Regulatory adherence, risk control, and financial transparency are more important than ever in the UAE’s constantly changing corporate environment. Internal auditing in the UAE is highly significant for making sure that your business runs smoothly, ethically. In accordance with regional regulations. It’s essential whether you’re a startup in a Free Zone or a huge company that operates business all across the Emirates.

We designed a free audit checklist for businesses in the UAE to help them improve their governance and financial validity. This article will help you make an internal audit checklist and perform beneficial internal audits. It helps ensure you stay updated with the current audit rules in the UAE.

Internal Audit: An Introduction

Internal audit procedure is the act of checking a corporation’s internal controls, governance practices, and accounting systems to make sure they adhere to the rules, manage risks, and improve how effectively they work.

It is unlikely to be tedious to check documents as part of the internal audit process. If you do it well, it will be a great chance to find out how your firm operates well and what needs to be better.

To comprehend that your firm can be as honest and trustworthy as it claims, you need to go through the procedure with a composed and competent attitude.

Need Expert Guidance to Complete Your Internal Audit?

Why Companies Need an Internal Audit?

Internal audits methodically analyze a business’s processes. Their purpose is to find problems with their functions, make sure that compliance standards are observed, and lower the risks to finances and operations.

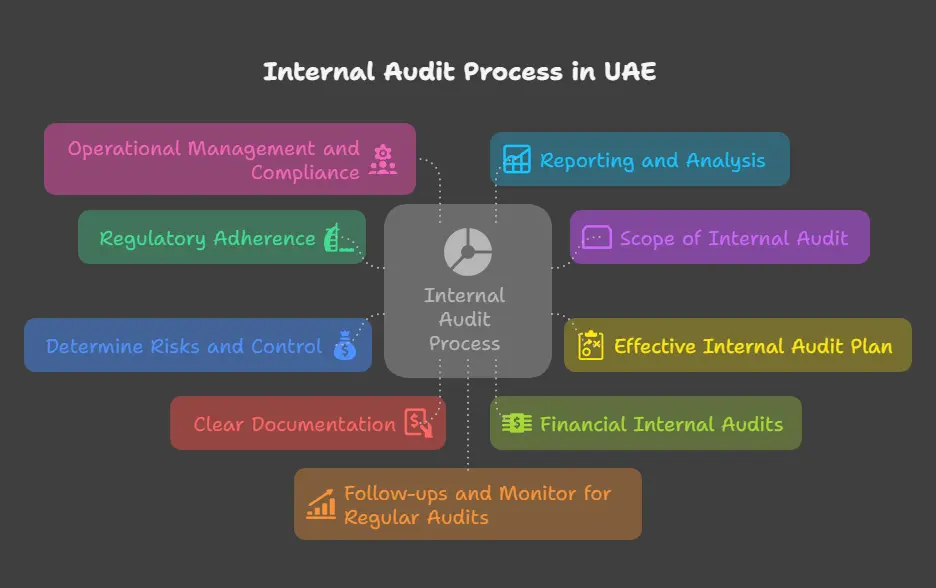

Businesses in the UAE must comply with regulations and rules, such as VAT, Anti-Money Laundering, and Corporate Tax laws. Companies can prevent fines, legal challenges, and mistakes with their financial resources by having regular internal audits. These are the most important parts of an internal audit checklist:

Regulatory Adherence:

You need to know and comprehend the regulations of the UAE if you want to run a business there. In real life, the rules and regulations are changing and are very complicated, which affects practically all businesses that operate in their territory, either directly or indirectly. The laws are clear and well-defined, but they also change throughout time, no matter what stage or industry you’re in.

When forming a corporation in the Dubai Mainland, you have to adhere to the rules set by both federal and municipal laws and licensing requirements. As a business owner, you need to make sure that your organization complies with the most recent rules for corporate taxation (CT) in Dubai. Be ready for diligence at all times to avoid complications and keep your organization secure from compliance difficulties.

Scope of Internal Audit:

Before starting the internal audit process, make sure to define a clear scope and identify all the goals you want to achieve through this audit, just like you would in different fields. Keep in mind that these goals should be linked to the aims of the whole organization.

When you set the limits for an internal audit, think about the company’s operational processes, compliance guidelines, internal checks and controls, and financial activities. It’s a good idea to set SMART targets.

SMART stands for Specific, Measurable, Achievable, Relevant, and Timely. Your auditors will be able to get more useful financial information and advice obvious ways to make things better in areas that require it, with this structure in place.

Effective Internal Audit Plan:

Once you know what the audit will cover, you need a good action plan to make sure the Internal Auditing Process goes smoothly. An internal auditing action plan that works should answer these questions:

- What are the exact parts that need to be looked at?

- What kinds of audits will be done?

- Who is on the audit team? What are their duties and obligations?

- What is the total cost of the audit?

- What is the audit’s overall schedule?

- What details does the corporation need to give the auditors?

- What are the main risks and problems that the audit has to look into?

- What steps are taken during the auditing process?

- Did someone check this process in the past?

- What did the last audits find?

- What do you expect to happen as a result of the audit?

- A well-organized approach for internal auditing makes things clearer and provides stakeholders with more trust in the process.

Unsure if Your Company Meets UAE Compliance Standards?

Determine Risks and Control:

It is one of the most crucial things to accomplish during an internal audit. Internal audit services perform a thorough investigation and make a list of all the present and possible hazards that could affect the business’s financial condition. Next, make measures to reduce those financial risks and verify how well the current checks are working.

When you’re in a financial crisis, you can better handle problems by looking at the current controls. It is often called crisis management. If you run a hotel in Dubai, your risk may be different from that of a company that makes cosmetics, produces goods, or sells healthcare products.

Clear Documentation:

Internal audit is an extensive process that can take anywhere from a few days to several months, depending on your firm, operational procedures, availability of resources, and many other factors. Due to this, it is quite possible to skip the details if you don’t document everything.

Throughout the internal audit, create clear documentation and add recommendations, results from tests, workpapers, sample checks, and audit planning paperwork to ensure better clarity and efficiency. Not only this, but maintaining clean documents during your audit helps ensure that your future internal audits are quick and involve less effort.

Financial Internal Audits:

Your finances are the backbone of your firm’s long-term success. Check the accuracy of your financial reports, compliance with AS (Accounting Standards), etc. To ease the process, especially for businesses with massive data and records, assign clear responsibilities. It will enable you to thoroughly check your financial statements and identify any errors and financial fraud.

At this time, cross-check all records and data integrity with the entries. Conduct an assessment of the control action plan and review bank reconciliation, expense controls, and authorization regulations. Lastly, check the UAE’s latest tax regulations and policies and compare whether your company’s financial compliance is the same.

Operational Management and Compliance:

It seems apparent from the heading that all you need to do right now is audit your organizational procedures and how well they work. Check your main KPIs, current industry standards, and company operations, and check how effectively your defined procedures work.

Now is an excellent moment to look at how you can make your operations better, cut out manual and repetitive processes, and save capital. Finally, check how resources are being used and make improvements where needed.

As a business in the UAE, you must comply with a number of rules and regulations that are relevant to your sector and business. Make sure you pay the taxes properly, keep your permits and licenses up to date. Confirm that your business fulfills all local and federal rules.

You could potentially hire a lawyer who knows a lot about the details that apply to your business and can help you safeguard and improve your company’s growth and credibility.

Reporting and Analysis:

The final phase is to analyze the information and prepare an internal audit report on the final results. Audit findings refer to the evidence, criteria, and determinations of the audit. For preparing the auditing report, it is important to consider the criteria, conditions, reasons, consequences, and corrective measures for Internal Auditing.

From minor issues to major threats, everything will be recorded and disclosed in the report. It covers the strengths, weaknesses, areas of improvement, and compliance with the standards of the organization. With this Internal Audit Report, businesses are equipped to find the root cause of the problems and take corrective action.

Follow-ups and Monitor for Regular Audits:

After the internal audit is done, it’s important to follow up on the problems and suggestions that were found. It means keeping an eye on the development of the adjustments. Making sure they are working, and keeping track of the corrective measures and their implementation. Internal audit outsourcing services perform regular monitoring that helps find potential threats or areas that need more work. It makes sure that the necessary changes are being made.

How We Can Help You with Internal Audits?

MBS Consultancy is one of the most ideal audit services in Dubai that makes things easier, whether they are starting a new firm or looking for auditing services in the UAE for an existing one. We have helped organizations in the UAE with the ins and outs of running their businesses, keeping up with changing laws, and getting the most out of their investments for a long time.

We’re one of the best internal audit enterprises in the UAE. We’re ready to assist you in getting through every obstacle in the way. Call our consultants today.

Final Words

Internal audits are an important way for firms in the UAE to make sure they comply with the rules. Improve their financial operations, and lower their risks. By using the internal audit checklist in this blog article, businesses can do thorough and useful internal audits that meet their individual needs.

Regular internal audits give the organization useful information about how it works. Point out areas that need work, and help keep things open and accountable. In the end, firms in the UAE that contributed a great deal to internal audits follow the advice they receive from the auditors. They will be more equipped to expand and succeed in the ever-changing business environment.

Partner with Professionals to Simplify Your Audit Process

FAQs

What Is an Internal Audit Checklist, and Why Is It Important for UAE Companies?

For UAE companies, an internal audit checklist is a tool. It is usually used to review compliance, risks, and operations. The companies utilize this to adhere to VAT, corporate tax, and licensing rules. It aids them in improving efficiency and protecting against penalties.

What Key Areas Should Be Included in An Internal Audit Checklist for Businesses in The UAE?

The internal audit checklist covers key areas such as:

- Financial audits

- Regulatory compliance

- Operational efficiency

- Risk management

- Clear documentation

- Governance checks and

- Reporting

These guarantees transparency, accurate records, and alignment with UAE laws and industry standards.

How Does an Internal Audit Checklist Help Ensure Compliance with UAE Corporate Tax and VAT Laws?

The UAE’s internal audit checklist ensures businesses cross-check tax filings. It helps review financial records and assess compliance with VAT and corporate tax regulations. As a result, this helps avoid misreporting, fines, and compliance gaps. This keeps businesses aligned with UAE tax laws.

Should Free Zone and Mainland Companies in The UAE Have Different Internal Audit Checklists?

Mainland and free zone firms follow UAE-wide tax and compliance laws. Free zone firms must meet special zone-specific requirements. On the other hand, mainland companies must adhere to broader federal and municipal laws. The tailored checklists avoid regulatory oversights.

Can an Internal Audit Checklist Help UAE Companies Prepare for External Audits?

Of course! The internal audit checklist highlights gaps. It ensures that records are in order and verifies compliance before external auditors review. This preparation reduces the risks of errors. Businesses will be free from delays and penalties during external audits.

What Role Does Risk Management Play in An Internal Audit Checklist?

In an internal audit checklist, risk management is central. The checklist identifies financial, operational, and compliance risks. It also tests existing controls and ensures measures are in place to mitigate threats. This greatly helps companies protect assets and maintain business continuity.

How Often Should UAE Companies Update Their Internal Audit Checklist?

UAE Companies should update their audit checklist regularly. Do it ideally before each audit cycle or whenever UAE laws change. Updates that are frequent ensure the checklist reflects current tax, compliance, and operational requirements.

Does the Internal Audit Checklist Cover Fraud Detection and Prevention in UAE Businesses?

The UAE’s internal audit checklist includes financial reviews, internal control checks, and reporting mechanisms. They detect irregularities early. It safeguards transparency and prevents financial losses by addressing fraud risks.