Thinking about launching your audit firm in the UAE? The opportunity is huge, but the actual licensing process is rarely spelled out. This guide breaks it down step by step.

The UAE’s growing economy and emphasis on financial transparency have created a strong demand for audit professionals. But while the opportunity is clear, getting licensed isn’t straightforward unless you know exactly what’s required. With a well-planned approach, though, you can make the process smooth and successful.

How to Get an Audit License in the UAE (2026 Guide for Expats & Nationals)

Before you begin your audit business, you must first secure a valid audit license in the UAE. This license grants you legal authority to offer auditing and assurance services in the country.

Whether you’re a UAE national or an expat, the same fundamental steps apply, but knowing the right procedure and collecting the correct documents can make all the difference. This section maps out everything from eligibility criteria to the paperwork you need to get started the right way.

Stay Compliant with UAE Audit Regulations and Avoid Costly Penalties

Who Can Apply for an Audit License in the UAE?

Not everyone qualifies to offer audit services in the UAE. The authorities have specific eligibility rules to maintain the profession’s credibility and trust. These rules apply differently for individuals and companies.

Individual Requirements

To apply as an individual, you must:

- Hold a Bachelor’s degree in accounting, finance, or a closely related field.

- Prove at least three years of relevant audit experience.

- Submit certifications such as ACCA, CPA, or CA.

Company Requirements

If you’re setting up a firm:

- Appoint a qualified auditor as a manager.

- Secure a physical office location in the UAE.

- Include auditing as a listed business activity in your license.

Mainland vs Free Zone: Best Way to Get Audit License in UAE

Your license will either be issued under a mainland jurisdiction or a free zone. Both have pros and cons; the right choice depends on your target market, business goals, and budget.

Mainland Audit License

Mainland licenses, issued by the Department of Economic Development (DED), let you operate across the UAE and serve both government and private sector clients without restriction. It’s the best route if you plan to serve mainland-based companies or government clients.

Free Zone Audit License

Free zones offer attractive incentives for startups and international firms. Some of the common jurisdictions for audit firms include:

-

DMCC and IFZA, which follow standard free zone licensing frameworks

-

DIFC, which operates under an independent legal system and requires registration and approval from the Dubai Financial Services Authority (DFSA)

However, free zone licenses may limit your ability to serve clients in the mainland UAE unless you obtain additional permits or partner with a local service provider.

Step-by-Step Guide with Real Costs & Documents

Here’s a clear, step-by-step look at how to get an audit license in the UAE in 2026. Follow this path to avoid costly delays and rejections.

Step 1 – Choose Your Jurisdiction

Decide whether you’ll set up in the mainland or a free zone. This impacts your licensing costs, business scope, and operational flexibility.

Step 2 – Reserve Your Trade Name

Submit your preferred business name for approval. It should reflect your services and meet the authority’s naming guidelines.

Step 3 – Submit the Required Documents

Prepare and organize your paperwork correctly. Even one missing document can stall your application.

Required Document Table

| Document | Details |

| Passport Copy | Required for all shareholders and the manager |

| Degree Certificate | Must be attested by the UAE embassy or MOFA |

| Professional Certification | Submit a valid ACCA, CPA, CA, or equivalent |

| Experience Letter | At least 3 years from a recognized audit firm |

| Business Plan | Must include services, structure, and target clients |

| Office Lease Agreement | EJARI for the mainland; valid lease in the free zone |

Step 4 – Apply for Initial Approval

This initial clearance lets you proceed to final steps. It’s not a license yet but is essential for moving forward.

Step 5 – Finalize Legal Agreements and Make Payment

You’ll sign the MOA, secure your lease, and pay all required fees. You can also begin applying for residency visas for yourself and your team.

How Much Does It Cost to Get an Audit License in the UAE?

Budgeting for your audit license is key. Here’s what you should expect in terms of costs:

Estimated Cost Breakdown (2026)

- Mainland License: AED 15,000 – AED 30,000

- Free Zone License: AED 12,000 – AED 25,000

- Office Lease: AED 10,000 – AED 20,000 per year

- Document Attestation & Legal Services: AED 5,000 – AED 10,000

Some free zones offer cost-effective packages that bundle licensing and workspace, which can reduce initial expenses. However, you must confirm what’s included to avoid surprise fees.

Build Investor and Stakeholder Trust with Accurate Audit Reports

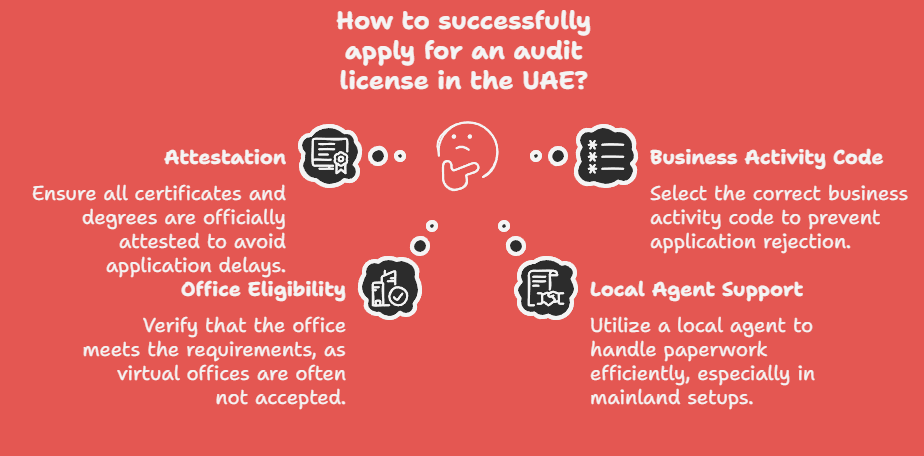

What No One Tells You About Getting an Audit License in the UAE

Most guides skip the tricky parts. Here are things you must know before applying:

- Attestation Is Non-Negotiable: All certificates and degrees must be officially attested.

- Choose the Right Business Activity Code: Picking the wrong one can delay your application.

- Check Office Eligibility: Virtual offices are not accepted in many zones for audit firms.

- Local Agent Support: In mainland setups, a trusted local service agent can handle most of the paperwork for you.

These seemingly small steps make a big difference in getting your license approved quickly and without hassle.

How Long Does It Take to Get an Audit License in the UAE?

Timing depends on preparation and document accuracy. On average, expect:

- Mainland: 3–6 weeks

- Free Zone: 2–4 weeks

Incomplete or incorrect paperwork is the number one cause of delays. Work with experienced professionals if you want to stay on schedule.

How to Get Approved for an Audit License in UAE Without Delays or Rejection

A well-prepared application is your best defense against delays. Here’s how to stay on track:

- Get all degrees and professional certificates attested in advance.

- Write a simple, clear business plan focused on your auditing process.

- Make sure your office lease meets all zoning and documentation standards.

- Consider working with an expert consultancy like MBS to avoid common pitfalls.

Even one small error can send your application back for revisions, delaying your launch.

Audit License in UAE: Who Can Apply, How Much It Costs, and How Long It Takes

Need a quick summary? Here’s a breakdown of everything covered:

- Who Qualifies: Accounting professionals with experience and recognized certifications

- How Much It Costs: AED 12,000–40,000, depending on setup

- Processing Time: Typically 2 to 6 weeks with all documents ready

Every step matters, but the right planning can speed up the process. This is why many successful applicants work with setup specialists.

The Growing Demand for Audit Licenses in UAE 2026

The UAE’s financial landscape is evolving fast. With corporate tax rules now active and transparency laws tightening, licensed auditors are in high demand.

Holding an audit license gives you firm credibility along with full compliance. It opens up high-value contracts, and helps build long-term trust with clients.

This demand is especially high in sectors like real estate, finance, and e-commerce. Accurate reporting is important in these sectors. If you’re planning to build a long-term presence in the UAE, securing your audit license is more important than ever.

Let MBS Consultancy Handle It for You

Get Licensed. Stay Focused. Grow with Confidence.

Still wondering how to get an audit license in the UAE without stress or delays? Let MBS Consultancy take care of everything.

From document preparation to trade name reservation and authority approvals, we provide complete setup solutions tailored for audit professionals.

Our team handles:

- Legal structure setup

- Certificate attestation

- Licensing across mainland and free zones

- Office and visa arrangements

With MBS, you save time, avoid paperwork errors, and focus entirely on your business growth.

Partner with MBS Consultancy — where your license becomes your launchpad.