Confidently steer your Dubai business, knowing exactly where the risks hide and how strong your controls truly are. That feeling of confidence doesn’t come from sheer luck. A good internal audit process instills that feeling.

An internal audit process is similar to a regular health check up, but for your company. It comes in handy for spotting any of these little paper cuts before they become gaping wounds left untreated for too long.

Too many businesses, unfortunately, treat audits as something chaotic, stressful, and full of unwanted surprises. Have you ever wondered to yourself what if you could flip that sentiment? Instead make it predictable, valuable, and even useful? You absolutely can!

This blog post discusses the simplest steps for implementing an internal audit process that actually works for your team in Dubai.

What is an internal audit process?

Simply put, it’s a structured, independent way to check if your company’s activities match its goals, policies, and regulations. Think of it as asking:

- “Are we doing things the right way?”

- “Are our controls actually working?”

- “Where are we exposed?”

It’s not about blame. It’s about insight and improvement. And crucially, it’s internal, and it is done by your team or trusted partners specifically for your benefit, unlike external audit services which focus on historical financial statements for stakeholders.

Understanding the process of external audits in the UAE is important for compliance. Though, your internal process is about your company’s day-to-day health.

Why you should consider the idea of internal audit processes

What’s the secret to business stability? It’s auditing before things end up going sideways!

It is a well known fact that numbers don’t lie. But mismanagement does a great job of hiding the truth. Internal audits help you catch it early on.

Companies often discover weaknesses when it’s too late. A good internal audit process gives you a deeper look into your company’s operations.

Let’s talk about the easiest way to implement it.

Why internal audits aren’t just for big corporations

Small and mid-sized businesses think audits are only for the big guys. That’s false. Here’s what a clear internal audit process does for every company:

- Spots operational inefficiencies before they burn cash

- Protects against fraud, errors, and misreporting

- Helps you prep for external audit services

- Builds trust with stakeholders

- Keeps you one step ahead of compliance issues

Internal audit process, step by step

Running a business in Dubai’s market is nothing short of exhilarating. But, at the same time, it’s also complex. Financial hiccups, operational snags, or compliance slips can quickly derail momentum.

An internal audit process doesn’t only help you find faults. It assists you with spotting any potential risks early on. Here’s the simplified internal audit process:

1. Define what you are auditing, your scope & goals

(What Are We Checking & Why?)

Don’t try to audit everything at once. Focus on:

- Financials: revenue recognition, expense tracking, vendor payments

- Operations: inventory management, procurement, logistics

- HR & Payroll: contracts, benefits, timesheets

Start focused. Ask:

- What keeps you up at night? Is it cash flow? Inventory shrinkage? Data security? New regulations?

- What are your biggest goals this year? Launching a new product? Expanding the team? Improving customer satisfaction?

- What areas are inherently riskier? High-value transactions? Complex supply chains? Reliance on key tech?

Pick 1 to 3 key areas for your first audit cycle. This focus makes the internal audit process manageable and immediately valuable. For example: “This quarter, we’ll audit our accounts receivable process to reduce overdue payments and improve cash flow.”

2. Create your audit plan

(Without Overcomplicating It)

Good audit plans are like meal preps: organized, consistent, and time-saving. Include:

- Objectives: What are you trying to improve?

- Timeline: Set a clear start and end date

- Tools: Spreadsheets? Audit software? Manual logs?

- Team: Who’s responsible for what?

This is where the magic of a smooth audit happens. Dig deep:

Understand the process

Map out exactly how the area under review should work. Interview staff, review manuals, observe.

Identify key controls

Pinpoint the checks and balances designed to prevent errors or fraud. Examples would be approval levels, reconciliations, system access controls.

Assess risks

What could go wrong? How likely? How severe would the impact be? Focus testing on high-risk spots.

Develop your audit program

This will be your specific checklist for exactly what you will test, how (interviews, sampling documents, or observing), and who does what. This is where visualizing the internal audit process flowchart helps immensely by mapping the flow and control points. We share one in the next section too!

3. Gather the goods

(i.e., Your Evidence)

Now collect:

- Financial records

- Process checklists

- Compliance documents

- Department reports

This is your data set. If something seems off, pull more from the same source.

4. Review, compare, question

Go through the records and:

- Match actual performance to policies or forecasts

- Look for inconsistencies, unusual patterns, and missing documents

- Ask questions internally when things don’t add up

This step is where issues usually surface. Pay attention to the stories numbers are telling.

Now you execute your plan. This involves:

- Interviewing staff involved in the process. Ask open-ended questions.

- Examining documents (invoices, approvals, logs). Does reality match the policy?

- Performing sample transactions or checks. For example: trace a sample sale from order to cash receipt.

- Watching processes in action.

Document everything very thoroughly. Your findings need clear evidence to back them up. This brings us to our next section:

5. Document everything

This part is boring. Do it anyway. Write down:

- Findings with clear evidence

- Risk level (low, medium, high)

- Suggested actions

- Who’s responsible

- Deadlines

Raw data isn’t useful. Synthesize it:

Review findings

What controls worked? Where were there gaps? What were the root causes?

Assess significance

Not every finding is a five-alarm fire. Rate issues based on risk and impact.

Draft the report

Clear, concise, and constructive is key. Include:

- What was reviewed (Scope)

- What was found (Observations)

- Why it matters (Risk/Impact)

- What caused it (Root Cause)

- What needs fixing (Recommendations)

Organized documentation makes follow-up smoother and saves you during the process of external audits in UAE.

6. Report it

Be transparent. No one’s perfect. Share:

- What went well

- What went wrong

- What’s urgent

- What needs a longer fix

Use visuals and summaries.

Craft great recommendations. We have some tips here to help you out:

Be specific

Not “Improve controls,” but “Implement a monthly reconciliation of X by Y person.”

Be actionable

Can the process owner actually do this?

Be realistic

Consider cost, time, and resources needed.

Focus on solutions

Frame it positively: “To prevent X, we recommend Y.”

7. Follow-up

You are not done until you:

- Check whether corrective actions were taken

- Re-audit risk-prone areas

- Adjust your internal controls if necessary

Accountability is where good audits turn into great systems.

The audit’s value is realized after the report is issued. This step is often overlooked!

Present findings

Discuss the report with management and process owners. Ensure understanding.

Agree on actions

Get clear commitment: What will be done? By whom? By when?

Track progress

Don’t let promises gather dust. Set reminders, check in. This is where the internal audit process steps truly drive improvement.

Verify implementation

Once the deadline hits, check if the fix was actually put in place and is working.

Internal Audit Process Flowchart

Our team shares a simplified flowchart of the process to better visualize it:

Identify Audit Area

↓

Build Audit Plan

↓

Collect Data

↓

Analyze Records

↓

Record Findings

↓

Share Report

↓

Follow Up

8. Refine the process

Your first audit is a milestone, not the finish line. A stronger internal audit process is a continuing cycle:

Review your process

What worked well? What was clunky? Refine your planning, testing, and reporting.

Update your risk assessment

Business changes? New regulations? Update your focus areas.

Plan the next cycle

Based on updated risks and previous findings, define the scope for the next audits.

Communicate value

Share successes! How did findings save money, improve efficiency, or reduce risk?

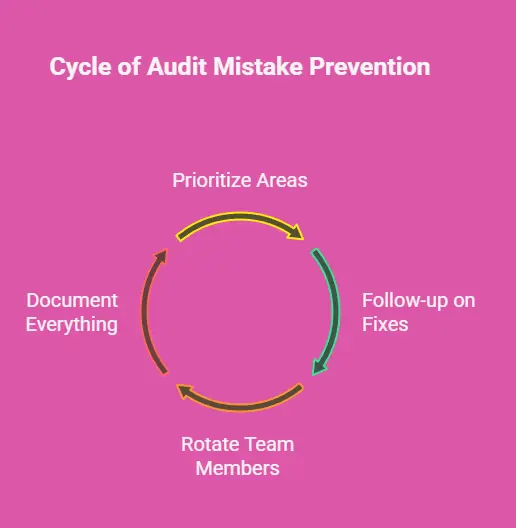

Common audit mistakes and how to prevent them

These are some of the common mistakes during audits and we offer their solutions alongside them:

Over-auditing

Instead of wasting time on areas with no known issues, prioritize what matters

Lack of follow-up

Fixing without checking results means wasted effort.

Too much reliance on one person

This one’s never good. That’s why you should rotate or involve multiple team members.

Skipping documentation altogether

If it’s not recorded, it didn’t happen.

When to call in MBS Consultancy for assistance

Sometimes, a DIY audit won’t cut it. Maybe your business grew faster than expected. or books are… confusing. Maybe your internal auditor just quit.

That’s where seasoned auditors in Dubai step in. With an objective eye and a process-honed toolkit, we:

- Spot red flags faster

- Help fine tune your internal controls

- Make you audit-ready all year round

Get peace of mind without burning internal bandwidth. Contact us now.

FAQs

How often should I conduct an internal audit?

At least once a year. High-risk areas may need quarterly reviews.

Can I use internal audit results in external audits?

Absolutely. A solid internal audit process makes external audits smoother and faster.

What’s the difference between internal and external audits?

Internal audits are ongoing and done by or for the company. External audits are one-time checks done by independent experts.

Is there a standard checklist I can use?

Yes, but tailor it to your business type. No one-size-fits-all in auditing.

Can small businesses benefit from audits?

Yes! Audits help prevent errors, streamline growth, and build investor confidence.

How much does setting this up cost?

Costs vary wildly based on size, complexity, and whether you use internal staff or external auditors in Dubai. The real question is the cost of not doing it: potential losses from fraud, inefficiency, fines, or missed opportunities often far outweigh the investment in a good audit process.

Conclusion

Implementing an internal audit process isn’t about adding bureaucratic layers on top of your already hefty workload. Instead, internal audit processes actually empower your Dubai business with clarity and control.

When you follow these clear steps (defining scope, planning meticulously, testing objectively, reporting constructively, and following through relentlessly), you turn an audit from a scary word into a strategic advantage.

You move from hoping things are okay to knowing where you stand and where to improve. Start small. Stay consistent. And watch your operational health as well as your peace of mind strengthen.

If your audit process feels like a stressful chore, it’s broken. The right internal audit process helps your business stay sharp, stay legal, and stay successful. Implement it well, and you will spend less time reacting and more time running things right.

Need help making your audits less painful and more powerful? Check out our auditing services. Contact us now.