Financial reporting is essential when it comes to displaying the economic situation of any business. It is required to share a clear picture of finances with the stakeholders who are partners of a company in the UAE. In this country where businesses face cutthroat competition, accurate reporting keeps them ahead of the curve.

The business stands distinguished with sustainable growth and fulfills the legal responsibility. Therefore, it is essential to understand the importance of financial reporting. Not only it ensures compliance with the legal regulation but it also attracts investors.

What is Financial Reporting?

The documentation and presentation of financial data is reporting. It can be displayed to stakeholders, shareholders, management, and regulatory authorities. It proceeds by compiling different financial statements including:

- Balance Sheet: Displays a company’s assets, liabilities, and equity at a specific point in time.

- Income Statement: Highlights revenue, expenses, and profit over a period.

- Cash Flow Statement: Tracks cash inflows and outflows to ensure liquidity.

For businesses in the UAE, adhering to a robust financial reporting framework is vital for transparency, accountability, and growth.

Why Financial Reporting Matters for UAE Businesses

Financial report tells the financial story of any business. The businesses in UAE must consider this process to be done because of its many advantages. Have a look at them below:

1. Compliance with UAE Regulations

The UAE emphasized the following regulatory requirements regarding financial matters. This works under the VAT laws, anti-money laundering regulations, and corporate tax frameworks. Non-compliance can result in severe penalties that can be enforced in case of non-compliance. This influences the business’s reputation and financial health negatively.

2. Building Stakeholder Confidence

Precise financial reporting allows business partners or shareholders to gain trust in your business. Clear reports of all finances enhance their reliance and promote their contribution. The reporting also indicates internal control over the company’s financial dealings.

3. Supporting Strategic Planning

Financial reports reflect prominent insights into a company’s performance. This brings forth the areas of improvement as well as the strengthening points. This data gives rise to strategic planning and informed decision-making.

4. Attracting Investments

In a competitive market like the UAE, businesses seeking funding or partnerships must present detailed financial statements. A solid finance reporting framework is often a deciding factor for investors.

5. Tax Efficiency

Accurate financial reports simplify tax calculations and filings. Staying compliant with UAE’s corporate tax rules becomes more manageable, avoiding unnecessary fines and audits.

Key Components of a Strong Financial Reporting Framework

To ensure reliable and comprehensive financial reporting, UAE businesses should focus on the following elements:

| Component | Description |

| Accuracy | Ensure all financial data is precise and free from errors. |

| Timeliness | Reports should be prepared and shared within set deadlines. |

| Compliance | Adhere to local laws, including UAE corporate tax and VAT regulations. |

| Transparency | Provide clear and detailed explanations for financial results. |

| Automation | Use software tools to streamline data collection and reduce manual errors. |

Challenges UAE Businesses Face in Financial Reporting

Despite its importance, finance reporting comes with its own set of hurdles. UAE businesses often encounter unique challenges that require careful navigation to maintain accuracy and compliance.

1. Complex Regulatory Landscape

With evolving laws like corporate tax and VAT, businesses must stay updated to ensure compliance.

2. Lack of Expertise

Many SMEs in the UAE struggle with financial reporting due to limited resources or a lack of skilled personnel.

3. Technology Integration

Implementing modern financial tools can be challenging, especially for traditional businesses transitioning to digital platforms.

4. Cross-Border Transactions

For companies involved in international trade, managing financial reporting across jurisdictions adds complexity.

5. Data Management

Handling large volumes of financial data while ensuring its accuracy and security can overwhelm businesses without proper systems.

How to Improve Financial Reporting in Your Business

To build a system of finances that reflects efficiency and presents clarity, financial reporting needs to stay compliant at every step. For advancement, businesses in the UAE must consider these practical steps.

- Invest in Technology Adopt finance reporting software to automate processes, enhance accuracy, and save time.

- Hire Professional Services Consulting firms can provide expert guidance. They ensure compliance with legal standards. These service providers gain good internal control over finance reporting with their best practices.

- Regular Training Educate your finance team on the latest regulations and reporting standards in the UAE.

- Audit Your Reports Conduct internal audits regularly to identify and address discrepancies in financial reports.

- Implement Standardized Processes Create consistent procedures for data collection, report preparation, and validation to reduce errors and improve reliability.

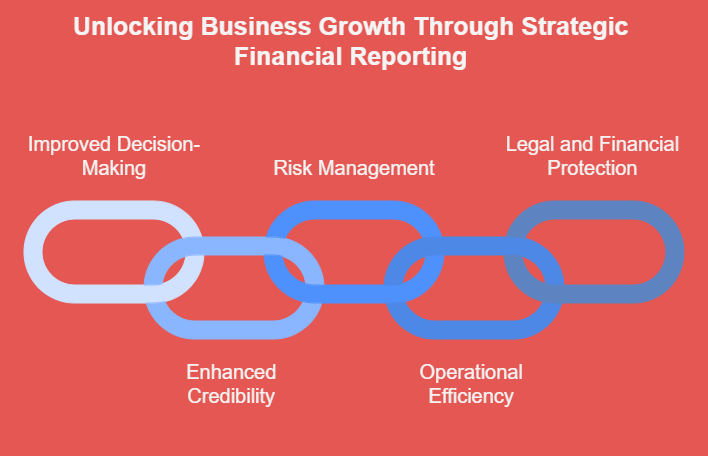

Benefits of Financial Reporting for UAE Businesses

The advantages of financial reporting go beyond compliance. It’s a tool that drives growth, builds trust, and safeguards your business against potential pitfalls.

1. Improved Decision-Making

Detailed financial reports provide actionable insights, helping businesses plan for future growth.

2. Enhanced Credibility

Accurate reporting increases trust with external parties like banks, investors, and suppliers.

3. Risk Management

Identifying potential financial risks early allows businesses to mitigate them effectively.

4. Operational Efficiency

Financial reports help track performance, ensuring resources are allocated efficiently.

5. Legal and Financial Protection

Proper reporting safeguards businesses from legal disputes and supports transparency during inspections or audits.

The Role of Financial Reporting in UAE’s Economic Growth

This step of Financial analysis determines the success of the business. Along with this, this report strengthens the UAE’s economic ecosystem. If this process remains Transparent and error-free, it is easier for foreign investment to grow. The company paves its way forward with confidence in the local market.

Many industries gain an advantage from well-structured report systems. These may include real estate, retail, and technology.

Future Trends in Financial Reporting for UAE Businesses

The future of financial reporting is also bright. The tech-induced era shapes the importance of this vital aspect with surging trends. Knowing these trends keeps your business on the right track.

1. AI and Automation

Artificial intelligence is becoming a major helping hand in assessing financial situations. By avoiding repetitive tasks, AI enhances accuracy. It helps generate real-time insights.

2. Blockchain Integration

Blockchain technology ensures the integrity of financial data. This proceeds by providing a tamper-proof ledger for transactions and records.

3. Sustainability Reporting

As ESG or Environmental, Social, and Governance gain importance. Businesses prefer incorporating sustainability metrics into their financial disclosures.

4. Cloud-Based Solutions

Cloud platforms enable secure access to financial data anytime, fostering collaboration and streamlining reporting.

5. Regulatory Evolution

With global accounting standards continuously evolving, businesses in the UAE need to adapt swiftly to remain compliant.

MBS Consultancy: Your Partner in Financial Reporting Excellence

Financial reporting may come with difficulties that can be overwhelming to deal with on your own. MBS Consultancy is the name of assistance in such situations. With years of experience in drafting finance reporting and following regulatory compliance, our team provides tailored solutions to meet your business needs.

Why Choose MBS Consultancy for Financial Reporting?

- Our team stays updated with the latest UAE financial regulations.

- We use advanced tools to streamline your financial reporting process.

- Whether you are a start-up or an established enterprise, we customize our services to your requirements.

- We empower your team with the knowledge needed to manage reporting effectively.

Don’t let finance reporting challenges hold your business back. Contact MBS Consultancy today and ensure your business’s financial transparency and growth.

In conclusion, Financial reporting stands as the unavoidable requirement for the success of the business in the UAE. Accurate and transparent reporting gives a clear picture of finances. This leads to building trust and investment goals in 2025 and beyond.