely to trust VAT-registered businesses.

What is a TRN and Why It’s Important

Your TRN is your VAT identity number issued by the FTA.

How to Use Your TRN

Display your TRN on all invoices, business letters, and internal systems. It must also be shared with your accountant or tax consultant for filings.

Voluntary vs. Mandatory VAT Registration

Understanding these categories helps you decide the right time to register.

Mandatory VAT Registration

If your annual revenue exceeds AED 375,000, VAT registration is required. Apply within 30 days of crossing the limit.

Voluntary VAT Registration

If your revenue is between AED 187,500 and AED 375,000, you can register voluntarily. It helps recover input VAT and improves business credibility.

VAT Group Registration in UAE

VAT group registration is a powerful option for businesses operating under the same ownership or control. It allows multiple companies to be treated as a single taxable entity for VAT purposes, making compliance easier.

What is VAT Group Registration?

Two or more companies can collectively apply for group registration. If they are closely linked financially, economically, or legally, they can register with the Federal Tax Authority (FTA). Once approved, they receive a single Tax Registration Number (TRN) and file one VAT return for the entire group instead of multiple returns. This helps businesses manage their VAT more efficiently.

Group members must be legal persons established in the UAE. There should also be evidence of control, such as common shareholders or intercompany agreements.

Benefits of Group Registration

Group VAT registration simplifies accounting processes and reduces the need for separate recordkeeping. Businesses save time and effort in filing returns and managing VAT between internal entities.

Another advantage is that no VAT is charged on transactions between group members. This avoids the need for reclaiming input VAT on internal sales and purchases, streamlining cash flow and reconciliation.

However, all members are jointly liable for the VAT obligations of the group. It’s important to evaluate the risks and benefits carefully before applying.

How to Apply for VAT Group Registration

You must submit a group registration application through the EmaraTax portal. Details of each entity, including trade licenses, ownership structure, and financials, are required. The FTA will review and issue a single TRN if the entities meet the eligibility criteria.

VAT Registration for E-Commerce and Online Sellers

Online sellers are not exempt from VAT regulations.

Digital Platforms and VAT

E-commerce businesses crossing AED 375,000 in annual revenue must register. This applies to sellers on websites, apps, social media, and digital content providers.

Issue VAT-compliant invoices and track your online revenue to stay compliant.

When Should You Deregister for VAT?

VAT registration isn’t permanent. If your business no longer meets the criteria, it’s important to apply for deregistration on time to avoid penalties.

Conditions for Deregistration

You should apply to deregister if your taxable revenue falls below AED 187,500 or if you’ve stopped taxable activities altogether. Businesses that shut down operations, sell the company, or change their business model may no longer need to remain registered for VAT.

The FTA requires that deregistration applications be submitted within 20 business days of becoming eligible. Missing this deadline can result in penalties of AED 1,000 for each month of delay, up to AED 10,000.

How to Deregister from VAT

Log in to your EmaraTax portal, access the VAT dashboard, and click on the “VAT Deregistration” option. You’ll need to provide a valid reason, along with supporting documents such as updated bank statements or business closure notices.

Once approved, you must continue filing VAT returns and pay any outstanding VAT liabilities until the deregistration is officially confirmed by the FTA. Keep all related documents for at least five years in case of an audit.

Deregistering responsibly ensures that your business remains compliant and avoids unnecessary fines after VAT obligations end.

Frequently Asked Questions About VAT Registration

Is it mandatory for freelancers to register?

Only if their taxable income crosses AED 375,000 annually.

Can I register even if I don’t meet the threshold?

Yes, if your turnover is over AED 187,500, you can apply voluntarily.

What happens if I delay registration?

You’ll face fines starting at AED 10,000 and possibly more for continued delays.

MBS Consultancy: Your VAT Registration Partner

VAT Registration Made Simple and Reliable

Struggling with how to register VAT in the UAE? MBS Consultancy offers end-to-end VAT registration services tailored for businesses of all sizes—from startups to large corporations.

We prepare and review all your documents, guide you through the EmaraTax portal, help you avoid mistakes, and ensure a quick TRN issuance. Our consultants are updated with 2026 regulations, saving you from penalties and delays.

Why Choose MBS Consultancy

- Fast-track VAT registration with zero hassle

- Dedicated consultants who understand your business model

- Support for voluntary and mandatory VAT registration

- Reliable post-registration services, including return filing and audits

Thousands of UAE-based businesses trust MBS Consultancy to handle their VAT needs. Let us handle the technicalities while you focus on growth.

Contact us today and get your VAT registration sorted—accurately and on time.

VAT Registration Made Easy with MBS Consultancy

MBS Consultancy takes the hassle out of registering VAT in the UAE. From document checks to TRN delivery, we handle everything.

Our team helps new companies register fast, growing businesses stay updated, and SMEs handle filings and audits. With expert support, you’ll never miss a step.

Let us be your guide through every step of VAT registration in the UAE.