For small and medium enterprises (SMEs), the word financial audit might conjure up images of towering stacks of papers and calculator-tapping accountants. But hold on. Financial audits don’t only tick boxes for compliance. What’s the annual health checkup for your business, and the benefits? Oh, they’re so worth their weight in spreadsheet.

If you’re wondering whether financial audits are a must-do or a nice-to-have for SMEs, keep reading because this isn’t your average accounting blog post. We’re about to break it down with some interesting takes and practical insights.

- What is financial audit?

- SME Edition of Audit Adventures

- Let’s the clear the ledger on if financial audit is compulsory for SMEs

- Do SMEs even need financial audits?

- Audits for SMEs — Myths, Truths and Benefits

Why SMEs Should Befriend the Financial Audit

You might think your SME is flying under the radar. But financial audits are the spotlight you didn’t know you needed. They do more than satisfy regulatory requirements; they’re a gateway to clarity, credibility, and cash flow confidence.

1. Boost Your Credibility Game

Ever heard the phrase Show me the numbers? A financial audit does precisely that. It’s a credibility booster for potential investors, lenders, and partners. When you have a verified audit report, your business looks polished, trustworthy, and ready for the big leagues. It’s the version of wearing a well-tailored suit to a board meeting so people take you seriously.

2. Crystal Clear View of Your Books

Running an SME often means juggling a hundred tasks. Errors and inconsistencies can sneak into your records. A financial audit serves as a magnifying glass. It helps you identify red flags before they turn into raging fires. Think of it as decluttering your finances in Marie Kondo style because clean books spark joy.

Explore how proper Financial Reporting supports clean and accurate books..

3. Stay in the Good Books with the Financial Audit Authority

Sometimes audits for your SME might seem overkill. But they are an excellent way to stay on the right side of the law. The financial audit authority Dubai may not come knocking often. But when they do, having your finances in pristine condition is a huge advantage. Compliance future-proofs your business.

4. The Competitive Edge

In this cutthroat market, standing out is important. A financial audit signals professionalism and trustworthiness to clients as well as competitors. It’s the secret ingredient to turning heads and opening doors to new opportunities.

Financial Audit — Not Only for the Big Fish

SMEs sometimes assume financial audits are reserved for corporate giants. That’s similar to saying gym memberships are only for bodybuilders. Regardless of your size, staying financially fit is necessary. This is how a financial audit can reshape your SME’s destiny:

1. Find Better Financing Opportunities

Banks and investors want to see solid proof that your financials are in check. An audited report is a golden ticket to better loan terms, higher credit limits and equity funding opportunities. And well who doesn’t like a win-win scenario?

A strong Financial Statement backed by an audit can help secure funding with ease.

2. Strengthen Decision Making

Accurate financial data is a decision-making superpower. Be it expanding to new markets or launching a killer product, a financial audit gives you the numbers you need to make smarter moves. No guesswork and no surprises. There are only facts.

3. The Shield Against Fraud

Fraud might seem to be a big company problem. But SMEs are often the most vulnerable. A thorough financial audit acts as a firewall by protecting your hard-earned money from internal or external threats. Think of it as cybersecurity for your cash flow.

4. A Pathway to Growth

Financial audits help you maintain the status quo. They also pave the way for expansion. When you know your financial health, scaling up becomes a calculated and confident step forward, not a leap of faith.

Plan your next move with confidence through smart Financial Planning.

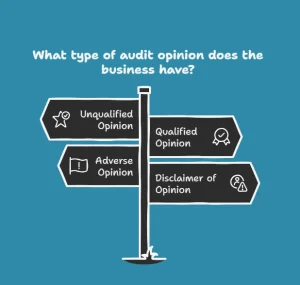

Types of Audit Opinion That Matter to SMEs

An audit opinion can be as sweet as a clean chit or as bitter as a qualified report. Types of audit opinion include:

- Unqualified Opinion

This is the gold standard of audits. It’s similar to an A+ for your finances.

- Qualified Opinion

That’s one polite way of saying you’re doing okay but there is still room for some improvement.

- Adverse Opinion

This is the ultimate red flag. It signals that the time has come to revise your accounting practices.

- Disclaimer of Opinion

Well, it is a wake-up call to fix glaring issues when auditors can’t form a definite opinion.

Being understanding of these opinions helps SMEs see where they stand. It assists them in showing what’s needed to move up the financial reliability ladder. It’s also a chance to welcome the transparency onboard that modern businesses thrive on.

Internal vs. External Audits

Financial audits often steal the spotlight. But internal audits and external audits work together to keep your SME’s financial machinery humming.

This is your day-to-day watchdog which makes certain of your operational efficiency and compliance in the company. It’s having an in-house detective.

- External Audits

These are the big guns who validate your financials for stakeholders and regulatory bodies. An external auditor’s seal of approval adds weight to your business’s integrity.

Together they create a strong framework that protects your SME from financial pitfalls. Plus, the collaboration between internal and external audits ensures no stone is left unturned.

Is Financial Audit Mandatory? Regional Rundown

In some areas, SMEs are required to go along with audits based on:

- turnover thresholds

- industry regulations

- tax requirements

If you operate in UAE, understanding the legal requirements is necessary. Voluntary audits can be a smart move to gain a competitive edge.

Financial audit checklist requirements may also vary based on jurisdiction and business structure. Internal and external audits also tie into broader compliance requirements. A little extra effort now can save you a world of trouble tomorrow. Beyond compliance, audits can also help SMEs match international standards. This makes them attractive to global investors and clients.

Wrapping It Up with a Financial Bow

On the surface level, a financial audit might seem to be a tedious chore. But for SMEs, it’s full of benefits. Be it boosting credibility or uncovering inefficiencies and ensuring compliance, the advantages far outweigh the effort.

Whether it is an unqualified opinion you’re aiming for, building stronger investor trust or only sleeping better knowing your books are in order, a financial audit is the way for sustainable growth.

It is not only about crunching numbers. More so it is about creating opportunities. So why not make financial audits your business’s new best friend?

Financial audits mean more than just a legal requirement or a business necessity — they’re a tool that propels your SME towards transparency, growth, and financial stability. The next time you hear the word audit, don’t groan. Instead, grin because you’re stepping into a brighter and more secure future.