Think Your Financials Are Safe? Think Again.

In 2026, UAE businesses are under the microscope like never before. Audit risk is no longer lurking in the shadows. It’s staring straight at your spreadsheets.

Audit risks are multiplying in unexpected corners, from overstated revenues to digital vulnerabilities. Every unchecked process could be a pothole in your compliance journey. It’s not just about spotting issues, it’s about outsmarting them before they cost you.

This guide unpacks the hidden audit traps, the myths businesses still believe, and what smart companies are doing differently this year. Get ready to dissect the risks that matter and learn strategies that not only protect your numbers but sharpen your edge.

Are You Overlooking These Hidden Audit Risks?

Running a business in the UAE isn’t just about growth and innovation; it’s also about staying one step ahead of financial and operational blind spots. With tighter regulatory oversight and evolving market expectations in 2026, knowing where audit risk lurks is more than a box to check. It could mean the difference between smooth operations and serious setbacks.

Whether you’re a CFO, internal auditor, or business owner, understanding audit risk isn’t optional; it’s essential to keeping your business out of trouble.

We Help You Identify and Manage Audit Risks Before They Become Issues

What Is Audit Risk, and Why Should UAE Businesses Care?

Before diving into the risk areas, it’s important to understand what audit risk is. Learn how it directly impacts UAE businesses in today’s financial landscape.

Audit risk is the chance that financial statements may be materially misstated, even though they were given a clean bill of health by the auditors. In simpler terms, it’s what could go wrong despite everything looking fine on the surface. For UAE businesses, this means unseen financial irregularities, overlooked internal controls, or even unintentional non-compliance.

Keeping a sharp eye on audit risk helps businesses avoid financial penalties, reputational damage, and stakeholder mistrust.

Top Audit Risk Factors Affecting UAE Businesses in 2026

Understanding the specific areas where audit risk tends to emerge allows UAE businesses to take control before issues escalate. Here are the most common and dangerous risk factors.

Weak Internal Controls Can Sink Your Business

Internal controls form the backbone of financial reliability. When these controls are weak or missing, the likelihood of errors or frau/d grows exponentially.

Outdated Systems and Manual Processes

Why Legacy Tools Increase Audit Risk? Many companies still depend on outdated spreadsheets or legacy financial software. These tools are not only inefficient, but they’re also vulnerable to data entry mistakes, version control issues, and a lack of integration with audit systems. As a result, they contribute heavily to audit discrepancies.

Segregation of Duties (or Lack Thereof)

How Role Confusion Leads to Financial Blind Spots? When one person is responsible for initiating, approving, and recording transactions, internal fraud becomes easier to commit and harder to detect. Clear role division minimizes this risk. As emphasized in a thorough risk assessment in an audit, this is one of the first internal control areas to evaluate.

Revenue Recognition: The Silent Risk Driver

Revenue recognition is a subtle but serious trigger of audit risk. When revenue is recorded at the wrong time or in the wrong amount, the entire financial outlook becomes unreliable.

Overstated Revenues – The Illusion of Growth That Hurts Later

UAE companies, especially in high-growth sectors, sometimes push to meet revenue targets by prematurely recognizing income. This creates a misleading financial picture and increases audit risk when actual performance is reviewed.

Complex Contracts – Tricky Clauses That Trigger Red Flags

Businesses offering multi-phase projects or bundled services often struggle with correctly timing revenue recognition. If clauses are misinterpreted or overlooked, it can lead to non-compliance with financial reporting standards.

Tax Compliance Risks in UAE You Can’t Ignore

With regulatory bodies increasing tax audits across industries, tax compliance is one of the most heavily scrutinized areas where audit risk can arise.

VAT Filing Errors

Many businesses misclassify VAT-exempt and standard-rated transactions or file incorrect returns. These errors not only lead to fines but also put your company under deeper scrutiny during audits.

Transfer Pricing Irregularities – Cross-Border Transactions Under Audit Radar

Transfer pricing continues to be a complex issue for multinational companies. Inadequate documentation or inconsistent pricing models can result in significant adjustments and penalties from regulatory authorities.

Cybersecurity Gaps That Threaten Financial Accuracy

As companies rely more on digital systems, any gaps in cybersecurity can lead to financial manipulation or errors that trigger audit risk.

Poor Data Access Controls

Who Has the Keys to Your Financial Vault?

Access to financial systems should be limited to authorized personnel only. Without proper user controls, unauthorized changes to financial data can go unnoticed until an audit occurs.

Inadequate IT Audit Trails

No Logs, No Proof, More Risk

Audit trails track user activity and help verify the accuracy of financial entries. Without these logs, it becomes nearly impossible to trace who made which changes and why, raising serious concerns during financial audits.

Table: Quick View of Common Audit Risk Areas in UAE

A summarized glance at key risk zones helps identify where action is needed most.

| Audit Risk Area | Common Triggers | Consequences |

| Internal Controls | Manual processes, no oversight | Fraud, errors, and audit red flags |

| Revenue Recognition | Early booking, complex contracts | Misstated earnings, investor issues |

| Tax Compliance | VAT errors, missing documentation | Penalties, FTA scrutiny |

| Cybersecurity/Data Integrity | Weak access control, no audit trail | Data loss, financial discrepancies |

Why You Need a Risk-Based Audit Strategy in 2026

A risk-based audit approach focuses on areas that are most likely to create material misstatements. This approach is becoming more relevant than ever in the UAE.

Traditional audits often fail to address specific threats unique to each business. A risk-based audit zeroes in on areas with the highest potential for errors or fraud, helping UAE businesses direct their resources effectively.

Benefits of Using a Risk-Based Audit Approach

A risk-based audit approach offers a smarter way to manage resources and uncover financial vulnerabilities before they grow into bigger issues. Here’s why UAE businesses are increasingly shifting to this method in 2026.

Improved Focus on High-Risk Areas

Instead of spreading audit efforts equally, this approach concentrates on the areas with the highest risk, increasing the chances of detecting errors or fraud.

Cost and Time Efficiency

By avoiding unnecessary checks in low-risk zones, companies save time and audit-related costs while still maintaining strong oversight.

Stronger Internal Controls

A risk-based audit reveals weaknesses in processes and systems, encouraging businesses to strengthen controls and policies before auditors flag them.

Higher Confidence from Stakeholders

When audit processes are targeted and robust, stakeholders—including investors, regulators, and board members—gain more confidence in your reporting integrity.

Adaptability to Regulatory Changes

The audit environment in the UAE is evolving quickly. A risk-based audit allows for quicker adjustments when new regulations or market shifts emerge.

Ultimately, this method is not just about meeting standards—it’s about staying ahead of them.

Using a risk-based audit framework allows businesses to:

- Pinpoint areas with the highest financial exposure

- Reduce wasted effort on low-impact audit areas

- Enhance stakeholder trust through focused audit planning

Adopting a risk-based audit is not just efficient—it’s necessary for companies aiming to stay compliant and competitive.

With Our Expertise, UAE Businesses Can Address Audit Risk Areas Confidently

Practical Steps to Lower Audit Risk in Your Company

Proactive companies don’t wait for problems—they prevent them. These practical strategies can help you lower audit risk significantly.

Perform Regular Risk Assessment in Audit

Make It a Monthly Habit, Not an Annual Scramble

Rather than waiting for the year-end, conduct monthly or quarterly internal audits. Frequent reviews catch discrepancies early and prevent them from snowballing into major audit issues.

Train Your Team to Spot Red Flags

Knowledge Gaps Lead to Costly Errors

A well-informed team is your first line of defense. Training sessions should be held regularly to educate staff on detecting fraud, unusual transactions, or accounting irregularities.

Leverage Smart Tools to Detect Issues Early

Use Tech to Strengthen Your Risk Shield

Invest in AI-powered audit software that automates anomaly detection and improves financial reporting accuracy. These tools are becoming essential for audit teams across the UAE.

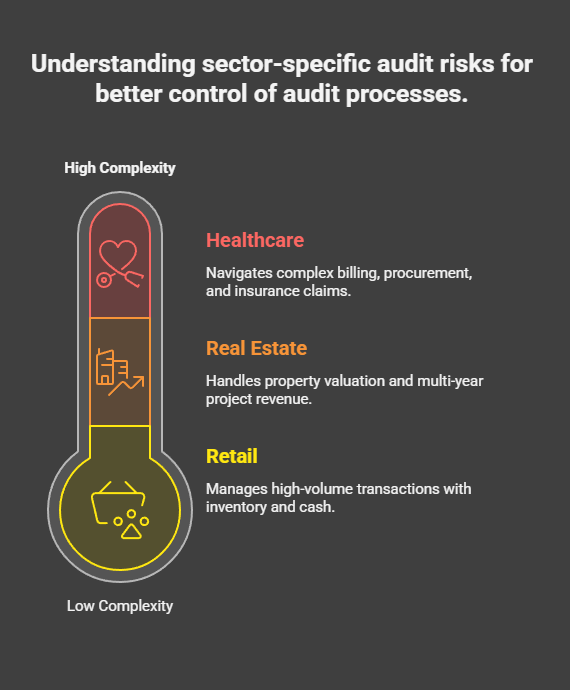

Audit Risks by Sector: What to Watch in Your Industry

Audit risks differ from one industry to another. By understanding these sector-specific risks, UAE companies can take better control of their audit processes.

Real Estate

Escrow Accounts, Valuations & Revenue Timing

Developers often face challenges around property valuation and revenue recognition from multi-year projects. Improper handling of escrow funds can also lead to audit violations.

Retail

Inventory, Cash Handling, and Discounts

Retailers often deal with high-volume transactions. Audit risks include unrecorded discounts, inventory shrinkage, and poor reconciliation of cash sales.

Healthcare

Billing, Procurement, and Insurance Claims

Healthcare providers juggle complex billing systems and supplier relationships. Audit red flags in this industry include duplicate payments, insurance fraud, and poor procurement documentation.

MBS Consultancy: Your Watchtower Against Audit Risk

Turn Risk into Resilience with MBS Consultancy

At MBS Consultancy, we help UAE businesses see audit risk not as a threat but as an opportunity to grow smarter. Our team offers tailored risk-based audit services, up-to-date insights, and hands-on guidance to fortify your financial processes.

Whether you’re looking to implement a risk-based audit, perform a risk assessment in an audit, or simply reduce your audit risk exposure, we’ve got your back.

Don’t wait for an audit to expose the cracks—let us help you seal them today.