Audits often come with stress, time, and cost that no business leader likes. Your teams see them as disruptions, not as opportunities. However, the reality is far different. When done right, external audits build trust, protect against risk, and unlock growth opportunities.

In other words, an external audit is an independent review of your financials, systems, and compliance. You can think of it as a safety net that prevents costly mistakes and reassures your stakeholders.

And here’s the kicker: companies without strong audit practices face significant risks. According to the research, 41% of businesses without continuous compliance oversight suffered delayed deals or lost opportunities. That’s the cost of not using auditing. This guide shifts the conversation. Instead of treating audits as a burden, you’ll see them as an investment

In this guide, we’ll cover what an external audit really means, the types of audits and where they fit, the top benefits of an external audit for organizations, a step-by-step breakdown of the external audit process, the biggest challenges, and how to overcome them.

Define an External Audit:

An independent examination of a company’s financial statements, internal controls, and compliance practices is called an external audit. It is conducted by certified auditors outside the organization. The core purpose is to give stakeholders a fair view of the company’s position.

As an employer, think of it like inviting a referee into the game. Internal teams know the playbook, but external auditors bring impartiality. Their fresh perspective makes your reporting credible and impactful.

Internal vs. External Audit:

We have crafted the differences between the internal and external audit in the form of a table for your better understanding:

| Aspect | Internal Audit | External Audit |

| Performed By | Internal audit is performed by employees or the in-house audit team | External audit process is performed by an independent external firm |

| Focus | Operational improvements & risk checks | Compliance, financial accuracy, and transparency |

| Objective | Improve processes, mitigate risks | Provide unbiased assurance to stakeholders |

| Frequency | Continuous, flexible | Annual or regulatory-driven |

| Stakeholder Value | Helps with management decisions | Builds investor, regulator, and public trust |

This internal audit and external audit difference matters: internal audits fix problems, external audits prove you can be trusted.

Who Needs It Most?

Public companies are legally required to conduct an external audit to achieve transparency. Highly regulated industries, including banks, healthcare, and energy, also needed it.

An external audit is for growing startups that are attracting funding and partnerships. The companies seeking tenders, expansion, or government contracts often require it.

Compliance Failure Example:

The Abu Dhabi Global Market penalized Baker Tilly Middle East and its audit principal, Neil Andrew Sturgeon, in the year 2024. The ADGM handed down fines of US $50,000 and US $12,500, respectively. As per reports, the penalties stemmed from serious failings and gaps in their audit work for two ADGM-regulated companies.

External Audits Types:

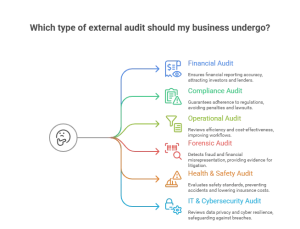

For businesses, external audits aren’t one-size-fits-all. It usually depends on your goals, industry, or risk exposure. For instance, different types serve different needs:

Financial Audit:

The purpose of a financial audit is to validate financial reporting accuracy. Its key users are investors, lenders, and regulators. Having transparent financials improves valuations and investment appeal. A startup seeking venture capital needs financial statement audit services. They need it to prove their numbers are reliable.

Compliance Audit:

The compliance audit guarantees adherence to tax and regulatory requirements. The tax authorities and legal bodies conduct this audit. It protects against penalties, lawsuits, or license suspension. A pharmaceutical firm must pass FDA compliance audits before product approval.

Operational Audit:

An operational audit reviews efficiency, processes, and cost-effectiveness. It is usually performed by the management teams and identifies waste, reduces costs, and improves workflows. A logistics company uncovers route inefficiencies through operational audits.

Forensic Audit:

Forensic audit detects fraud, embezzlement, or financial misrepresentation. Mostly, your legal teams, courts, and regulators use it to provide evidence for litigation or insurance claims. Organizations utilize it in detecting procurement fraud in a large corporation.

Health & Safety Audit:

A health and safety audit evaluates compliance with occupational safety standards. Its key users are regulators, insurers, and employees to prevent accidents while lowering insurance costs. A construction company reduces on-site injuries after a safety audit.

IT & Cybersecurity Audit:

This audit type reviews data privacy, IT controls, and cyber resilience. Your tech teams, executives, and regulators performed an It and cybersecurity audit. As per Cybersecurity Venture’s 2026 report, cybercrime costs are projected to hit $10.5 trillion annually by 2026. IT audits safeguard against costly breaches. For instance, a fintech ensures GDPR and ISO compliance through IT audits.

In short, each audit type strengthens a different pillar of organizational resilience. This shows the importance of conducting an audit for your business, helping you to achieve transparency and fair practices within your organization.

Advantages of External Audit:

External audits prove their worth with their outcomes. We have shared 10 major advantages of external audit, backed by research and real-world relevance.

Improve Financial Transparency:

External audits assure stakeholders that your financial books are accurate. Often, this approach builds trust with shareholders and credit agencies.

Regulatory Compliance:

Compliance mistakes cost big to businesses. According to recent research, regulatory non-compliance expenses are 2.7x higher than the cost of compliance programs. Performing a proper and transparent audit ensures you meet requirements and avoid fines.

Strengthening Internal Controls:

In organizations, weak controls create loopholes for fraud and error. Having an external audit test these systems and highlight gaps if they exist.

Enhanced Decision-Making:

External auditors provide insights into inefficiencies and risks. Business leaders use this data to make informed and strategic choices.

Attracting Investors & Shareholders:

Audited numbers boost investor confidence. The survey by the Center for Audit Quality reported that 78% of investors express confidence in audited financial statements

Boosting Stakeholder Confidence:

Customers, employees, and suppliers all trust audited companies more. This may lead to better contracts, retention, and loyalty.

Fraud Detection & Prevention:

The (ACFE) Association of Certified Fraud Examiners estimates that organizations lose 5% of annual revenue to fraud (ACFE, 2024). Before damage multiplies and control escalates, external audits catch red flags.

Improve Efficiency & Cost Savings:

For businesses, operational audits flag bottlenecks and inefficiencies. This may eliminate waste, save time, and resources.

Health & Safety Benefits:

According to the ILO 2024, 80% of occupational accidents could be prevented if all ILO member States used the best accident prevention practices that are easily available. These benefits of external health and safety audits extend to lower premiums and higher morale.

Reputation & Market Advantage:

Mostly, audited companies stand out in tenders, global expansion, and client negotiations. It has been experienced that an audit seal signals accountability and professionalism.

External Audit Procedure:

A structured audit isn’t as scary as it sounds. The step-by-step external audit process is as follows:

Planning & Risk Assessment:

Scope, timeline, and risk areas are identified in the planning and risk assessment phase.

Data Collection & Testing:

At this point, auditors review ledgers, contracts, and compliance documents.

Internal Control Evaluation:

The evaluation includes testing of approval workflows, access controls, and segregation of duties.

Substantive Testing:

In substantive testing, it may involve sampling, transaction verification, and analytical checks.

Reporting & Recommendations:

Auditors issue their audit report with findings and suggestions.

Follow-Up Actions:

Management implements corrective measures if required.

In short, the external audit structure keeps the process predictable and less intimidating, followed by actions like planning, testing, and follow-up actions.

Challenges Organizations Face and How to Overcome Them:

Many businesses find themselves juggling compliance standards. This leads to frequent gaps in audit readiness. Companies always compromise on compliance due to business pressures, highlighting how overwhelm can cause shortcuts.

A lack of organized records slows audits and inflates costs. In organizations, many team members view audits as blame-focused rather than improvement-driven. This mindset creates friction and slows responsiveness.

Moreover, audits demand considerable time and focus from teams who are managing day-to-day operational pressures, especially smaller firms, which feel the strain.

Many executives see audits as cost sinks and do not take them as a value driver. However, evidence tells the right story. Per the U.S. DCAA, audits in FY 2024 delivered 5.1 billion dollars in net savings, with an ROI of 7.20 dollars for every dollar spent.

To overcome challenges, businesses need to build a compliance roadmap by partnering with advisors or service providers who stay updated on regulatory shifts and treat audit requirements as strategic checkpoints.

They should implement digital document management, including central filing, standardized naming, and version control. For this, they can use audit-aware tools to track changes. It keeps evidence ready annually.

Furthermore, employers must recast audits as opportunities. It is required to host pre-audit sessions to explain how audits build credibility, protect the company, and highlight individual contributions.

It is suggested to plan ahead by automating data pulls, assigning audit liaisons, and scheduling audits during quieter business periods. If timelines overlap with critical deadlines, bring in temporary support.

Businesses frame audit spending as investment, not cost. They can use ROI data like this to illustrate how audits reduce long-term risk and build operational strength.

Preparing for an External Audit:

Preparation is everything, whether it’s an internal audit or an external audit. Below is your list to get audit-ready:

Keep Financial & Compliance Records Organized:

It is required to store contracts, statements, and ledgers systematically before the audit. This avoids delays when auditors request files.

Train Employees on Transparency:

Before the audit, train your employees to maintain transparency. Make teams aware that audits must be validated. They are not conducted to punish them or their work.

Use Automation & Software:

Using software and automation makes the process easier and faster. These automated tools minimize manual errors and highlight audit risk areas early.

Communicate with Auditors Clearly:

It is necessary to communicate with auditors openly. Set expectations before and during the audit, provide auditors with access needed, and maintain open dialogue with them.

Run Internal Audits Regularly:

Internal audits smooth the external audit. It can be used as a mock audit before the final one. You can think of it as a rehearsal before the big performance. Be proactive to make the final audit report far more favorable.

Wrapping Up:

Audits aren’t a distraction; count it as a catalyst. It helps your business to achieve compliance. They tend to prevent fraud, which leads to efficiency and growth.

For businesses, the external audit advantages far outweigh the costs. Ignoring audits is no longer an option with global regulations tightening.

At MBS-Consultancy, we deliver tailored external audit services that go beyond checklists. We help organizations build credibility, avoid risks, and fuel growth. Therefore, stop seeing audits as a burden. Start seeing them as your business growth partner.

FAQs:

What Are the Main Benefits of An External Audit for Businesses?

There are many advantages of conducting an external audit for businesses, including transparency, compliance, fraud prevention, and improved stakeholder trust.

How Does an External Audit Differ from An Internal Audit?

External audits are independent, while internal ones are in-house checks. The combination of both ensures balance.

What Are the Benefits of An External Health and Safety Audit?

The external health and safety audit has many advantages for businesses. The audit reduces accidents, cuts insurance costs, and improves employee morale.

How Can External Audits Help Prevent Fraud?

External auditors detect anomalies for businesses before they escalate. They do so by testing transactions and controls.

How Often Should an Organization Conduct an External Audit?

Organizations often conduct an external audit on an annual basis, which is standard. However, high-risk industries may need semi-annual audits.

What Industries Benefit Most from External Audits?

Industries like Finance, healthcare, construction, and tech are most benefited from external audits. In an external audit, compliance and investor trust matter most.

What Is the Difference Between an Internal Audit and An External Audit?

Both internal and external audits are different from each other. Internal audit focuses on process improvement, while external audit provides stakeholder assurance.