Tax planning has become an avoidable aspect for any business. This strategic move makes the enterprises compliant with the law regulations. This foolproof approach allows any business to take full advantage of available tax breaks, deductions, and credits. This is also a way to avoid penalties or overpay taxes.

Discover comprehensive knowledge about what tax planning is and why it’s important for businesses. Know how it works, especially for businesses operating in the UAE and other regions with unique corporate tax regulations.

What is Tax Planning?

Tax planning is creating foolproof measures to optimize their tax liability. This involves organizing financial affairs in a way that minimizes tax obligations. This also leads to complying with tax laws and regulations.

It involves analyzing the company’s financial situation and understanding current tax laws. There are measures taken such as deductions, credits, and corporate structures to reduce taxable income.

For businesses, tax planning is more than minimizing taxes and encompasses anticipating and managing future tax obligations to bring long-term financial stability.

Why Is Tax Planning Important for Businesses?

Any business can avail immense benefit through well-curated tax strategies. Whether it is all startups or large corporations, can benefit immensely from a well-thought-out tax strategy. Some of the key benefits include:

Reduced Tax Liability

Tax planning helps businesses legally reduce their taxable income, lowering the amount of taxes owed.

Cash Flow Management

Businesses can free up cash for reinvestment, expansion, or covering operational costs.

Avoidance of Tax Penalties

Proper tax planning ensures that businesses comply with tax regulations, reducing the risk of costly penalties or audits.

Maximize Deductions and Credits: Businesses can identify and utilize all available tax credits and deductions, lowering their overall tax burden.

Financial Forecasting and Strategy

Tax planning allows businesses to anticipate future tax liabilities and create long-term financial strategies.

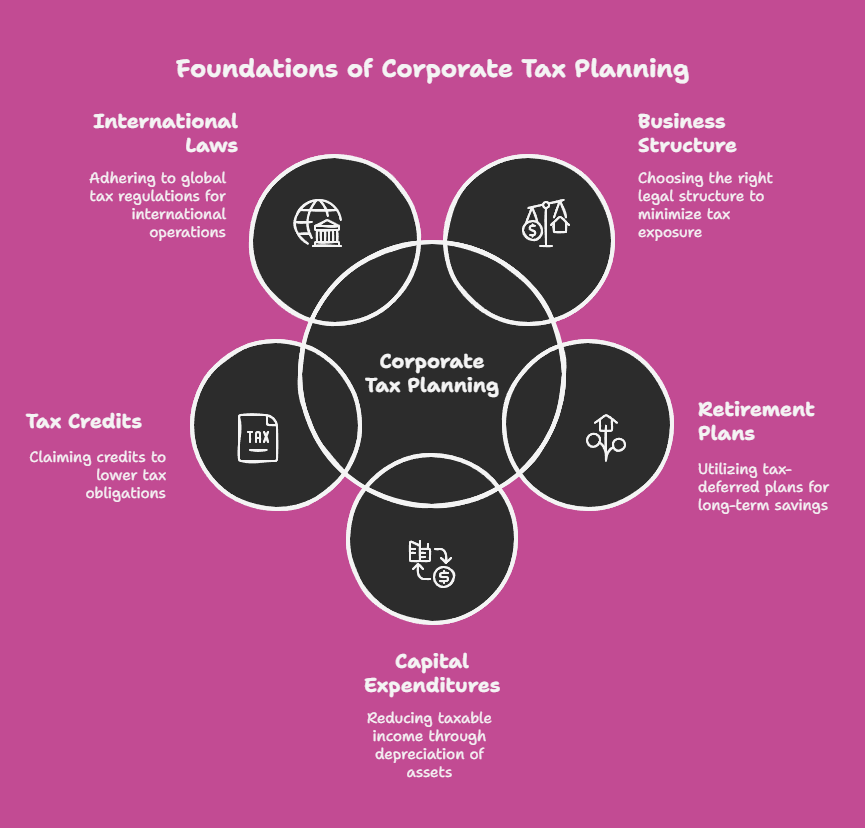

Key Aspects of Corporate Tax Planning

Corporate tax planning means much more than just year-end tax preparation. Rather, it is the expression of proactive strategies for structuring how a corporation goes about its business and its finances to minimize tax exposure. Here are a number of core components of good corporate tax planning:

1. Choosing the Right Business Structure

There are many legal structures, and some of them are taxed differently compared to others because they stand on different tax rates. For instance, one with a sole proprietorship may be taxed as differently as compared to an LLC or corporation. You can make the best choice concerning this structure and objective of your business and end up saving a lot in taxes.

2. Tax-Deferred Retirement Plans

You can now avail the option of saving money for retirement by using tax-deferred retirement plans. It proceeds with no income taxes on your contributions and investment earnings until you withdraw the money. This allows you to keep the retirement money in-cash than you would have been able to if you’d invested in a taxable investment account.

3. Capital Expenditures and Depreciation

Depreciation is a way of investing in capital assets like property, equipment, and machinery. By deducting depreciation, businesses can reduce their taxable income over time.

4. Utilizing Tax Credits

Various tax credits, such as research and development credits or energy-efficient tax credits, can significantly reduce tax obligation. Businesses should ensure they are aware of and claim all applicable credits.

5. International Tax Considerations

In case of businesses operating internationally, make sure to acknowledge all international laws. It needs to be followed by the businessmen looking to expand their operations.

How Tax Planning Works for UAE Businesses

Corporate tax planning comes into importance as the tax landscape within the country differs for businesses operating in the UAE. Most businesses in the UAE are known to operate in its attractive tax regime, most of which enjoy zero percent rates in corporate taxes.

However, with new changes, tax policies today tend to introduce new challenges and opportunities that businesses need to consider.

Corporate Tax in the UAE: What You Need to Know

UAE implements federal corporate tax system for the first time in its 2024 year: Business With the profits over AED 375,000 are liable to this tax. It has one of the lowest corporate tax rates across the world and is pegged at 9% over and above this threshold.

The tax rate, however, is just one of the considerations. Effective business tax planning in the UAE would also entail a more holistic approach on structuring the business, managing costs and keeping abreast with the revisions in tax regulations.

How to Create an Effective Tax Planning Strategy

After understanding the basics of tax planning and implications for businesses, learn how you can craft an effective strategy. Follow a simplified, step-by-step process:

1. Assess Your Current Tax Situation

- Review your current tax obligations and financial situation.

- Identify areas where your business may be overpaying taxes or missing potential deductions.

2. Understand Tax Laws and Regulations

- Stay updated on local and international tax laws, especially if your business operates in the UAE or internationally.

- Work with a tax advisor to ensure compliance with evolving tax rules.

3. Identify Opportunities for Tax Reduction

- Leverage available deductions, credits, and tax-efficient structures.

- Take advantage of tax incentives such as R&D credits, energy credits, or capital gains exemptions.

4. Implement the Strategy

- Make changes to your business structure, operational costs, or investments to align with your tax planning goals.

- Ensure compliance with tax reporting requirements, such as VAT or corporate income tax filings.

5. Monitor and Adjust

- Tax laws change frequently, so it’s important to regularly review and adjust your tax strategy.

- Work with a tax advisor or consultant to keep your business’s tax position optimized.

Benefits of Partnering with a Tax Professional for Your Business

Partnering with a tax professional offers some important advantages to a business, in and around all issues-from getting compliant with tax laws to maximizing tax savings and efficiency. Tax professionals bring experience, personal advice, and strategies that can be called upon to minimize tax liabilities, avoid costly errors, and provide opportunities for growth.

They maintain a record of all the latest tax laws and regulations. Their professional know-how enables a business to stay within the best boundaries of current tax laws as well as to identify all possible deductions, credits, and incentives capable of reducing the tax burden highly.

Another reason that working with a tax professional like MBS Consultancy is that they can give businesses peace of mind. They are aware of the fact that tax obligations are left in an expert’s care. This frees up valuable time and resources so that business owners and managers might focus core operations and long-term strategic goals.

Tax professionals help businesses navigate complex tax environments, such as international tax laws or changes in regulatory requirements within countries, such as recent changes happening within UAE, to ensure the business remains compliant but optimizes its financial position.

Conclusion

Tax planning is a safety measure to keep your business at reduced cost. This way, you will be on the right track to stay away from potential harm and challenges. For businesses in the UAE, incorporating tax planning is a significant method to improve the financial landscape of a corporation.

The following of certain rules, leads to the growth of business. Understanding each aspects and fold of corporate tax regulations, you can easily plan your tax strategy. For this, you can consult the expert of this field to guide you at every step of the way.