Maintaining a competitive edge hinges on robust internal controls, and financial transparency is crucial. Especially in the dynamic landscape of the United Arab Emirates. Here’s where the internal audit report comes into play.

An independent internal audit team or a qualified external firm conducts the internal audit reports. The audit team offers businesses invaluable insights into their operations.

They do so by examining financial records, assessing internal controls, and identifying potential risks. On the other hand, internal audit reports empower UAE businesses to make informed decisions, safeguard assets, and ultimately achieve their strategic goals.

This blog aims to equip you with essential knowledge to help you understand the internal audit report in the UAE. Let’s begin the exciting journey here.

What is an Internal Audit Report?

The internal audit reports are created to evaluate the internal control of companies. It includes accounting processes and the corporate governance of organizations. There are four primary types of internal audit reports. However, the purpose of these reports is to ensure compliance with regulations and laws. They help in maintaining accurate and timely data collection and financial reporting.

Why is an Internal Audit Report Important for a Business?

Every business now and then needs to assess the potential risks its business involves. Apart from risk, the companies also seek ways to improve operational efficiency while ensuring compliance.

Here comes the need of the hour, that is, the internal audit progress report. We can say that it is a tool for businesses to identify their potential risks. The internal audit reports also assist in improving operational efficiency. They help in ensuring compliance with regulations and laws. Also, they aid in enhancing financial reporting while assuring stakeholders.

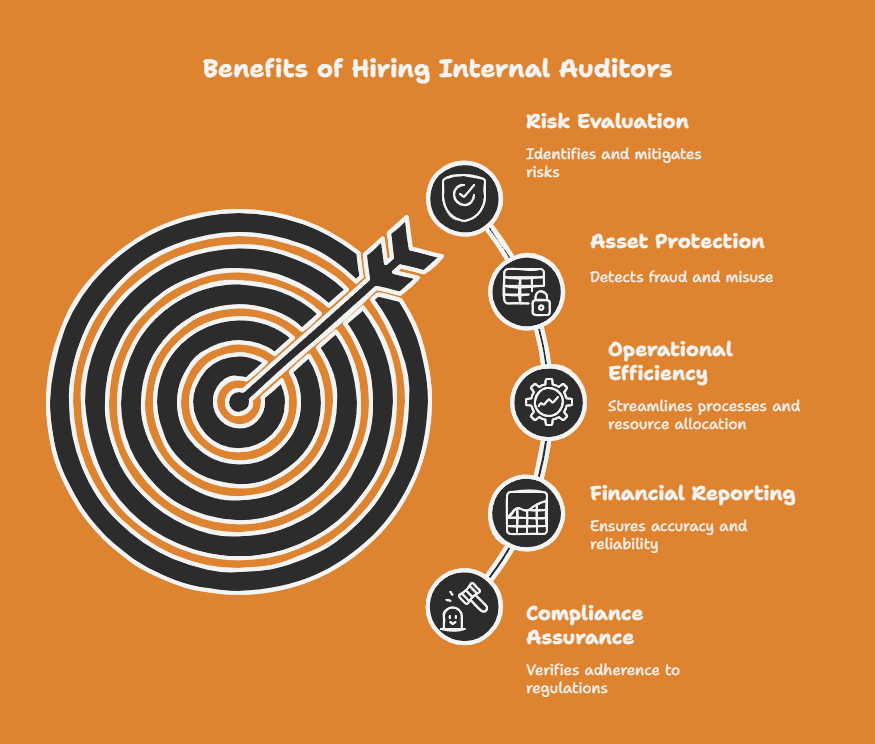

Benefits of Hiring an Internal Auditor

Some benefits of hiring an internal auditor for your business in the UAE include:

Risk Evaluation

The businesses that hire internal auditors assess vulnerabilities in processes. It includes identifying and mitigating financial and operational risks and internal audit challenges before they escalate.

Protects assets

Internal audits safeguard a company’s valuable assets. They do so by detecting fraud or misuse of resources. It helps in minimizing financial losses.

Improves Operational Efficiency

Why invest in an internal audit? Having internal audits, you can identify redundancies and inefficiencies in your workflows. By this, you can recommend improvements to streamline operations. It also assists in optimizing resource allocation.

Upgrades Financial Reporting

They ensure the accuracy and completeness of your financial records. Helping to boost the reliability of your financial reporting for decision-making and stakeholders.

Compliance Assurance

They verify adherence to relevant regulations and internal policies. Minimizing the risk of legal penalties and reputational damage.

Provides Targeted Insights

The internal auditors offer an objective perspective. That’s going beyond surface-level financials. It provides targeted insights that support strategic decision-making and business growth.

An Internal Audit Report Format

There’s no mandated format for internal audit reports in the UAE. Generally, there are accepted best practices and content recommendations. A breakdown of a common internal audit report template for businesses in the UAE:

- Include the report title, company name, date, and internal audit department (if applicable).

- Briefly summarize the key findings, conclusions, and recommendations of the audit.

- Outline the purpose and scope of the internal audit.

- Mention the specific areas or departments reviewed.

- Describe the approach taken for the audit, including procedures used and testing methods.

- Detail the audit findings, categorized by department or process area.

- Identify any control weaknesses, breaches of policies, or areas of potential risk.

- Use evidence to support your findings, such as data analysis or observations.

- Summarize the overall assessment of the internal control environment based on the findings.

- Assess the likelihood and potential impact of identified risks.

- Provide clear and actionable recommendations for addressing control weaknesses and improving processes.

- Assign ownership and timelines for implementing suggested improvements.

- Include any supporting documentation, such as detailed data tables, control matrices, or interview notes.

You can get an internal audit report example from previous records to create an effective format for the current audit.

Get Professional Internal Audits with MBS Consultancy

Worried about your company’s audit? We can understand this as it is a matter of your business. A company that continues speedy growth while evaluating risks performs out of the box!

MBS Consultancy is your savior when it comes to professional internal audit reports and internal audit summary reports. Our expert team closely looks into your business financials and helps you in making informed decisions. We assist in identifying all potential risks and major improvement evaluation.

With us, you can obtain the support you need to take your company to new levels. The MBS Consultancy is the leading business consultant in Dubai. Let us give you the tools and advice you need to make the best business decisions. Get professional internal audits with the expert team at any time!

Conclusion

In conclusion, businesses need to assess the potential risks to be successful in the UAE market in the long run. Besides this, the companies also seek ways to improve operational efficiency while ensuring compliance. It can be achieved by creating an internal audit report.

These reports can be designed and planned by auditors depending on the business type. Different internal audit types serve as a tool for businesses to identify their potential risks. They also assist companies in improving their operational efficiency. At the same time, they ensure compliance with regulations and laws.

There are several benefits for businesses that opt for internal audit reports in the UAE. It is advisable for companies to learn more from the previous examples of internal audit reports about what’s needed and when needed to utilize internal audit reports to learn about their business risks and improvements in depth.