Financial security and wealth growth are essential for a stable future. Whether you are an expatriate, a business owner, or a UAE national, financial planning in UAE helps you achieve your personal and professional goals. With the right strategies, you can manage expenses, make smart investments, and secure your future without financial stress.

In this guide, we will explore financial planning essentials, including savings, investments, tax management, and risk mitigation, ensuring your financial future is well-structured in the UAE.

Why is Financial Planning Important in UAE?

Financial planning is crucial for a comfortable lifestyle, smart investments, and long-term security. Here’s why:

- High Living Standards – Managing finances is essential to sustain the luxurious lifestyle in the UAE.

- Retirement Security – A well-planned financial future ensures stability in later years.

- Business Growth – Entrepreneurs need strong financial planning to manage cash flow and investments.

- Tax-Free Income Management – Proper planning helps maximize savings and smartly allocate wealth.

- Economic Stability – With fluctuating markets, financial planning protects individuals from uncertainties.

- Debt Management – A structured plan helps prevent unnecessary financial burdens.

Key Steps to Effective Financial Planning in UAE

1. Setting Clear Financial Goals

Financial planning begins with goal-setting. Identify short-term, mid-term, and long-term objectives:

- Short-term – Emergency funds, travel, or minor investments.

- Mid-term – Buying a home, starting a business, or higher education expenses.

- Long-term – Retirement savings, wealth transfer, or property investments.

Clear goals provide direction and ensure financial decisions align with personal and professional aspirations.

2. Creating a Solid Financial Plan Statement

A financial plan statement provides a clear structure for managing your finances. This document should include:

- Income sources and expenses

- Savings and investment allocations

- Debt repayment plans

- Emergency funds

- Retirement and estate planning

Regularly updating your financial plan statement ensures it remains aligned with your evolving needs and lifestyle changes.

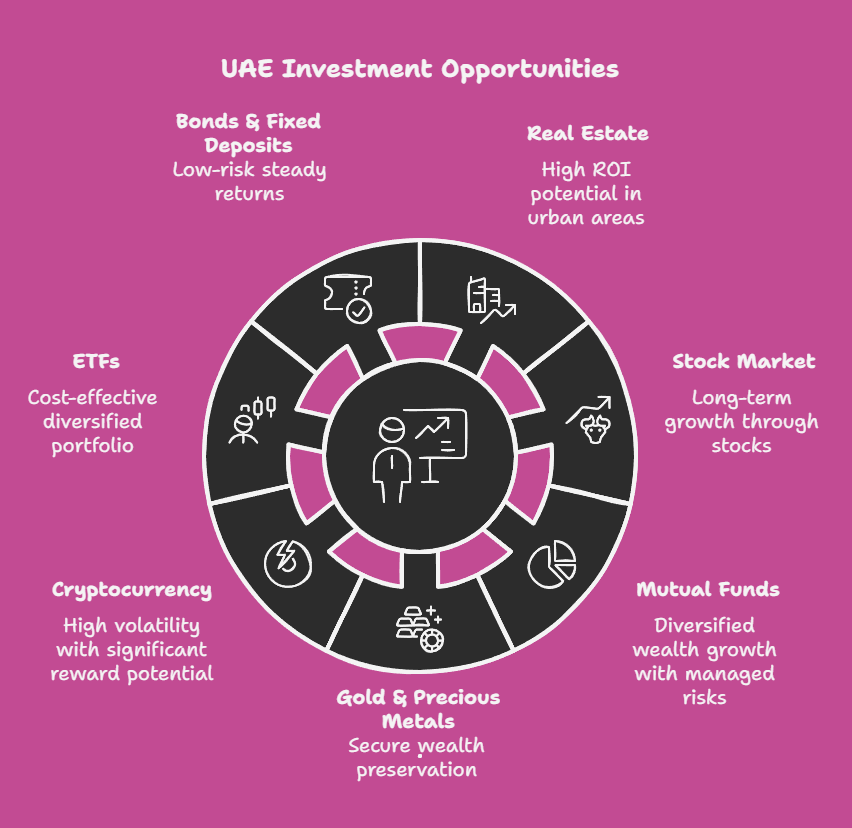

3. Investment Planning in UAE

The UAE offers diverse investment opportunities. Investment planning UAE involves evaluating risks and rewards before making financial commitments. Some popular options include:

- Real Estate – A preferred investment with high ROI potential, especially in cities like Dubai and Abu Dhabi.

- Stock Market – Investing in UAE and global stocks for long-term growth.

- Mutual Funds – A diversified approach to wealth growth with managed risks.

- Gold & Precious Metals – A secure and traditional investment choice, ideal for wealth preservation.

- Cryptocurrency – A modern investment avenue with high volatility but significant reward potential.

- Exchange-Traded Funds (ETFs) – A cost-effective way to invest in a diversified portfolio.

- Bonds & Fixed Deposits – Low-risk investments offering steady returns.

4. Smart Budgeting and Expense Management

Budgeting is the foundation of effective financial planning. Follow these steps:

- Track income and expenses using financial tracking apps.

- Prioritize savings before spending.

- Avoid unnecessary luxury expenses to maintain financial stability.

- Plan for monthly fixed costs and unexpected expenditures.

- Set spending limits for discretionary purchases.

5. Tax Planning in UAE

The UAE offers a tax-friendly environment, but financial planning is necessary to maximize benefits. Some tax considerations include:

- No Personal Income Tax – UAE residents do not pay personal income tax, allowing them to focus on wealth accumulation.

- Corporate Tax Planning – Businesses must comply with new tax regulations introduced in 2023.

- VAT Management – Understanding and complying with UAE’s VAT system helps in cost optimization.

6. Planning for Emergencies and Retirement

Building an emergency fund helps tackle unexpected expenses. Experts recommend saving at least 6 to 12 months’ worth of living expenses in an easily accessible account.

Retirement planning should start early. Consider:

- UAE’s pension schemes and gratuity benefits.

- Private retirement plans tailored to expatriates and nationals.

- Long-term investments that ensure steady income post-retirement.

- Estate planning to manage wealth transfer efficiently.

Comparison of Investment Options in UAE

| Investment Type | Risk Level | Returns Potential | Recommended For |

| Real Estate | Medium | High | Long-term investors |

| Stock Market | High | High | Experienced investors |

| Mutual Funds | Medium | Moderate | Balanced growth seekers |

| Gold & Precious Metals | Low | Stable | Safe investors |

| Cryptocurrency | High | Very High | High-risk investors |

| Bonds & Fixed Deposits | Low | Low to Moderate | Conservative investors |

Low Investment Business Plan for Financial Growth

For individuals looking to start a business, a low investment business plan can be a great financial decision. Options include:

- Freelancing – Content writing, digital marketing, or graphic design.

- Dropshipping – Selling products online without holding inventory.

- Home-based Baking – A growing industry in the UAE.

- Online Tutoring – Teaching languages, skills, or academic subjects.

- Event Planning – Organizing events with minimal overhead costs.

- Consulting Services – Using industry expertise to guide others.

A low investment business plan minimizes financial risks while providing an opportunity for significant returns.

How to Choose the Right Financial Advisor in UAE

A financial expert can guide you through smart investment and savings strategies. When selecting a financial planner, consider:

- Experience – Years of expertise in UAE financial regulations.

- Credentials – Certifications such as CFP (Certified Financial Planner).

- Transparency – Clear fee structure and investment strategy.

- Client Reviews – Reputation and client testimonials.

- Customized Planning – Advisors should provide tailored financial strategies based on individual needs.

Secure Your Future with MBS Consultancy

MBS Consultancy – Your Trusted Partner in Financial Success

Financial planning requires expertise, strategy, and continuous monitoring. MBS Consultancy offers professional financial planning services in UAE, helping individuals and businesses achieve their financial goals. Their services include:

- Personalized Wealth Management

- Investment Planning and Portfolio Management

- Retirement Planning and Pension Solutions

- Business Financial Advisory Services

- Tax and VAT Consultancy

Whether you need investment guidance, tax optimization, or a retirement strategy, MBS Consultancy ensures tailored solutions for your financial security.

Start planning today and take control of your financial future!

Conclusion

Financial planning in UAE is essential for a stable and prosperous future. By setting clear goals, managing expenses, and making smart investments, individuals and businesses can thrive in the UAE’s dynamic economy. Whether you are planning for retirement, growing a business, or securing an investment, structured financial planning will lead you to success.

For expert financial planning advice, trust MBS Consultancy to guide you on the right path. Secure your future today!