External audits are more than a formality for UAE businesses. They’re the seal of trust that stakeholders, regulators, and investors look for. A well-executed external audit process not only keeps you compliant, it solidifies your reputation as a credible, well-governed entity, as well.

Takeaway points of our article.

- breaking down the process of external audits in UAE companies

- exploring the significance of said audits

- highlighting how working with top external audit services in UAE can make a huge difference

Why External Audits Matter for UAE Businesses

Transparency, accountability, and innovation, these are the sugar, spice and everything nice of UAE’s strong business scene. External audit processes are a foundation of this system. They are required by many businesses across industries.

This guarantees compliance with regulations set by International Financial Reporting Standards – IFRS. But beyond compliance, external audits provide deeper insights into your business operations, financial health, and governance.

This audit process helps stakeholders make informed decisions, minimize risks, and build confidence among investors. When executed by leading external audit firms in the UAE, the external audit process becomes a tool for growth. It’s not treated as a box to tick.

External Audits — Your Ticket to Business Longevity

Sustainability in UAE’s competitive market requires more than innovation. It demands your trust. The external audit process acts as a ticket to longevity by nurturing confidence among your stakeholders. They offer an unbiased assessment of your company’s financial health and compliance. This translates to better decision-making for your investors, lenders, and partners.

For businesses, it’s about building a legacy. A clean audit report from top external audit services in the UAE positions your company as a trusted entity. It paves the way for growth avenues. Beyond compliance, it shows the world that your operations are transparent and built to last.

The Role of Technology in External Auditing

External auditing in the UAE has adapted technology at its core. Advanced data analytics, AI powered insights and cloud computing have changed how audits are conducted. These tools reduce human error. It speeds up the external audit process. Not to mention, deeper insights into financial patterns are also offered.

Work with auditing companies that embrace innovation. This way, your business can access faster audits. These are also far more accurate. Technology doesn’t only enhance the quality of audits. It also enables auditors to provide actionable insights. This can help businesses improve their processes and performance.

Red Flags That External Audits Can Uncover

Think of an external audit process as a health check for your business. It uncovers vulnerabilities and flags potential risks before they escalate into bigger problems. Auditors are trained to spot these issues.

- improper financial reporting

- lack of internal controls

- Non compliance with local regulations

Engaging top external audit firms in the UAE guarantees these red flags don’t go unnoticed. Addressing them early prevents penalties. It also strengthens your business’s foundation. These audits are a great preventive measure against operational and financial mishaps.

How External Audits Align With UAE’s Vision for Transparency

UAE’s government has placed a strong emphasis on transparency and governance. It attracts global investors and contributes to economic growth. The external audit process is an important part of this vision. It ensures your business operates with integrity. It’s a good way to make sure your business is up to the highest international standards.

Choose the right external audit services in UAE. This will have your company operating in the light of national priority. It’s not only about compliance either. This is about contributing to a larger movement toward accountability and trust. You set your business apart in the marketplace, as well.

The Anatomy of an External Audit

External audits involve several planned stages. Each of them assesses the accuracy of financial records and compliance to regulatory standards. We share a breakdown of the external audit process.

1. Engagement and Planning

The process of external audit begins with identifying your company’s unique requirements. Auditors curate their approach with the industry you operate in. They note the size of your organization. This phase is necessary for creating a roadmap. It ensures no stone is left unturned.

2. Fieldwork and Data Collection

This is the heart of the external audit process. Auditors perform the following tasks.

- look deeper into your financial records

- verify transactions

- assess risk management systems

- identifying any discrepancies

Working with seasoned audit services in Dubai ensures this phase is precise.

3. Testing and Evaluation

Auditors scrutinize financial statements to test their accuracy and reliability. This involves:

- analyzing income statements

- balance sheets

- cash flow statements

All the while, they’re also keeping an eye out for compliance gaps or financial misstatements.

4. Reporting and Recommendations

The final phase culminates in a detailed audit report. It provides an unbiased assessment of your financial standing. This report also includes actionable recommendations to improve processes and address risks. When you work with expert external audit services in UAE, the feedback is an asset for optimizing your business operations.

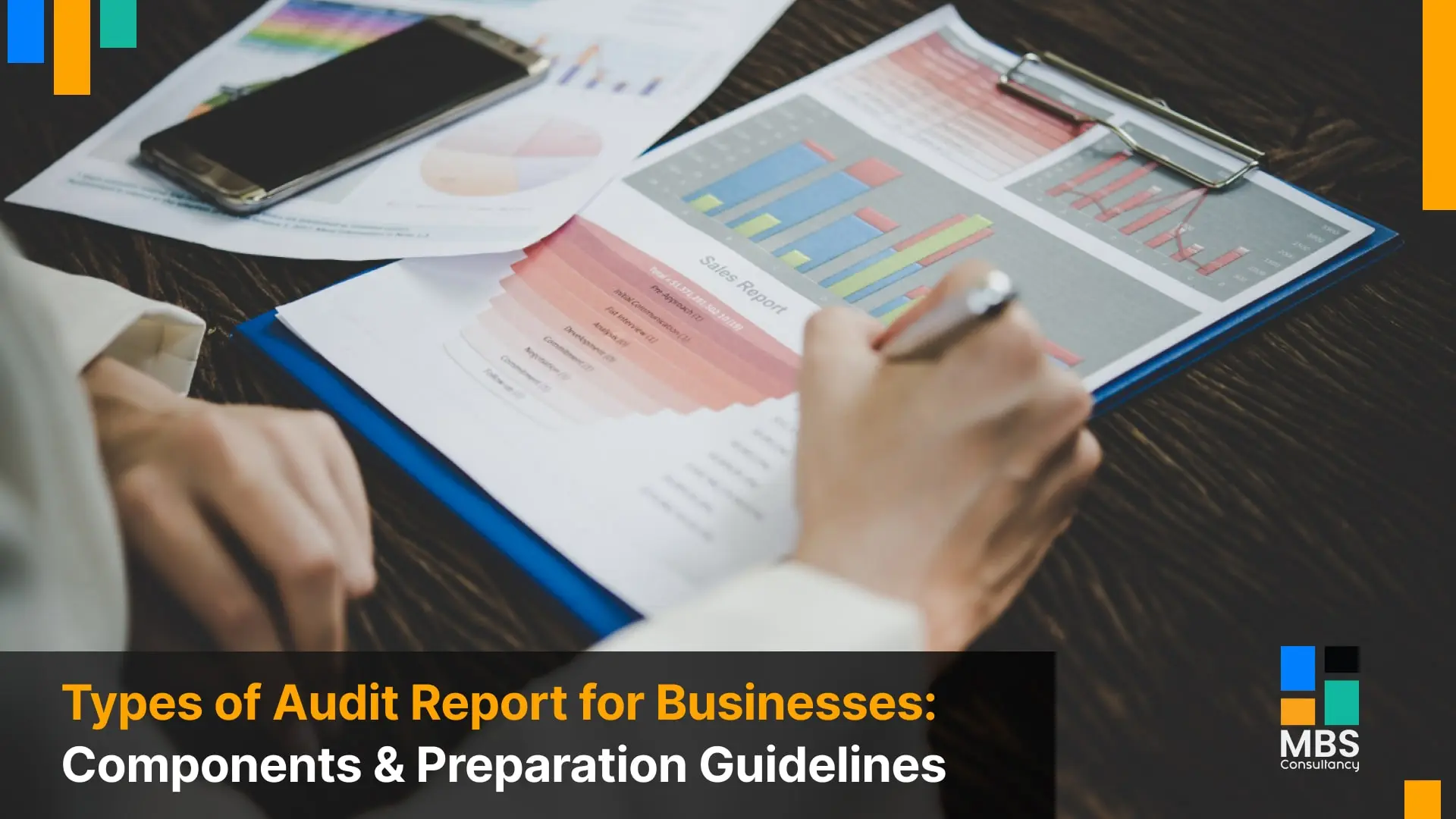

Benefits of External Audits

External audits reap a multitude of advantages. These extend way beyond regulatory compliance.

- Enhanced Credibility – Boosts trust among investors, partners and customers.

- Risk Mitigation – Identifies gaps in financial systems and provides strategies to close them.

- Operational Insights – Offers a clearer understanding of inefficiencies and growth.

- Regulatory Compliance – Keeps your business operating under UAE laws and international standards.

Difference Between Internal and External Audit

Understanding the distinction between internal and external audits is necessary if you want to properly leverage them.

We illustrate how internal and external audits differ from each other.

| Internal Audits | External Audits | |

| Objective | focus on improving internal processes | validate financial accuracy for third party assurance |

| Independence | performed by independent firms | internal audits are conducted by in-house teams or consultants. |

| Scope |

|

|

| Audience | findings are for internal stakeholders | aimed at regulators, investors and external stakeholders. |

Why UAE Companies Need Expert External Audit Services

Business regulations are dynamic. And competition is fierce. Having a reliable audit partner is quite the game changer. Leading external audit firms bring their expertise to the table. They make sure your business stays compliant and competitive.

Partnering with seasoned auditors means:

- gaining insights specific to your industry

- following complex financial regulations with ease

- accessing cutting edge auditing tools and external audit methodology

Professional external audit services in UAE not only validate your financial health. It also provides a roadmap for achieving growth in the long run.

What Sets Great Auditing Companies Apart

Not all auditing companies deliver the same level of service. The best firms in the country combine their technical expertise with a deep understanding of local business. They keep up with global trends and local laws. This is their way of making certain your business is future ready.

When you work with a trusted external audit firm, you position your business as a credible player in UAE market’s. Ready to attract investors, win contracts and build lasting relationships, if we’re being more precise.

Conclusion — The Power of a Great External Audit

External audits are a necessity for UAE businesses aiming for compliance, credibility, and growth. They’re not only checking financial accuracy. Instead, they’re a strategic tool that, when used right, can lead to many new avenues and shinier prospects.

When you select our external audit services in UAE, you meet regulatory requirements and exceed expectations. With our experts by your side, you can focus on growing your business in this economy.

It’s time to make the external audit process work for you. With us, move closer to greater transparency, accountability and success.

Contact us for our services.