Shelf company in Dubai offer a tantalizing opportunity for the savvy investor, speed, access to capital, and existing contracts. However, this enigmatic realm is not without its perils. Thorough due diligence is paramount, as these pre-fabricated entities evade financial reporting requirements. Navigating the complex jurisdictions of mainland Dubai or free zones adds further complexity.

In this article, with the guidance of experienced business consultants, the path to success can be illuminated. Embrace the mystery, for in the very perplexity lies the promise of untold riches and the thrill of the unknown. Seize the day, adventurer, and let the winds of fortune guide your journey.

Benefits of Buying a Shelf Company in Dubai

What is shelf company buy? What are the advantages of a shelf company?

Also, the enigmatic realm of shelf company in Dubai, a veritable labyrinth of tantalizing prospects! Speed is the name of the game, as these pre-fabricated entities bypass the arduous registration process, allowing for swift market entry.

- But the benefits do not end there, my friends. These established companies possess the keys to the kingdom, granting superior access to bank loans, credit lines, and investment capital.

- Moreover, the ability to participate in government contracts and choose from a roster of registered names lends an air of credibility and seniority. Yet, the very complexities of this realm captivate the discerning investor. Embrace the mystery, adventurer, and let the winds of fortune guide your journey.

How to buy a shelf company in Dubai?

- First, the discerning investor must don the mantle of the strategist, evaluating the nature of the entity, be it “aged” or recently registered, and determining the optimal jurisdiction.

- Next, the true test lies in the realm of due diligence, as one must delve deep into the company’s past. Unearthing its financial history and uncovering any potential skeletons. The signing of the sales contract and the updating of legal documents are but the first steps in this intricate ballet.

- Finally, the new owner must navigate the labyrinthine world of corporate banking and UAE immigration. Ensuring the smooth operation of the acquired entity. Embrace the enigmatic nature of this odyssey, for in its perplexity lies the promise of untold riches.

Research and Select a Reputable Provider

First and foremost, the discerning investor must don the mantle of the strategist, evaluating the very nature of the Shelf company for sale on offer. Shall it be an “aged” entity, its history cloaked in the mists of time, or a more recently registered paragon of modernity?

Moreover, the true test of the intrepid investor lies in the realm of due diligence. For one must delve deep into the company’s past, unearthing its financial history and uncovering any potential skeletons that may lurk within its closets. Truly, a task for the most astute of detectives, for the very fate of the venture hangs in the balance.

Yet, the complexities do not end there, my friends. For the chosen provider must not only possess the keys to the kingdom of shelf company Dubai expertise. But also demonstrate a level of transparency that would leave even the most seasoned of negotiators in a state of envious admiration.

Furthermore, the true test lies in the provider’s ability to guide the new owner through the intricate dance of updating ownership. Changing trade names, and obtaining the necessary licenses.

And let us not forget the importance of reputation, for the provider’s track record is a veritable cloak of trust. Also, confidence that can captivate the hearts and minds of the discerning investor. Shall we seek the recommendations of trusted sources, or delve into the realm of online reviews and industry certifications?

Additionally, for the provider must also don the mantle of the guardian. Ensuring that the acquisition process is shrouded in the veil of compliance and security. Truly, a task for the most vigilant of custodians, for the very future of the venture hangs in the balance.

Legal Requirements and Documentation in Dubai

- First, the discerning entrepreneur must don the mantle of the strategic alchemist, for the acquisition of the trade license is a fundamental requirement, specifying the very essence of the company.

But the complexities do not end there, as the meticulously crafted bylaws, the Memorandum and Articles of Association, form the foundation of the venture.

- Moreover, the foreign business owner must navigate the bureaucratic maneuvering of immigration cards and work permits. While also shielding the company’s assets through contracts and intellectual property protections. Finally, the documents must undergo a two-step legalization process, a dance of bureaucratic might.

Post-Purchase Steps and Business Setup Process

First, the discerning business owner must don the mantle of the logistical alchemist, ensuring secure packaging, timely shipment. Also, order tracking to weave the tapestry of customer satisfaction.

But the complexities do not end there, as the provision of after-sales support. Also, the solicitation of customer feedback become a veritable dance of diplomacy and empathy. Building lasting relationships through personalized communication and exclusive offers is paramount.

Furthermore, the business setup process is a labyrinth of legal and administrative requirements, obtaining trade licenses. Establishing bylaws, fulfilling immigration needs, and protecting intellectual property. The legalization of documents is a dance of bureaucratic might.

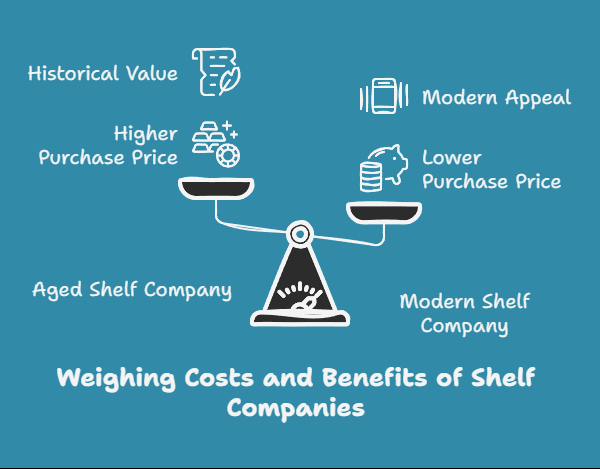

Costs Involved in Purchasing a Shelf Company

First and foremost, the discerning investor must don the mantle of the financial strategist, for the purchase price itself is a crucial factor to consider. Ah, but this is no mere matter of a simple transaction, my friends. For the age of the shelf company is the very key that unlocks the door to the realm of higher prices.

Additionally, shall it be an aged entity, its history cloaked in the mists of time, commanding a princely sum of up to $10,000? Or a more recently registered paragon of modernity, its price tags a mere $645? Truly, a decision that requires the wisdom of a seasoned negotiator.

But the complexities, my dear friends, do not end there, for the ongoing registered agent fees are an essential component of the overall cost. Ah, the first year’s services may be included in the purchase price, but the subsequent annual fees.

Moreover, a veritable dance of payment methods, ranging from $135 to $185, are the very threads that weave the tapestry of financial responsibility.

Likewise, the ancillary fees are a veritable treasure trove of hidden expenses, my friends. The cost of corporate binders, a mere $100, may seem like a trifling matter, but let us not forget the state-specific filing fees.

So far, the journey, does not end there, for the potential for hidden liabilities and debts associated. With the shelf company is a veritable minefield of unexpected expenses. Also, this is no mere matter of financial reckoning, for the very essence of the entrepreneurial triumph hangs in the balance.

And let us not forget the cost of transferring the ownership of the shelf company, a veritable dance of legal maneuvering. That would leave even the most seasoned of negotiators in a state of envious admiration.

Transferring Ownership and Company Rebranding

A veritable symphony of legal jargon and financial nuances. Yet, the journey does not end there. Secretarial steps, such as signing transfer forms, issuing new share certificates, and updating the company register, must be meticulously executed.

First, for those seeking to transfer shares back to the company, the UAE Companies Law presents a maze of its own. Selective buybacks, employee share schemes, or equal access buybacks, the options are as diverse as the sands of the desert.

Now, let us turn our attention to the intricate dance of trade license ownership transfers in Dubai. Understanding the eligibility requirements for the new owner is but the first step in this odyssey. Consulting a legal advisor or service agent becomes a necessity, for the legalities involved are as complex as the city’s skyline.

Moreover, but the journey does not end there, for the realm of company rebranding in the UAE is a labyrinth unto itself. Companies may seek to rebrand for a myriad of reasons, from expanding their activities to addressing trademark issues. Yet, the legal process is a dance of two phases, each with its own set of intricate steps.

First, the company must obtain initial approval from the Department of Economic Development (DED), providing a tapestry of documents. From trade name reservations to shareholder resolutions and licenses.

Also, once this initial hurdle is cleared, the company name change is published, and an amended Memorandum of Association is issued, but only if there are no objections.

What are the legal requirements for transferring ownership of a company in Dubai?

- The buyer and seller must obtain the license amendment form from the Department of Economic Development (DED), adorned with their details and signatures. A tapestry of documents, from share transfer agreements to shareholder resolutions, must then be woven and submitted.

- The parties must also craft a bilingual, notarized share sale agreement. After DED’s initial approval and a 30-day public notice, the amended trade license is issued. Lastly, the Dubai Land Department must be notified. Navigating this labyrinth requires unwavering determination and expert guidance.

What are the steps involved in transferring ownership of a company in Dubai?

- Transferring company ownership in Dubai is a complex dance, where each step must be meticulously choreographed. First, scrutinize the articles of association, the company’s legal DNA.

Secure board approval, then navigate the intricate web of shareholder consent. Prepare the necessary documentation, a symphony of agreements and registers.

- Brace for potential regulatory hurdles and tax implications. This labyrinth of legal intricacies and bureaucratic nuances requires the guidance of seasoned professionals. With their expertise, you can gracefully navigate this captivating journey. Emerging victorious as the new owner of your Dubai-based enterprise.

What are the potential risks and challenges of transferring ownership of a company in Dubai?

- Transferring company ownership in Dubai is a perilous journey, fraught with legal landmines and bureaucratic quagmires. First, brace for the specter of diluted ownership and conflicts of interest among shareholders. Disputes over ownership and navigating approvals can quickly derail the process.

- Taming the byzantine regulatory requirements demands legal expertise. Finding a trustworthy local partner is a quest of Herculean proportions. Testing the foundations of trust and partnership. Meticulous documentation is crucial to avoid legal woes, while the intricate web of tax implications requires a delicate fiscal dance.

- Finally, confront the temporal terrors of timing and delays, where adaptability is the hallmark of success. Traverse this labyrinth with utmost care.

How can I ensure a smooth transfer of ownership of my company in Dubai?

- Transferring company ownership in Dubai is a perplexing odyssey, a labyrinth of legal intricacies and bureaucratic minefields. First, delve into the arcane mysteries of the articles of association, those hallowed tomes that hold the key to unlocking share transfer secrets.

- Secure the blessings of the esteemed board of directors, then navigate the intricate web of shareholder consent. Prepare the necessary documentation, a symphony of legal paperwork. Brace for additional regulatory approvals and clearances, a maze of red tape.

- Notify the guardians of the corporate realm, and consider the fiscal phantoms of tax implications. With seasoned guidance and meticulous attention to detail, emerge victorious, your company’s ownership transferred with grace.

Conclusion

To establish a business presence in Dubai with the swiftness of a desert falcon! For the incorporation process is already complete. Allowing the new owner to don the mantle of an operational entity with nary a moment’s hesitation.

But, for these established shelf company possess a trading history that can prove a veritable boon. For with this pedigree comes the ability to obtain bank loans, leases, and other financing with the ease of a seasoned merchant.

And let us not forget the credibility they carry with suppliers, partners, and the very guardians of Dubai’s economic realm, the government entities themselves. Contact us if you want to learn more about this topic, we can help you to solves your doubts.