Behind every confident business decision lies a financial statement done right with accurate reporting. And you don’t need to be a CFO to create one. Thousands of UAE businesses are finally getting smart with their numbers; building financial statements in-house, outsourcing when needed, and showing up to audit season like pros instead of panic-mode messes.

Whether you are a startup founder, SME owner, or finance manager juggling 17 deadlines and a lukewarm coffee, this blog post shows you how to make financial statement documents that are clear, compliant, and surprisingly empowering.

Financial Confusion Is Real

- Struggling to track income and expenses clearly?

- Dreading what your next investor or auditor might say?

- Wondering if your Excel sheet would survive a financial statement audit?

You are not alone. Many business owners in the UAE (and well, let’s be honest, globally) avoid the numbers until they absolutely can’t. That moment when someone asks for your cash flow position and you mumble something about last month’s sales? That’s the red flag we are fixing today.

If you don’t understand your financial statements, you’re flying blind. But here’s the win: making sense of them is way easier than most people think.

What is a Financial Statement in Accounting?

A financial statement in accounting is a structured snapshot of your business’s money matters over a specific period. Think of it as the story your numbers are trying to tell; one that bankers, investors, auditors, and sometimes even government bodies want to read. Typically, it includes:

- Income Statement as it shows profit or loss (aka, are you actually making money?)

- Balance Sheet, which breaks down your assets, liabilities, and equity.

- Cash Flow Statement that tells where the money’s really going.

- Equity Statement tracking ownership changes, investments, and withdrawals.

When done right, these are more than just compliance tools. They are how you spot patterns, scale better, and sleep at night knowing you’re not missing a financial iceberg.

How to Make Financial Statement

We share how you should go about making a financial statement, explaining each step.

1. Gather the Right Financial Data

Start with your core financials:

- All income streams (sales, services, subscriptions, other revenues)

- COGS (Cost of Goods Sold)

- Operational and administrative expenses

- Asset purchases and disposals

- Liabilities, including loans, credit lines, and payables.

- Shareholder equity and owner contributions

If you are managing an inhouse financial statement process, get your reconciliations in order. Double check against bank records, receipts, and accounting software.

2. Build Your Income Statement

This is the performance report card. Are you profitable or just busy?

Formula:

Revenue – Cost of Goods Sold = Gross Profit

Gross Profit – Expenses = Net Profit

Highlight:

- Total revenue

- Direct costs

- Operating margin

- Net profit/loss

This report tells you if your pricing makes sense and where to trim ends if needed.

3. Construct the Balance Sheet

A snapshot of what you own and owe, ideally in harmony.

Key components:

- Assets: cash, inventory, property, receivables

- Liabilities: loans, unpaid bills, credit cards

- Equity: what’s left for shareholders after liabilities

The classic accounting rule: Assets = Liabilities + Equity

If it doesn’t balance, backtrack. A missing transaction, a misclassification, or a data entry error could be the culprit.

4. Draft the Cash Flow Statement

This one is a reality check. Even profitable companies can crash if they run out of cash. So break it all down:

- Operating Activities – day-to-day business operations

- Investing Activities – asset purchases or sales

- Financing Activities – loans, dividends, capital injections

This helps you avoid nasty surprises like making payroll late or needing emergency funding.

5. Add the Equity Statement

If you’ve got partners, investors, or plan to have them, it matters. That’s why you should track:

- Owner investments

- Shareholder withdrawals

- Retained earnings

- Dividend payouts

It shows how the value of ownership has changed and who gets what slice of the pie.

6. Tie It All Together

Now that you have the four key statements:

- Check for consistency across documents

- Cross-verify total cash from balance sheet and cash flow

- Match net profit with retained earnings shifts

If you are using financial software, run consolidated reports. If you are on spreadsheets, check formulas and cell references at least twice.

Financial Reporting: From Chore to Cheat Code

Smart financial reporting:

- Opens doors to better funding

- Helps spot cash leaks early

- Guides smarter hiring or expansion plans

- Keeps you out of trouble during audits

In UAE, where financial planning gets layered with zone-specific rules, VAT obligations, and investor expectations, having clean reports saves your time, reputation, and money.

Outsourcing your financial statement audit services to professionals who understand local nuances is smart delegation.

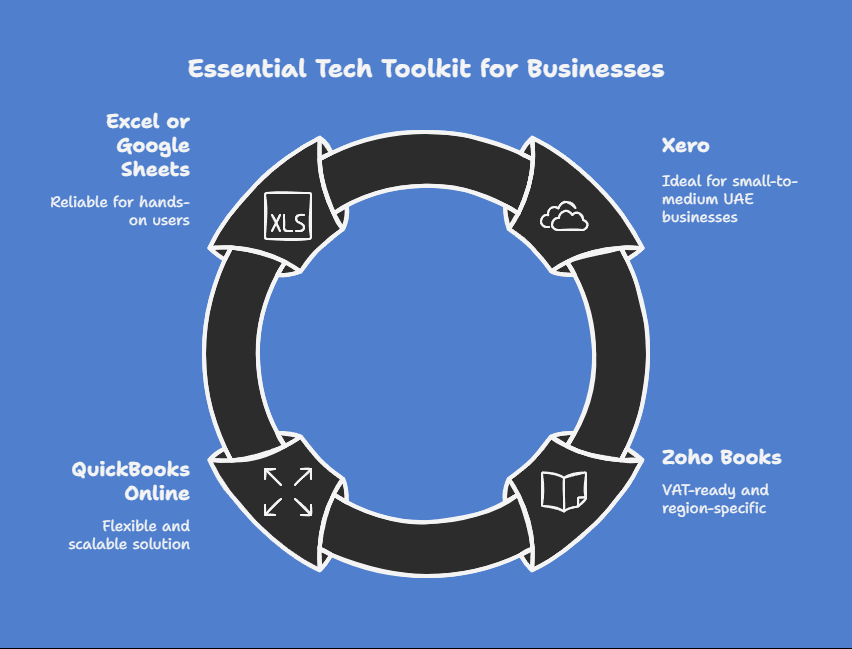

Tools That Make It All Less Painful

Whether you’re DIY-ing or calling in help, here’s your tech toolkit:

- Xero – Great for small-to-medium UAE-based businesses

- Zoho Books – VAT-ready and built for the region

- QuickBooks Online – Flexible and scalable

- Excel or Google Sheets – Old-school but reliable if you’re hands-on

Don’t automate away your understanding. Use tools to speed up tasks, but always know what the output means.

Quick Wins Most People Miss

- Always keep business and personal accounts separate.

- Reconcile monthly. Don’t wait till year-end.

- Review reports quarterly. Spot trends, not disasters.

- Keep backup documents. You will need receipts for the audit.

If your numbers don’t add up, it’s time to rethink your setup.

FAQs

Can I build financial statements without software?

Yes, but why would you? Manual is fine early on. But software saves time and improves accuracy.

What if my records are messy?

Start fresh with what you know. Work backwards. Document assumptions.

How do I get audit-ready?

Hire help, prep backup documentation, and keep records organized year-round. Don’t wait for the panic email.

When to Call the Experts

You don’t need to do it all on your own. Hire professionals if:

- You are seeking investment

- You need legally compliant reports

- You want peace of mind before tax season

- You have outgrown DIY spreadsheets

Own Your Numbers with MBS Consultancy

Our team offers financial statement audit services tailored to UAE businesses. We speak balance sheets, income statements, and tax deadlines fluently. We will help you:

- Catch reporting errors before they become liabilities

- Stay aligned with UAE reporting standards

- Show financial clarity to investors and partners

You don’t need to become an accountant overnight. But you do need to take control. Learning how to make financial statement documents, whether for compliance, funding, or confidence, puts you in the driver’s seat of your business.

So whether you are using an inhouse financial statement method or hiring outside help, don’t just fill out forms. Tell your financial story with clarity, logic, and a little swagger. Because when the numbers make sense, the decisions get a whole lot easier.

Let’s build reports worth reading. Book a free consultation with our experts today and make your next financial statement your strongest asset.