As Dubai moves approaching its digital evolution, it has emerged as the most desirable global location for technology and trade. With firms joining the city to unleash its growth potential, it is becoming a popular location for entrepreneurs from across the world.

Accounting outsourcing in Dubai is gaining popularity among new and experienced business owners for the purpose of maintaining financial records and complying with regulatory standards.

Meeting compliance is only one equation for running a profitable business. As the regulatory framework evolves, company owners must maintain openness, accuracy, and responsibility in their financial statements. This is where the demand for expert accounting services in Dubai emerges. These services help to drive proactive financial choices for long-term business growth and profitability.

Simultaneously, businesses in Dubai continue to seek information about accounting outsourcing Dubai in order to access a massive range of financial services and suit their unique business requirements. Let’s take a closer look at the environment and see how accounting and auditing companies in Dubai may significantly improve a company’s financial health.

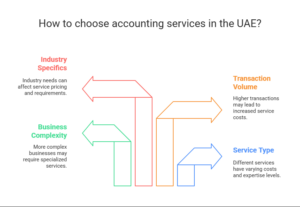

Factors Influencing Accounting Outsourcing Costs in Dubai

Accounting outsourcing expenses in Dubai differ depending on the range of services, organization size, and supplier.

More transactions often result in greater expenses.

Simple accounting is more affordable than complicated operations like tax preparation.

Specialized organizations tend to charge more.

Accounting standards vary by industry.

Accounting Outsourcing Cost-Effective Options:

Accounting Task Category

The fee will be determined by the nature of the activity, such as filing VAT returns in the UAE, maintaining your company’s accounting, seeking tax or VAT guidance, or registering for VAT in the UAE. The expense of accounting services in the UAE depends on the categories of services offered.

If you hire a full-time bookkeeper, you must pay more, and he might possess limited expertise, but an outsourced accounting business will work on all sorts of accounting jobs at a much lower cost.

Dimensions And Complexity Of The Business

The scope and complexity of your firm will also affect the expense of accounting services in Dubai. However, you may be a freelancer or sole owner with only one accountant, or you could be a larger firm with a manager and a certified public accountant to manage your taxes. A complicated industry with significant accounting rules may need the utilization of specialist skills, resulting in a higher charge.

Overall Business Transactions And Turnovers

Another important factor in calculating the expense of financial and accounting services in the UAE is a business’s transactions and turnover. So, UAE taxes are charged based on the firm’s merchandise, jurisdiction, or annual sales. They do, however, aid in determining the accounting service costs that will be imposed.

Industrial and Business Task

Auditing and accounting service fees in the UAE might vary from one firm to the next. You may work in the trades or need financial services for a restaurant, commercial property, startup company, or another field; prices may vary.

Additional Benefits of Accounting Outsourcing in Dubai:

Cost reductions include reduced overhead and access to trained personnel.

For improved efficiency, concentrate on the core business while outsourcing non-essential services.

Enhanced compliance and keep up with evolving requirements.

Easily alter resources as the company needs change.

Why Do You Require Accounting Outsourcing Services in Dubai?

Several enterprises from many industries have been working in the UAE. The competition is fierce, and they all must ensure that their firm functions smoothly to satisfy all of the requirements of their clients. In such a position, if they fail in any of their procedures, particularly accounting, they may suffer a significant loss that they could not have predicted. Businesses should simplify their accounting operations as a whole.

The following are indicators of why you should use accounting outsourcing services in Dubai.

A New Startup in the UAE

When launching a new startup business, the primary goal is to produce profits rather than spending. However, when an employer initially starts an enterprise, it becomes difficult to handle all of the business tasks, particularly the accounting duties. Businesses following successful starts always require accountants to monitor all financial activities effectively.

Tracking Finances

Enterprises must track every financial transaction and analyze the amount of funds invested, the amount of spending, and the overall earnings and profit ratio. However, a business owner cannot accomplish it without assistance. They are not experienced accountants, and there is a potential they do not understand the accounting procedure.

As a result, without a staff of competent accountants in Dubai, the company would be unable to make informed financial decisions.

Cut Down Overhead Costs

You may consider hiring an accounting outsourcing Dubai to help you organize your budget in order. They will help you to cut down overhead costs and maximize your profits efficiently.

Appropriate Financial Reports

If you are seeking new investors and funding, you must understand that investors and banks seek a precise representation of your business’s existing financial state. Thus, you need to manage accounting records carefully since any error in your company’s financial reports may result in the loss of a prospective financing or investment. Outsourced accounting firms such as MBS Consultancy are helping businesses in Dubai achieve their long-term objectives.

Be Prepared for an Audit

Dubai is the top location for starting firms in various industries due to its business-friendly legislation, such as lower taxes. To remain functioning and avoid penalties, any firm, regardless of industry, must comply with UAE legislation. It includes accounts book keeping for previous years to adhere to Value Added Tax legislation, Commercial laws, periodic audits, and other requirements. Outsourcing financial tasks to Dubai might help you stay on track when it comes to corporate auditing.

Escaping Financial Obligations And Penalties

If a firm fails to comply with the UAE’s tax and financial requirements, it may incur financial obligations and penalties. Continuous evaluation of the company’s finances and accounting operations is required to ensure compliance with policies and prevent penalties. Suppose you intend to prevent fines and penalties.

You may employ a reputable accounting services provider to keep your accounts updated on the most recent state rules and regulations and also help you satisfy those requirements. It will allow you to simplify your company’s finances and expand without hassles.

Conclusion

You can engage an in-house accountant for bookkeeping and pay monthly compensation plus allowances, corporate amenities, and perks. Accounting outsourcing services in Dubai would be an affordable option compared to hiring an in-house accountant expert.

Contact MBS Consultancy to find out more concerning the major advantages of outsourcing financial services in Dubai. Request a personalized cost for your UAE accounting services.