Did you know that over 70% of global investors rely on audit opinions before making funding or partnership decisions? An audit opinion is not just a formality – it’s a crucial statement by an independent auditor about whether a company’s financial records are accurate and compliant with standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Why does this matter? Because audit opinions directly influence business credibility, investor confidence, and regulatory compliance. A clean opinion builds trust, while an adverse or disclaimer opinion can signal serious risks.

In this article, we’ll explain what an audit opinion is, why it matters, and the four main types of audit opinions in audit reports. By the end, you’ll understand exactly what each opinion means for businesses and stakeholders – and why recognizing the differences is essential.

What is an Audit Opinion?

The auditor when examining a company’s financial records, policies, and operations gives an opinionated statement called Audit opinion. It is a conclusion and is part of the audit report. This opinion indicates if the financial statements provide a fair and accurate view of the company’s financial situation.

There are several audit opinion types based on what the auditor finds. These types of audit opinion range from clear approvals to serious red flags. We’ll explore each with practical audit opinion examples to help you understand what they signal.

Unsure Which Audit Opinion Applies to Your Business?

Why Do Audit Opinions Matter?

Audit opinions are significant in helping stakeholders, including investors, creditors, and regulatory agencies, make informed decisions about a company. Here’s why understanding audit opinions is essential:

- Audit opinions provide a snapshot of a company’s financial health and transparency, guiding investment and partnership decisions.

- Different opinions, especially adverse or disclaimer, highlight potential financial or operational risks.

- An unqualified opinion indicates regulatory and accounting compliance, building trust with external stakeholders.

The Four Types of Audit Opinion in Audit Reports

Let’s dive into each type of audit opinion and its significance. Get a detailed overview of each type, demonstrating the importance of each for the organization and its stakeholders.

1. Unqualified (Clean) Opinion

This one is also known as “clean” opinion. It is the most favorable type of audit opinion. It says that no significant issue is found within the financial statements. The statements are free from material misstatements and follow the generally accepted accounting principles or International Financial Reporting Standards.

What It Means: The financial statements are fair, accurate, and comply with all regulatory standards.

Importance: An unqualified opinion reassures investors, creditors, and other stakeholders that the company’s financial position is sound and reliable.

Who Issues It: Most commonly issued to well-organized companies with thorough financial practices.

Example: A large multinational corporation with detailed financial processes and transparent records will likely receive an unqualified opinion, indicating a high level of trust in its financial accuracy.

2. Qualified Opinion

A qualified opinion is less favorable than an unqualified one but isn’t a cause for major concern. Here, the auditor finds minor discrepancies or limitations in the financial statements. These issues might not significantly impact the overall financial health but require disclosure.

What It Means: The financial statements are largely accurate, but there is a specific area of concern.

Importance: A qualified opinion signals to stakeholders that they should review the identified issue, though it is typically not severe enough to alter the company’s overall financial outlook.

Who Issues It: Often issued to companies with minor reporting issues, such as inadequate disclosure of specific financial information.

Example: A small business that fails to disclose certain expenses may receive a qualified opinion, indicating a minor issue without questioning the broader financial statements.

3. Adverse Opinion

This one indicates a serious warning, displaying significant issues with a company’s financial statements. It suggests that the financial statements do not fairly represent the company’s financial status. It is often due to substantial misstatements, inconsistencies, or failure to follow accepted accounting principles.

What It Means: The financial statements have major inaccuracies and do not present a fair and truthful view of the company’s finances.

Importance: An adverse opinion can severely impact investor and stakeholder trust, as it questions the integrity of the company’s financial reporting.

Who Issues It: It is generated and given to companies with significant misreporting. It may indicate internal control issues or attempts to mislead stakeholders.

Example: The auditor will issue an adverse opinion if a company intentionally excludes the liabilities or raises assets to appear more profitable. a warning will be generated to stakeholders of unreliable financial statements.

4. Disclaimer of Opinion

This fourth type is issued when there is no opinion provided on the financial statements by the auditor. This might occur if the auditor lacks sufficient evidence, encounters significant limitations, or if the company restricts access to critical information.

What It Means: The auditor could not form a reliable opinion due to incomplete information or restricted access.

Importance: A disclaimer is often seen as a red flag, suggesting potential issues with transparency or internal control within the organization.

Who Issues It: Commonly issued when the company fails to provide necessary documentation, or if there are significant restrictions imposed on the auditor’s work.

Example: If a company restricts access to important financial records or the auditor finds severe data gaps, they may issue a disclaimer of opinion, highlighting uncertainty in the financial accuracy.

Among the more severe financial audit opinions, an adverse or disclaimer opinion can indicate serious concerns for stakeholders.

Make Your Next Audit Report Clear, Compliant, and Risk-Free

Factors That Influence Audit Opinions

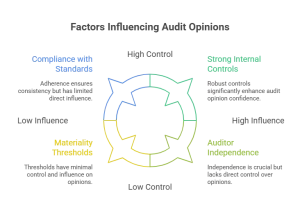

The type of audit opinion a company receives doesn’t just depend on its financial records-it is shaped by several important factors that auditors consider during their review. These include:

- Financial Reporting Accuracy: Transparent and accurate financial statements are the foundation of a positive audit opinion. Errors, omissions, or intentional misstatements increase the likelihood of a qualified or adverse opinion.

- Internal Audit Quality: Strong internal audit functions provide an additional layer of assurance and reduce risks of discrepancies. Weak or ineffective internal audit systems, on the other hand, may raise doubts about data integrity and influence the external auditor’s final opinion.

- Internal Controls: Reliable internal controls help prevent fraud, misstatements, and errors. A company with robust internal control systems is more likely to receive an unqualified (clean) opinion.

- Compliance with Standards (GAAP/IFRS): Adherence to recognized accounting frameworks like GAAP or IFRS ensures consistency and comparability of financial statements, which auditors look for before issuing their opinion.

- Materiality Thresholds: Auditors assess the materiality of errors-whether misstatements are significant enough to mislead stakeholders. Minor issues may result in a qualified opinion, while material misstatements could lead to an adverse opinion.

- Scope of the Audit: If the audit scope is restricted-due to lack of access to records or company-imposed limitations-auditors may issue a disclaimer of opinion. Full access allows for a more confident and favorable conclusion.

- Risk Management Practices: Companies with well-defined risk management frameworks demonstrate control over financial uncertainties. Poor risk management can increase audit risks and result in more cautious audit opinions.

- Auditor Independence and Objectivity: Independence is key. An auditor must be free from conflicts of interest or bias. If independence is compromised, stakeholders may question the credibility of the audit opinion, regardless of the findings.

Final Thoughts: The Importance of Audit Opinions in 2026 and Beyond

In 2026, audit opinions continue to play a critical role in building trust, compliance, and financial transparency. But the way they are shaped is evolving. AI-driven auditing, predictive data analytics, and ESG (Environmental, Social, and Governance) reporting are no longer just trends-they are becoming standard elements of the audit process. Companies that proactively adopt these practices will be better positioned to secure favorable audit opinions and strengthen investor confidence in the years ahead.

At MBS Consultancy, we help businesses navigate this evolving landscape with compliance-focused financial reporting, risk management strategies, and expert audit readiness support.

Ensure Your Board and Stakeholders Receive Accurate Audit Insights

Frequently Asked Questions (FAQs)

What Is an Audit Opinion in Simple Terms?

An audit opinion is the auditor’s professional judgment about whether a company’s financial statements are accurate, fair, and comply with accounting standards.

How Many Types of Audit Opinions Are There?

There are four main types of audit opinions: unqualified (clean), qualified, adverse, and disclaimer of opinion. Each type reflects a different level of confidence in the financial statements.

Which Audit Opinion Is the Best?

The best audit opinion is the unqualified (clean) opinion, which means the financial statements are accurate, transparent, and comply with GAAP or IFRS.

Is a Qualified Audit Opinion Bad?

Not necessarily. A qualified opinion points out a specific issue but usually means the overall financial statements are still reliable. It’s less severe than an adverse or disclaimer opinion.

What Happens if A Company Receives an Adverse Opinion?

An adverse opinion signals major inaccuracies or misstatements. It can damage the company’s credibility, reduce investor confidence, and may even trigger regulatory investigations.

Why Would an Auditor Issue a Disclaimer of Opinion?

Auditors issue a disclaimer when they cannot form a reliable conclusion due to lack of sufficient evidence or restrictions on their work. This often raises concerns about transparency.

How Can Businesses Prepare to Get a Clean Audit Opinion?

By maintaining accurate financial records, ensuring strong internal controls, complying with GAAP/IFRS, and supporting auditor independence, companies can improve their chances of receiving a clean opinion.